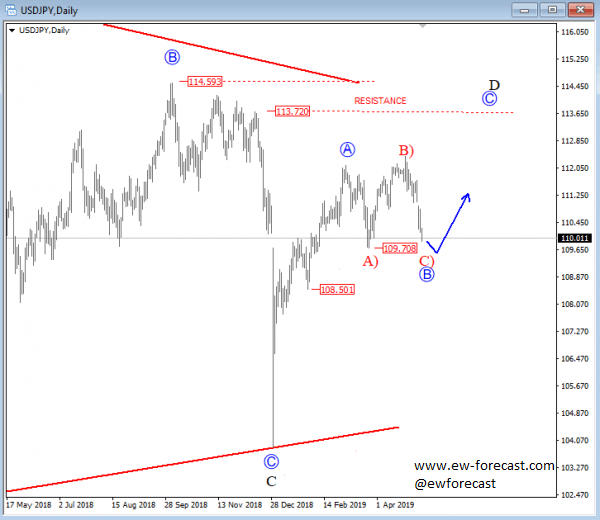

On USDJPY we are tracking a bigger triangle correction which can be fully visible on the weekly chart but maybe still incomplete. If that’s the case then current leg up on the daily time frame is wave D in three legs which can be headed much higher after current blue sub-wave B is completed, which is in progress as a flat correction with potential support around the 109.71 level.

USDJPY, Daily

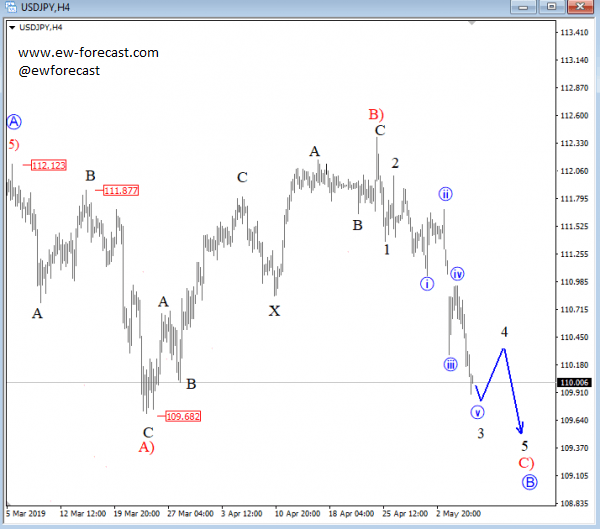

On the 4h chart of USJDPY, we see a sharp drop which happened overnight and can be part of a big flat correction rather that a triangle, currently with wave C) in play. The reason is no overlapping decline, so this can be an impulse in progress, meaning more weakness towards 109.50 will be expected after a sub-wave four bounce. Once we will be able to count five legs from 112.40 level, that is when bears will be expected to slow down as big flat correction in B will come to an end.

USDJPY, 4h

Get the 5 most predictable currency pairs

Elliott wave Analysis: USDJPY is Targeting 109.70 Level In Sharp Fashion