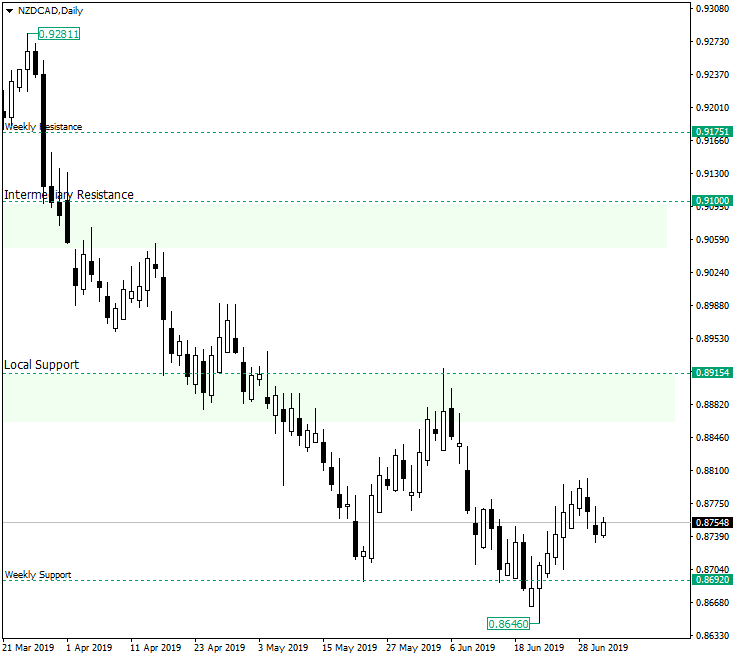

The New Zealand dollar versus the Canadian dollar currency pair did not manage to validate the piercing of the 0.8692 support level, sending the price above it and opening the path to 0.8915.

Long-term perspective

The descent from 0.9281, which brought the price under the weekly resistance of 0.9175 that was finally pierced just days before, gave the bears the necessary confidence to break all the subsequent important levels. Being so effective at piercing every support along the way, they tried to pierce the weekly support of 0.8692 as a final push, but the bulls were there to defend it, repelling the bearish progress and rendering the move under 0.8692 as a false piercing.

From the low of 0.8646 the price appreciated by printing not less than six consecutive bullish candles. Such a price-action from such an important level — the 0.8700 level being psychological and also a weekly support — gives a direction that can be only point to the north.

Of course, the price might oscillate for a while above 0.8692 before going upwards, but with or without any further consolidation, 0.8915 is just a matter of time, the second target being 0.9200.

Short-term perspective

The low of 0.8646 marked a turning point that would eventually cause the end of the descending trend, as the price pierced the double resistance etched by the upper line of the descending channel and the 0.8716 level. After 0.8716 was confirmed as support, the price made a new high by confirming 0.8782. The retracement that followed looks as if it is trying to make a new higher low and thus put in place an ascending channel.

As long as the price sits above 0.8716 or falsely pierces it, upwards movements are possible, targets being 0.8782 and then 0.8825.

Levels to keep an eye on:

D1: 0.8692 0.8915

H4: 0.8716 0.8782 0.8825

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.