The Australian and New Zealand dollars have enjoyed flows despite rate cuts. What is expecting us on the road ahead? Here is the view from Bank of America Merrill Lynch:

Here is their view, courtesy of eFXnews:

The search for positive yield has become a catch-all phrase to explain the resilience of high-yielding assets globally. Nowhere is this more evident than the AUD and NZD, where despite the reduction of policy rates over the past month, both currencies have strengthened markedly.

Looking ahead, the key question is how long these “carry inflows” can persist, even as the yield advantage compresses further.

There is clearly risk that structural price-inelastic flows like the grab for duration by pension funds and potential diversification by central banks may stay firm. But marginal carry demand should nonetheless weaken as yield spreads narrow and FX strengthens. As both the RBA and RBNZ extend their easing cycles, yield-motivated arguments for buying FX are likely to become less compelling over time.

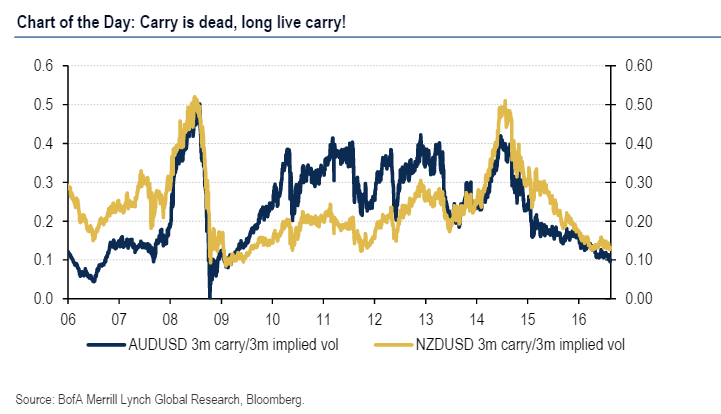

We present some key metrics that could help judge the inflexion point (if any) for these inflows: specifically, volatility-adjusted carry and real rate differential, both of which have explained the dynamics and levels of their exchange rates well over the past several years. These suggest caution in buying FX at these levels, especially the NZD.

AUD outperformance was one of our key themes for 2016 and the carry metrics are not yet flashing red, but with China data uniformly slowing we are neutral AUD over the short-term.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.