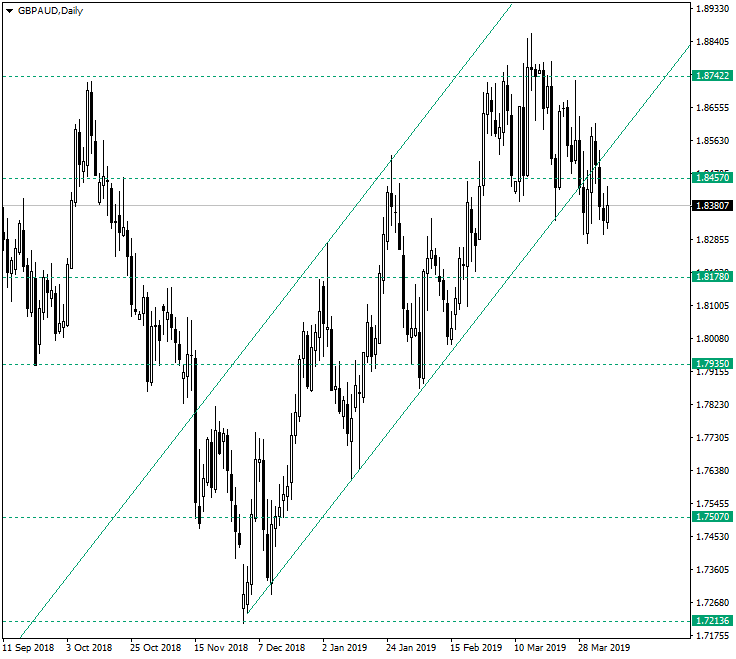

The recent break of the 1.8457 support area on the Great Britain pound vs. Australian dollar has the trails of an unsustainable move for the bears.

Long-term perspective

The ascending trend that began on the debut of 2019, from 1.7213, looks as if it is over. Such a conclusion can be easily drawn after acknowledging the break of two obvious support lines, the confluence of which consolidate an important support area. These two lines are the support trendline of the ascending trend and the 1.8457 level, respectively.

The first clue that the break is not on the right track for the bears is that after the close of the March 29, 2018, candle the next two candles not only that they were bullish, but they were tall and managed to get back above the confluence area. The second issue is that the drop that followed decelerated, leaving — at least for now — a higher-low on Friday, April 5.

Given these, a revisit of the 1.8742 level is just a matter of time.

Short-term perspective

The pair is in a poor angled descending move, and such trends do not last for a long time. This, coupled with the direction of the move, whispers that the pair points to the north. So, from here the price could insert itself above 1.8420, confirm it as a support, and continue to rally at least to the first target — represented by 1.8598 — or it could retrace to the 1.8264 support area and rally from there. The piercing and confirmation as a support of the double resistance, made up by 1.8598 and the resistance trendline of the descending move, will target 1.8732.

Levels to keep an eye on:

D1: 1.8457 1.8742 1.8178 1.7935

H4: 1.8164 1.8264 1.8420 1.8598

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.