The New Zealand dollar versus the Canadian dollar is sitting in a very interesting spot.

Long-term perspective

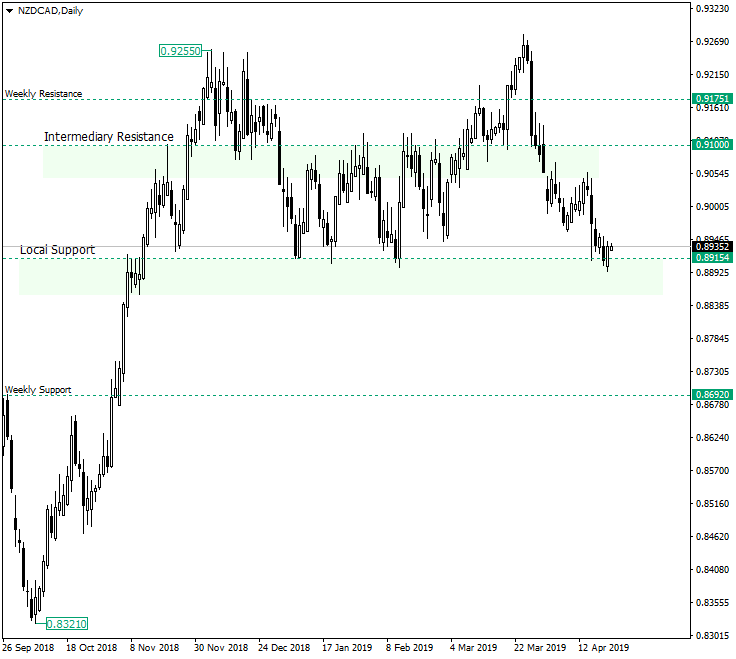

The current phase is a consolidation that started at 0.9255, marking at least a pause of the rally etched at 0.8321. It is important to take note of the landmarks that the price projected during this upwards move. These can be categorized into two important levels and two intermediary levels. The important ones are represented by 0.8692 (which is a weekly support) and 0.9175 (a weekly resistance). On its way up from 0.8321 and after the retracement from 0.9175 the price materialized the two intermediary levels: the psychological 0.9100 and the local support 0.8915. This local support and the weekly resistance limit this consolidation phase. Consolidation phases are continuation structures, and because this one is preceded by a rally the continuation is upwards.

So, as long as the local support holds — or is only falsely pierced — the expectations should be on the upside with a first resistance at 0.9100, a second one at 0.9175, and if this also fails to keep the bulls in check the way to 0.9530 is open. If 0.8915 will not be able to hold the bears, then 0.6692 would most likely be.

Short-term perspective

The price is in a descending move with a resistance line that connects the beginning and middle of April 2019. The current wave looks as if is prepared to end and let a new correction wave to form. If this new correction would be able to pierce the double resistance made possible by the resistance of the descending move and the 0.8984 level, then 0.9055 would be in reach. Such a case would represent a confirmation of the local support on the daily chart, with the associated outcome.

As long as the price remains contained within the short-term descending move new lower extensions could be expected.

Levels to keep an eye on:

D1: 0.8692 0.8915 0.9100 0.9175

H4: 0.8895 0.8984 0.9056

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.