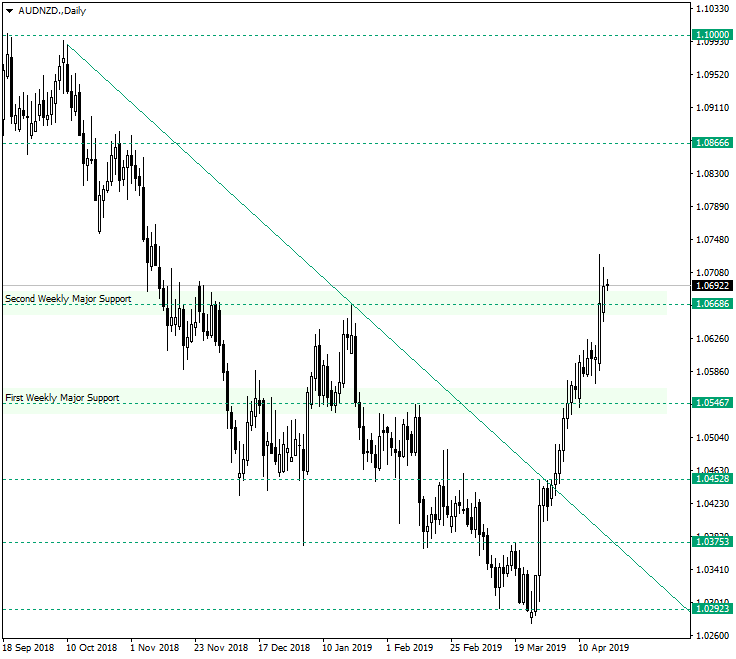

The Australian dollar versus the New Zealand dollar etched the new high of 2019, and this makes possible even more positive expectations.

Long-term perspective

The strong descending trend that started on October 2018 and extended until the end of March 2019 looks like it is really over. The April 2, 2019, piercing of the double resistance area established by the convergence of the resistance of the descending trend with the 1.0452 level advanced without looking back, overshooting 1.0546 and 1.0668. These two levels are very important weekly levels, and the price did not yet confirmed them as actual support areas — which it should do in order to sustain such a big move without labeling it as a panic move. With respect to this, the price should confirm at least the second weekly major support in order to have ground for new appreciations. On the other hand, it is very likely that the price would give back some of the gains and cross back under the 1.0668 level. But this should be no reason for any alarm from the buyers side, as the current high is higher as the previous one on January 21, 2019. To this adds the fact that, in such a scenario, the price will have the chance to confirm the first weekly major support area — at 1.0546 — as support. From there price would be able to advance towards 1.0668, confirm it as a support, and continue the upwards move. As long as 1.0546 stands still appreciations are a natural outcome.

Short-term perspective

The price is in an ascending move from 1.0398. As long as the support trendline of this move is honored, further advancement is in reach. If price manages to convert the actual supportive area of 1.0625 to resistance, then a decline towards 1.0542 is a possible outcome. For now, price could very well oscillate between the support of 1.0627 and the resistance of 1.0735.

Levels to keep an eye on

D1: 1.0546 1.0668 1.0866

H4: 1.0625 1.0672 1.0731 1.0762

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.