- The Indian rupee is ceding ground to the US Dollar.

- There are three primary drivers behind the move.

- The technical picture is bullish for USD/INR.

The Indian rupee is falling against the against the US Dollar. At the time of writing, USD/INR is around 71.75 after hitting a daily high of 71.90. The pair is trading at the highest levels since mid-December. The daily move to the upside is an extension of the increase seen earlier.

What is behind the fall? Here are three reasons:

1) Election economics

Prime Minister Narendra Modi is facing general elections in the spring and is getting ready. After his Bharatiya Janata Party suffered losses in local elections, the 68-year old PM is being laxer on the budget deficit. His budget, introduced on Friday, includes tax cuts for the lower and middle classes and also handouts for farmers.

The policies of the Gujarati-born PM trigger some negative reactions from investors who worry about slippages in the budget and weigh on the Indian rupee.

The so-called “Modinomics” that economists liked may be turning against the rupee.

2) Rising oil prices

Fuel prices are off the lows and continue ticking higher. The world’s second-most-populous country depends on imports of energy. The recent increase can be blamed on the ongoing political crisis in Venezuela, which suffers from a slump in its petrol output.

While prices of the black gold have not recently surged massively, the ongoing increase also takes its toll on the currency.

3) Stronger US Dollar

The rise in USD/INR also stems from a recovering US Dollar. After the Federal Reserve made a dovish twist, the greenback was downed. However, with a backdrop of a global slowdown and after closer scrutiny of the decision, markets found fresh interest in the US Dollar. The USD remains the “cleanest shirt in the dirty pile.”

USD/INR Technical Analysis

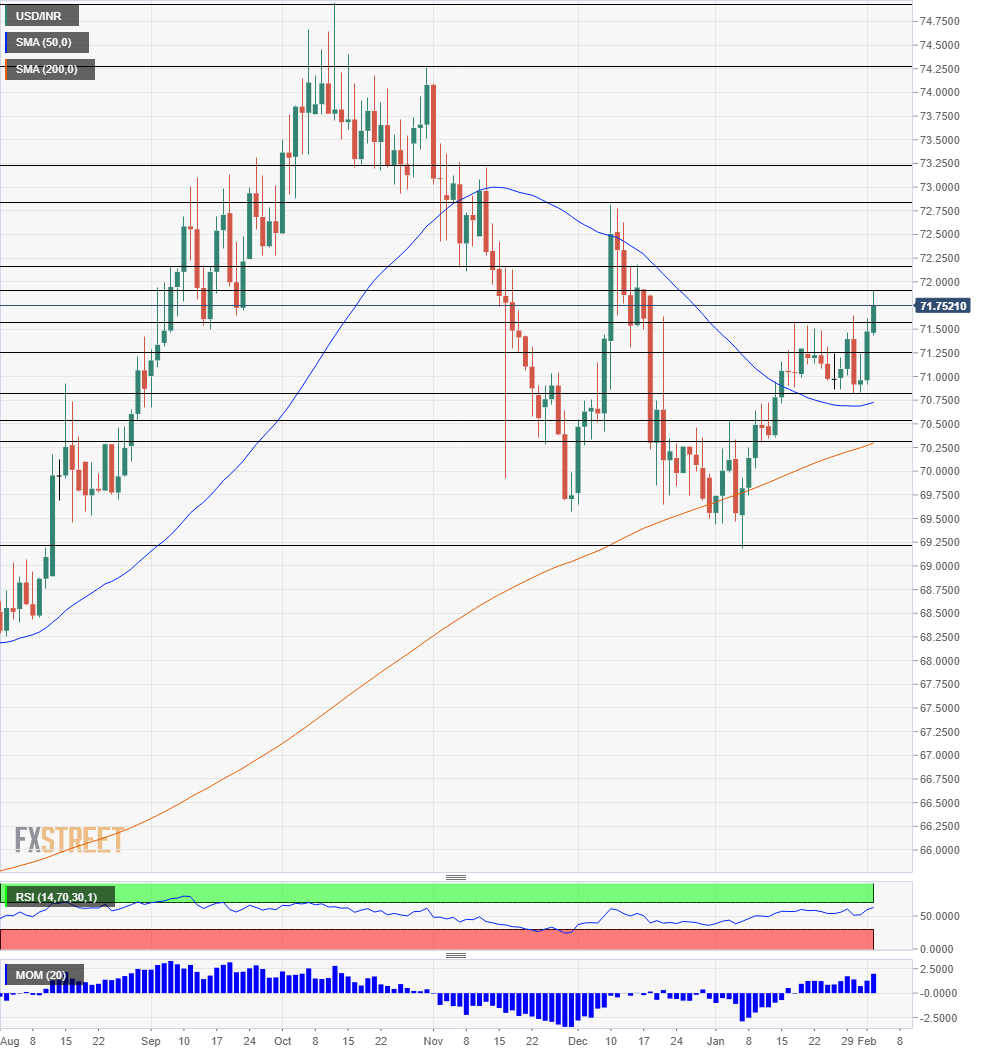

Examining the dollar/rupee daily chart shows growing Momentum to the upside. The Relative Strength Index is also rising but maintains a safe distance from the 70 level which indicates overbought conditions. Also, the pair trades above the 50-day and 200-day Simple Moving Averages.

All in all, the bias on USD/INR is bullish.

Resistance awaits at the fresh high of 71.91 recorded earlier. 72.30 capped recovery attempts in mid-December. 72.80 is a more substantial resistance line after holding USD/INR down early in December. There are additional levels to watch, with 75 serving as a high target in case things get out of control.

In case the rupee recovers, 71.60 is the initial downside target after holding down Dollar/INR. 71.25 served as both support and resistance in various occasions. 70.60 was the low level from where the pair recently rose. 70.50 was a cap in early January and guards the round 70 levels.

Get the 5 most predictable currency pairs