- The Canadian Dollar continued receiving bids on NAFTA hopes.

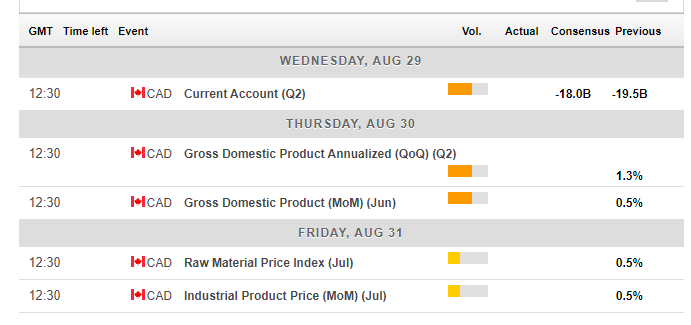

- Canada’s quarterly GDP is the central event of the last week of August.

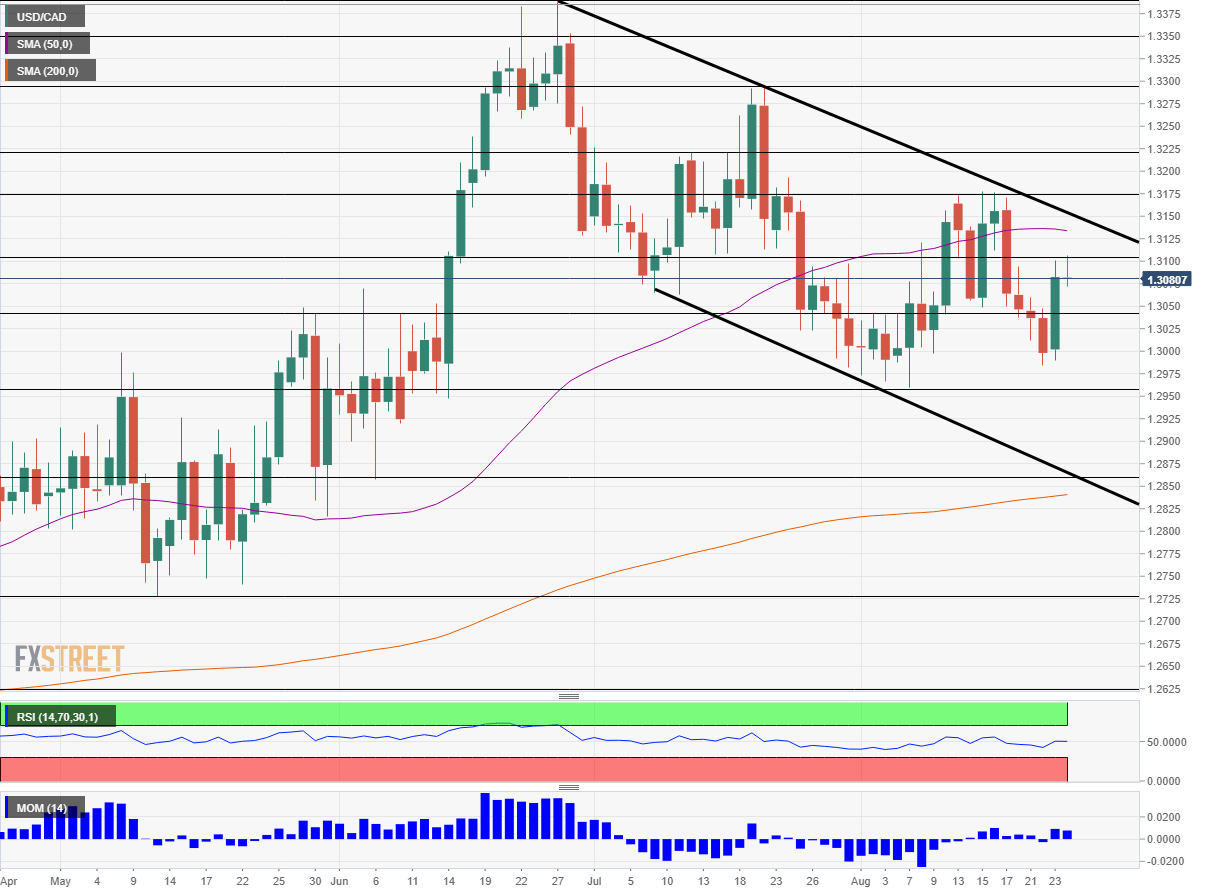

- The technical picture is mixed after a few weeks of range trading.

This was the week: Almost a deal all over again

The talks to renew the North American Free Trade Agreement remained the No. 1 mover for the Canadian Dollar. Reports of a “handshake deal” between the US and Mexico on cars pushed the loonie higher, but denials shot it down. While all sides said there is still work to do, they also expressed optimism on a daily basis. The news kept the C$ bid.

Canadian Prime Minister Justin Trudeau joined the chorus of optimism late in the week.

Canadian retail sales slightly disappointed with a drop of 0.2%, worse than -0.1% expected. However, the figure was balanced with an upwards revision.

In the US, Trump was at the center of attention. His criticism of the Fed’s path of higher rates sent the US Dollar lower. The testimony of his former confidant and “fixer” Michael Cohen also weighed. However, the Fed is set to raise rates in September according to the latest FOMC Meeting Minutes.

Also, hopes for a resolution in the trade spat with China went nowhere. The US proceded with imposing tariffs on $16 billion worth of Chinese products, as planned. Duties with $200 billion of goods still loom. The escalation in trade tensions pushes the greenback higher.

Canadian events: GDP report stands out, and NAFTA as always

Any stories about a breakthrough in NAFTA talks will boost the loonie while a deadlock could send it down. The deal is critical to Canada and overshadows everything else.

The week begins with Canada’s current account, which is expected to show another deficit in Q2.

Canada publishes GDP figures on a monthly basis and differs from many other countries. This time, the nation releases the numbers for June, concluding the second quarter. The quarterly figure carries more weight. A slow growth rate of 1.3% annualized was seen in the first quarter, and a quicker pace is likely now.

Friday sees the fresh Raw Materials Price Index which will likely pick up once again. Oil prices have had little effect on the loonie of late.

Here is the Canadian calendar for this week.

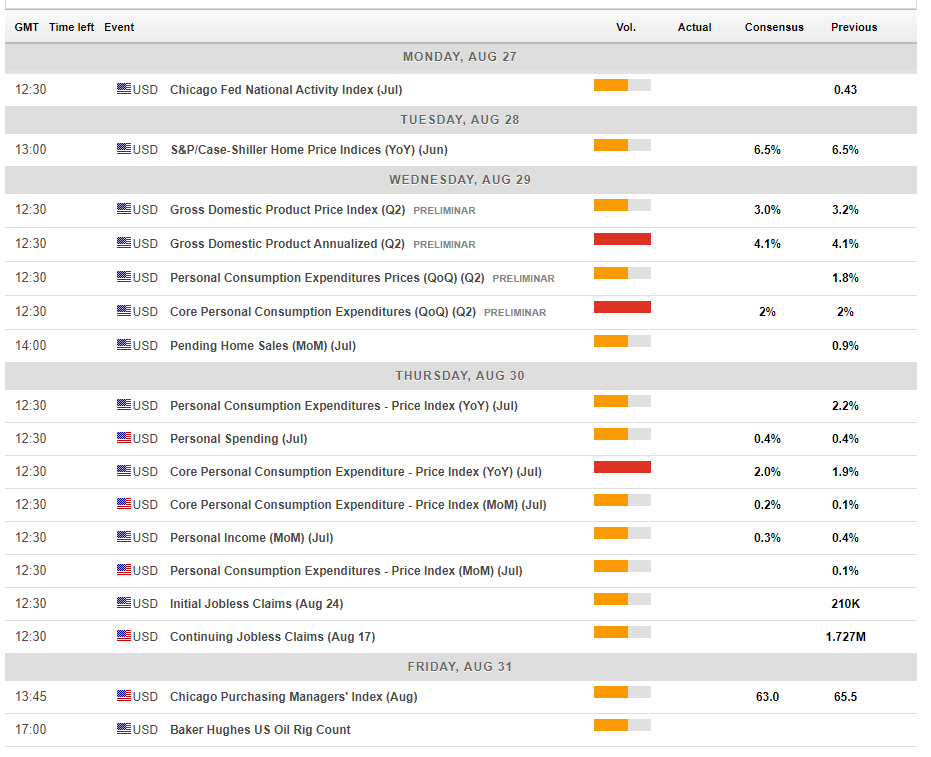

US events: Second release of GDP in the limelight

The legal troubles of President Trump are unlikely to move away but may take a breather in the week before Labour Day. Trade spats with China may also wait for a while. However, Trump is very unpredictable, and we should always expect surprises.

The S&P Case Shiller HPI is of interest after the recent disappointing data from the housing sector. More importantly, the second release of Q2 GDP will test the excellent first release, which stood at 4.1% annualized, the quickest pace in four years. Changes in the composition of growth will be watched as well, with consumer spending standing out as usual.

The Fed’s favorite inflation measure is expected to edge up in July to 2% YoY. The Core PCE usually tracks the Core CPI, which increased in July to 2.4% YoY. Personal income and spending are also of interest.

Here are the critical American events from the forex calendar:

USD/CAD Technical Analysis

The USD/CAD continues trading in the broad downtrend channel that accompanies it since July, currently in the upper half of the channel. The Relative Strength Index and Momentum are not going anywhere fast.

1.3100 capped the pair in early August and also late in the month. 1.3175 was a stubborn resistance in mid-August. Further up, 1.3225 was a peak in late July. 1.3380 was the high point in early July.

1.3050 was a support line in mid-August and resistance in June. Below 1.3000 we find 1.2960 as the low point in August. 1.2860 was a swing high in early June.

USD/CAD Sentiment

For the Canadian Dollar, the critical driver is NAFTA. As mentioned earlier, Trump is unpredictable on many fronts. Assuming no breakthrough nor breakup in the talks, upbeat Canadian GDP data could push the loonie a bit higher against the US Dollar.

The FXStreet forex poll of experts provides interesting insights.

Get the 5 most predictable currency pairs