- BTC/USD is trading close to $4,200, up some 10% on the day and some 20% off the lows.

- There are three reasons to be skeptical about this recovery.

Bitcoin and other cryptocurrencies are staging a recovery. At current prices, the advance from the trough of $3,456 may even be labeled as a “bull market” thanks to the rise of over 20% from the lows. In any case, it looks like a more meaningful recovery, at least at first site.

However, a deeper look reveals a darker picture. Here are three reasons to fade the recovery.

1) Technical view: not oversold anymore

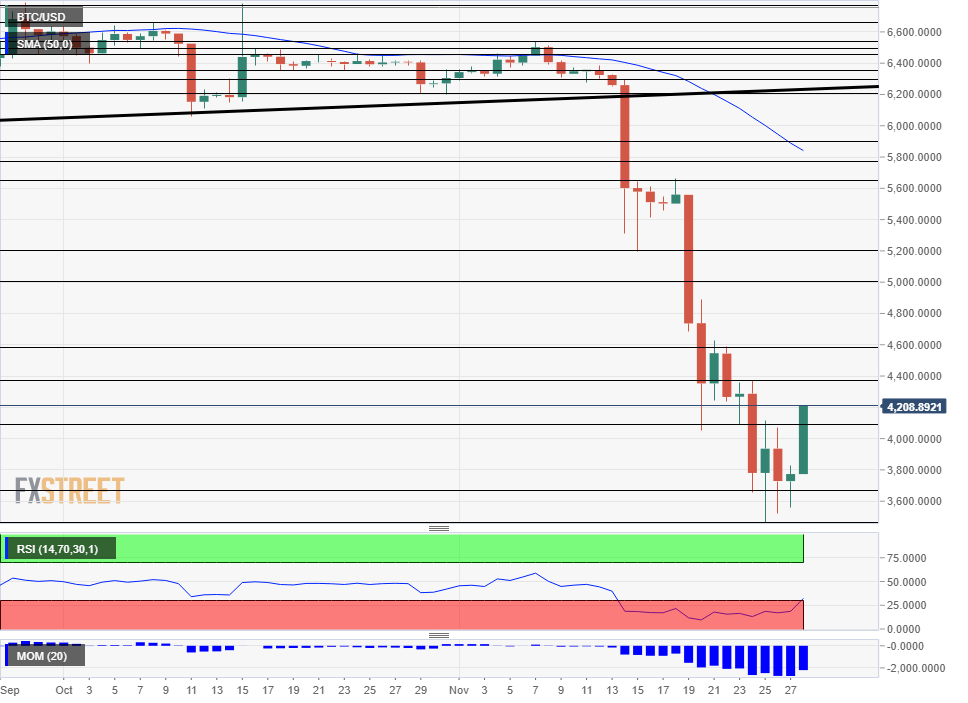

Looking at the daily chart, we see that Momentum remains to the downside despite the recent surge. More importantly, the Relative Strength Index (RSI) is now above 30, thus out of oversold conditions. So, there is room for a resumption of the falls.

$4,380 serves as initial resistance, and to truly see a turnaround, BTC/USD would need to climb above $4,595 that capped Bitcoin after the previous fall.

The top cryptocurrency is trading well below the 50 and 200 Simple Moving Averages. Support awaits at $3,650 and then at the low of $3,456 before the door opens to $3,000.

2) The 5-day crash pattern returns tomorrow

As we have already noted, Bitcoin lost $6,000 on November 14th, lost $5,000 on November 19th, and fell below $4,000 on November 24th. It is easy to see that 1K levels were ceded every five days.

Following this pattern, November 29th is when $3,000 will be lost. That’s tomorrow. Sure, patterns are not forever, but there is no guarantee that this recovery is the real thing.

3) Coinbase OTC not enough

The crypto-sphere is abuzz with the news that Coinbase, one of the world’s leading exchanges, kicks off an Over The Counter offering for institutional traders. The story supports the rally.

The thought that institutions demanded this from Coinbase means that fresh and heavyweight money is coming in.

Not so fast. While institutions made have a more accessible path to the market, it does not mean they will walk through this open door.

The real thing is a Bitcoin Exchange Traded Fund (ETF) that will make BTC investment easier for the masses. The SEC is not moving anywhere fast with approving a Bitcoin ETF.

More: Bitcoin ETF explained: 9 questions and answers about the critical crypto catalyst

All in all, there is a lot of room for skepticism. The rout may not be over, at least not yet.

Get the 5 most predictable currency pairs