Carney caused carnage in GBP/USD, delivering a comprehensive, coherent and timely package to mitigate the effects of Brexit. Cable dropped 200 pips and returned to the lower range.

However, when looking at the bigger picture, we are still above support. Here is why there is more room to the downside and what levels to watch.

Why this is pound negative

- The package is huge: The BOE went well below the expected rate cut: 60 billion in regular QE + 10 billion in corporate bond buys. The total is at the far end of those that expected QE to substitute a rate cut. Also, the Bank introduced a new lending scheme as well as small regulatory changes.

- There is scope for more: Carney apparently hinted about the possibility of another cut in this year, 2016. Also, there is room for further buying of corporate bonds. The BOE is dipping 10 billion into a market of 150 billion and this universe can expand.

- Gloomy picture: Without saying so explicitly, the Quarterly Inflation Report suggests a chance of a recession in the UK. They cut the forecasts by 2.5% in cumulative terms, the biggest cut on the record.

GBP/USD levels to watch

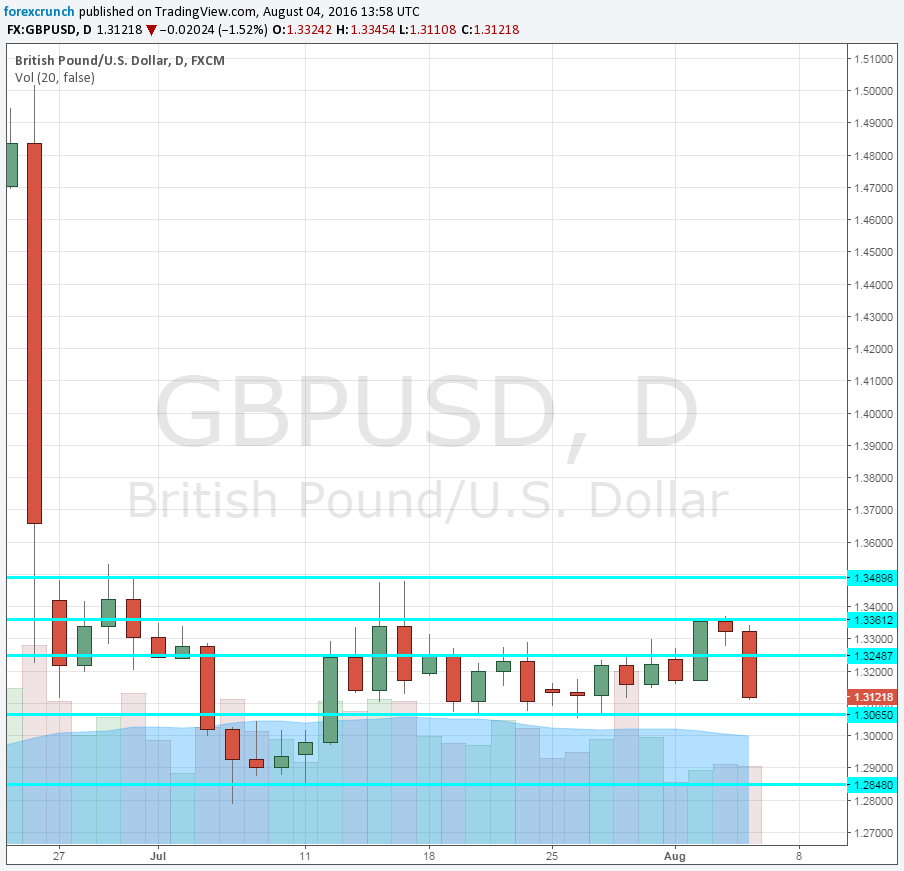

As aforementioned, sterling is still in range. It fell from the 1.3250 to 1.3360 range to a lower range, below 1.3250. The immediate level of support is at 1.3060. This line cushioned the pair during July.

Further below, we find the round number of 1.30, easily a psychological level. Further below, we find the “Leadsom Low” of 1.2840. This was the swing low just before Andrea Leadsom quit the Conservative Contest, clearing the path for the May government.

The next level on the downside is 1.2790, a line that is the trough of this cycle as well as the lowest level since 1985. Beyond this level, 1.25 is the next round number.

On the topside, we find 1.3250, 1.3360 and 1.3480, the high the pair reached just after the BOE disappointment on July 14th.