The US dollar is on the defensive with a string of poor data. Can this turn into a bigger move? Here is the view from SocGen:

Here is their view, courtesy of eFXnews:

The US economy is still trundling along at a 2%-ish rate, unable to deliver an investment-led acceleration but unlikely to see these weak figures persist as long as there is any slack left in the labour market. So the soggy data, combined with the sense that the global economy is still comfortably away from stalling speed, merely reinforce the pressure on investors to search for yield, wherever and whenever they can find it.

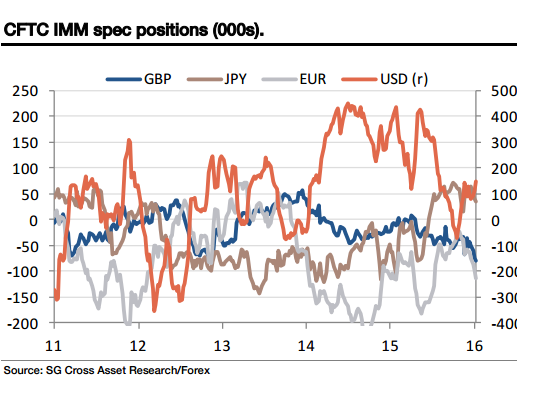

In that context it’s hard to be bullish of the dollar, unfortunately. Yield support is absent, and CFTC positioning data show dollar longs being cautiously rebuilt, and the GDP data will go a long way towards keeping the Fed inactive through the presidential elections. Not a good mix. Beware, in particular, a short squeeze in GBP/USD and a spike higher in EUR/USD.

UK PMI and CBI data were dire, and we’ll get more PMI figures at the start of the week. We’ll get a rate cut and more asset purchases from the BOE as well. Sterling is doomed to fall. And yet…the market is geared up for MPC easing, braced for bad data and short sterling already.

*SocGen maintains a short GBP/USD position from 1.3750 targeting a move to 1.25.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.