The US dollar versus the Japanese yen currency pair tried to establish an ascending move, but to no avail as the 110.27 resistance is heavily defended by the bears.

Long-term perspective

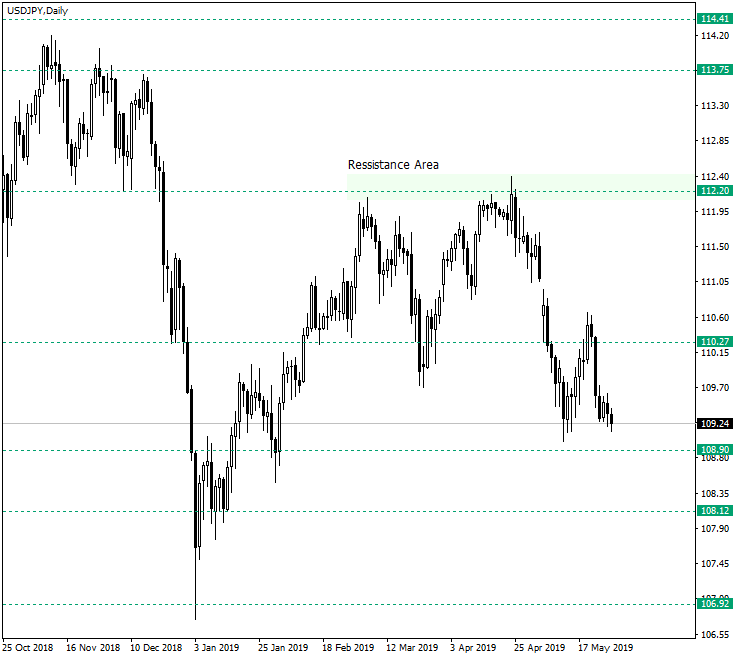

After the bearish confirmation of the important resistance area of 112.20 on April 25, 2019, the price dropped and printed a new low as it almost touched 108.90. From there, an appreciation emerged, but it was a short lived one as 110.27 forced the print of a lower high and a subsequent return to the area just above 108.90. So, after the confirmation of 112 no other bullish strength signs were to be seen in the price action of the currency pair.

The situation could continue as a flat, limited by 110.27 as resistance and 108.90 as support, and with further development — after the end of the potential flat — towards 108.12. Of course, the price could head for the 108.12 support by simply continuing the current descent phase.

Only the piercing and confirmation as support of 110.27 has the potential to give the bulls a new chance.

Shot-term perspective

Beginning with mid May, the price tried to appreciate from 109.12, but after that a very steep decent came by and brought the price back to 109.12. For now, the oscillations are limited by 109.74 and 109.12. If the resistance gives way, then the 100.23 level will be revisited, whereas if 109.12 will be the level that stops serving its role, then a drop to 108.77 is to be expected.

Levels to keep an eye on:

D1: 108.90 108.12 110.27

H4: 109.12 108.77 109.74 110.23

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.