- The Bank of England has not changed its policy but has expressed several concerns.

- These concerns comprise of baby steps towards removing the hawkish bias and weigh on the pound.

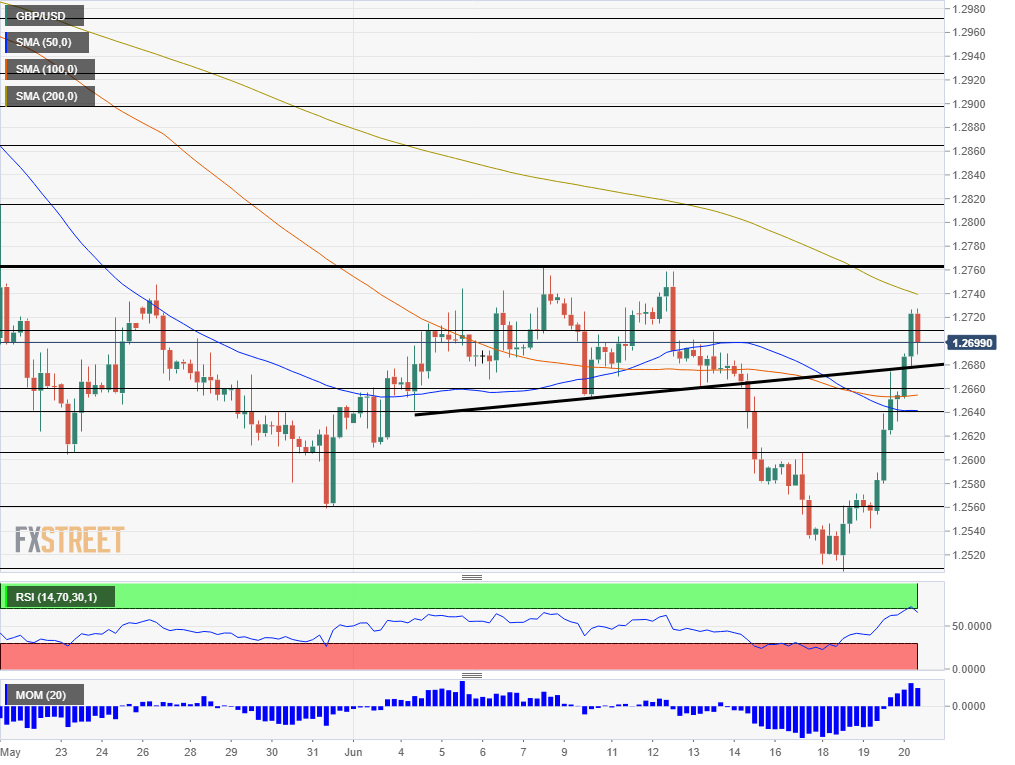

- GBP/USD faces several support levels on the way down.

The Bank of England has been moving towards the dovish side, beginning to align itself with its peers. Fewer than 24 hours after the US Federal Reserve opened the door to rate cuts, the Bank of England still intends to raise rates – but took steps to remove this bias.

Here are the main changes:

1) Downside risks increased: Similar to the Fed and the European Central Bank and the Fed, and the “Old Lady” has acknowledged slowing global momentum. They note a change since their May meeting.

2) Brexit assumption: While the BOE continues assuming a smooth Brexit as their base case scenario, Governor Mark Carney and his colleagues have acknowledged that markets may have a different opinion – fearing a hard Brexit. That is another small step towards the dovish side.

3) Weaker growth: The bank has cut its growth estimate for the second quarter from 0.4% to 0% – no growth. This assessment goes hand in hand with the squeeze of 0.4% the economy has suffered in April. Moreover, they also note that underlying growth has slowed in the first half of the year.

4) Wages leveling off: Average earnings have exceeded inflation in the past few months. Moreover, rising pay has been a bright spot in the UK economy – but this may have reached its limits. The BOE says there are increasing signs it may be leveling off.

5) Inflation is set to fall: Last but not least, the London-based institution has said that the consumer price index will likely fall below their 2% mandate later this year while inflation expectations remain well-anchored.

After having said all that, the BOE’s Monetary Policy Committee (MPC) is still stressing that ongoing tightening of monetary policy is needed, albeit at a gradual and a limited pace – thus maintaining the hawkish bias.

Nevertheless, the BOE is not projected to raise rates anytime soon – at least not until uncertainty regarding Brexit decreases.

There is a high chance that these warnings consist of the first step before the bank abandons its intent to raise rates. The pound’s sell-off in reaction to the decision points to that direction.

GBP/USD Levels to watch

GBP/USD has already lost the 1.2710 level, which was a swing high last week. The next levels to watch are 1.2640 and 1.2640, which were stepping stones on the way up in early June.

Further down, we find 1.2605, which was a low point in early June and also capped cable’s recovery last week.

May’s low of 1.2558 is the next cushion before GBP/USD faces the five-month low of 1.2505.

Looking up, the double-top of 1.2765 serves as fierce resistance. It is followed by 1.2815 and 1.2870.

Get the 5 most predictable currency pairs