Hello traders, and welcome to our intra-day updates. Let’s start the day with EURUSD.

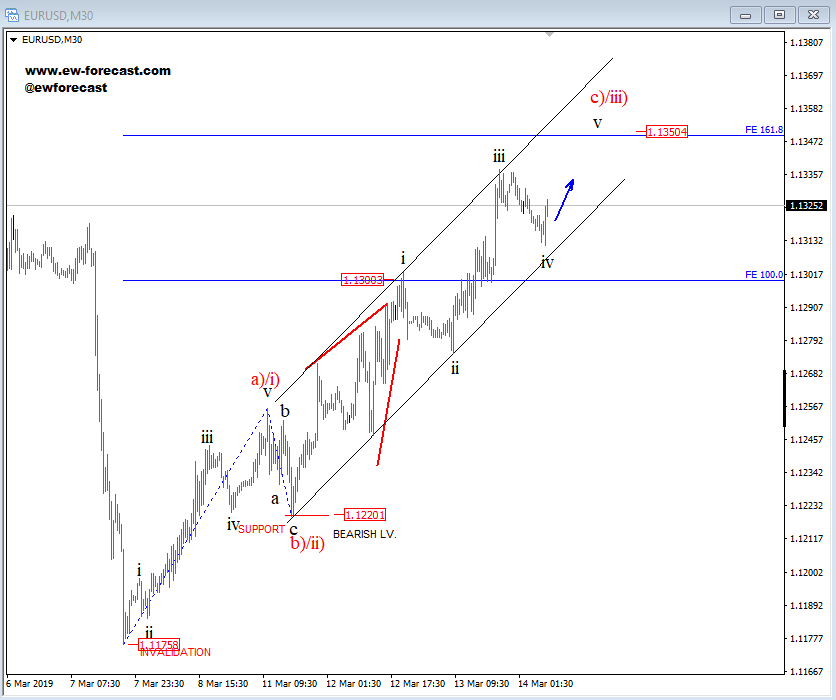

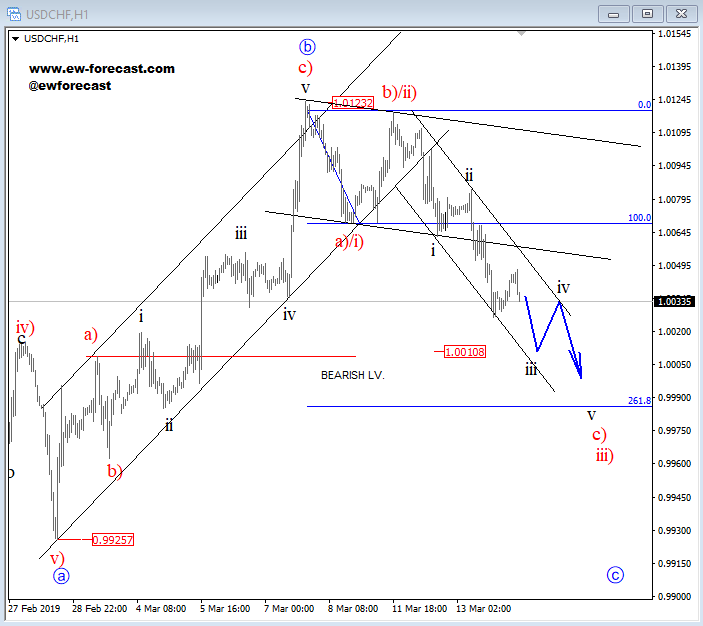

On EURUSD we are tracking a bigger three-wave recovery in play, which we labeled as wave a)/i), b)/2) and now c) or iii). That being said, at the moment we see price nicely unraveling a five-wave rally within wave c)/iii) with sub-wave v taking price towards the 1.135 resistance region. At the mentioned region, a top can be found and a minimum, three-wave bearish turn may follow. That said, in case of price later continues even higher, above the 1.135 level, then this would favor a bullish continuation in five waves. Now looking at the USDCHF chart, where we see a completely different picture regarding the price action. We know that USDCHF is negatively correlated to the EURUSD, which means, we expect to see more weakness on the pair, towards the 1.000 regions. At the mentioned area, a temporary rally in a minimum of three legs may follow.

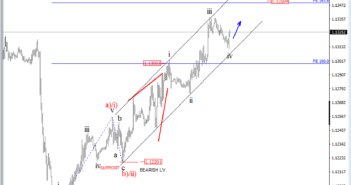

EURUSD, 1h

USDCHF, 1h

USDCHF, 1h

Get the 5 most predictable currency pairs

Elliott wave Analysis: EURUSD and USDCHF In Negative Correlation