- BTC/USD flirts with new lows in a week that saw a gradual decline.

- Bitcoin needs another pre-Christmas rally to move up.

- The charts show oversold conditions, will a bounce follow?

Bitcoin enjoyed a recovery of sorts during the weekend, reaching $3,600, but it began a gradual decline from that point onwards. The failure to stage a meaningful recovery is not a good sign. As the dust settles, that recovery looks like yet another dead-cat bounce. By the end of the week, Bitcoin dipped to new lows.

Pessimism spreads around the world about prices. The upside is: when everybody is short, who is left to sell? Crypto whales have been moving considerable sums of digital coins between wallets. Is it a sign of another significant sell-off or perhaps the beginning of a re-accumulation that bulls have been waiting for.

In industry news, Coinbase, one of the most prominent crypto exchanges, is exploring adding more coins. However, just two ASIC Bitcoin Mining rigs remain profitable in the current market environment. Tom Lee of Fundstrat says that Bitcoin should reach 150,000 according to “fair value.” That represents an increase of nearly 50-fold from current levels.

The central bearish driver is something that is not happening: a Bitcoin ETF. The latest delay by the SEC dealt a blow to all cryptocurrencies. The high-profile SolidX / Van Eck application has been pushed back to February.

Why is a Bitcoin ETF essential? It enables mainstream investors to pour into digital currencies.

More:: Bitcoin ETF explained: 9 questions and answers about the critical crypto catalyst

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

BTC/USD Technical Analysis

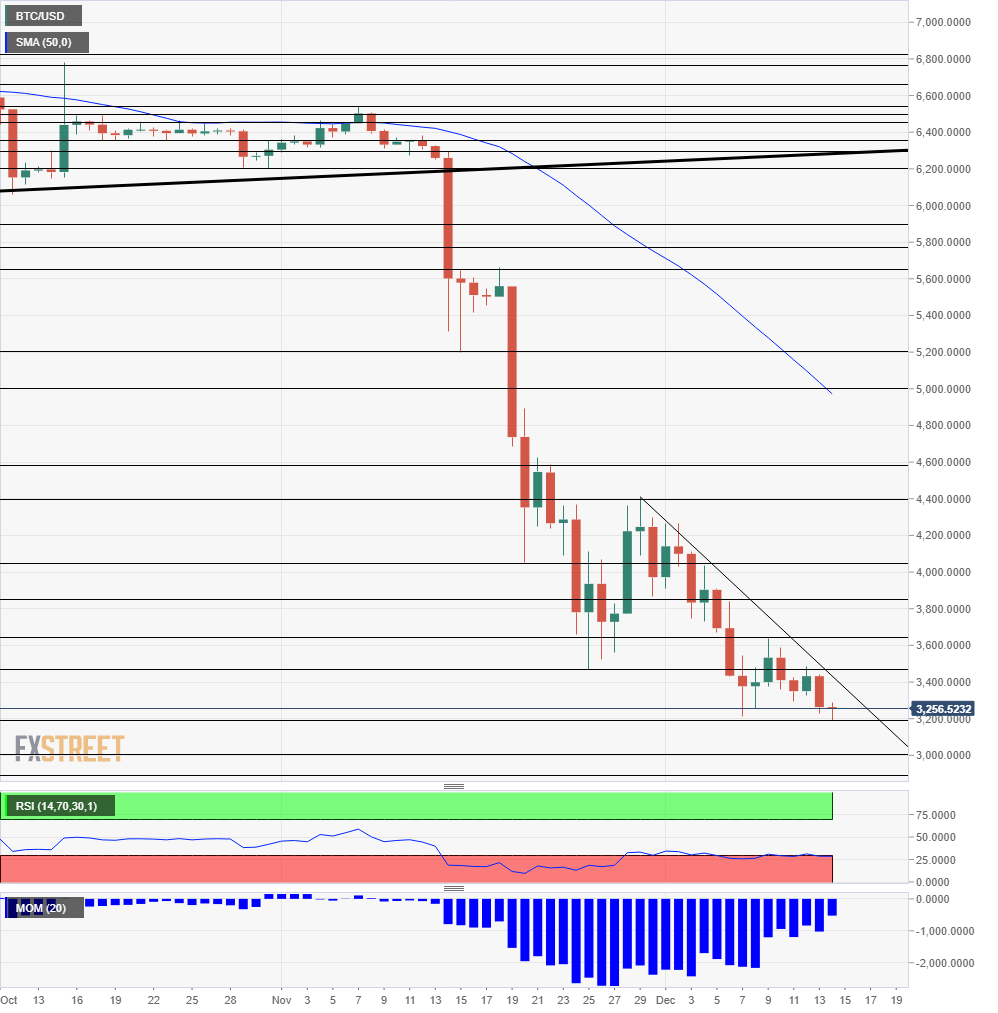

The Relative Strength Index on the daily chart is just below 30, indicating oversold conditions. However, the cryptocurrency suffered long spells amid similar conditions but did not experience an imminent bounce.

BTC/USD also trades below a downtrend resistance line. Escaping from that level could send alleviate pressures. One positive sign comes from Momentum, which remains down but is waning.

Critical support awaits at $3,200 which supported Bitcoin in the past week and remains the lowest level since September 2017. The next line to the downside is $3,000 which is eyed by many traders and also by the media. Further below, $2,890 is the level described by FXStreet crypto analysis Tomas Salles. It is a price congestion level.

Looking up, $3,480 is critical. It served as support on the way down and capped BTC/USD in recent days. $3,645 was the high point in a recovery attempt in last days. $3,820 worked in both direction: initially as support in late November and then as resistance in early December. $4,051 is next up the chart.

The Forecast Poll of experts provides interesting insights.

Get the 5 most predictable currency pairs