Will the Federal Reserve slash interest rates by 50 basis points and embark on a cycle of loose monetary policy? Or will it settle for a minor reduction in rates? That is the question markets are grappling with and June’s jobs report – coming after a disappointing one in May – may provide answers to.

The NFP is due on Friday, July 5th, at 12:30 GMT. Follow it live here.

May may have been a one-off

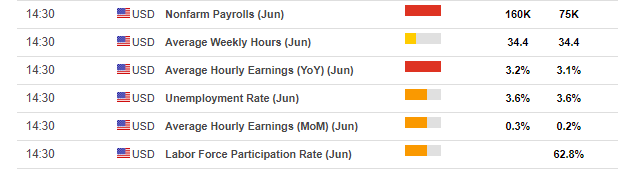

May’s Non-Farm Payrolls report has badly disappointed. The economy has gained only 75K jobs, and this increase came on top of downward revisions for April and March, which totaled 75K as well.

Moreover, the meager job growth in May was accompanied by an underwhelming increase in wages – only 0.2% month on month and 3.1% year on year – both 0.1% below expectations.

While it is impossible to sugarcoat May’s report, it is essential to note that the broader picture remains positive with the unemployment rate standing at 3.6%. Also, one-off weak jobs reports are frequent. The central bank eyes the average increase in positions.

The six-month average is 198K and the 12-month average is 196K.

But was it just a blip?

Expectations stand at an increase of 160K – a tad below the long-term averages but generally a return to normal. Analysts are cautiously optimistic.

Regarding wages,– which have only marginally dipped from the high levels – estimates stand at an increase of 0.3% MoM and 3.2% YoY. This is a repeat of last month’s projections. The unemployment rate is forecast to remain unchanged at low levels of 3.6%.

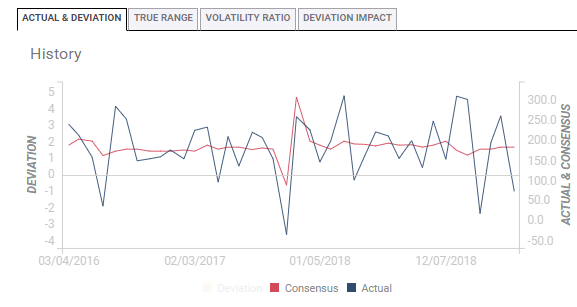

However, May’s downbeat jobs report was not the first disappointing figure so far this year. In February, the world’s largest economy also failed to grow its labor market by more than 100K jobs.

While employment growth jumped in March and April, the second non-consecutive miss is already worrying. Note the second sub-100K figure on the chart:

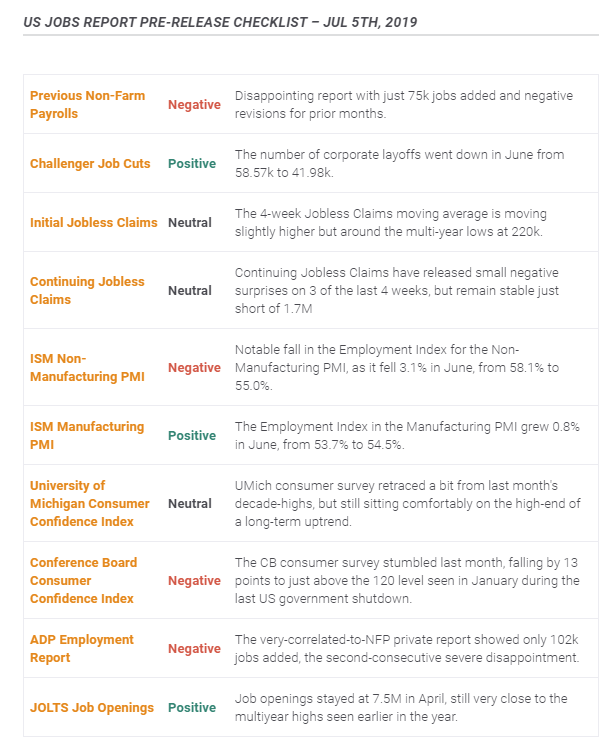

Moving from February to recent data for June, leading indicators are also leaning to the downside. Jordi Martínez explains why negatives outweigh the positives, emphasis mine:

The first glance at the table seems quite balanced, with four negative inputs, three neutral and three positive signals, but things get more negative looking at the details. It’s not only that we are coming from one of the worse NFP figures from the last decade, but also three of the most meaningful leading indicators have provided pretty strong negative surprises.

Here is the full list of leading indicators toward the release:

Overall, expectations are for a return of significant job growth, but below the averages. And leading indicators lean lower.

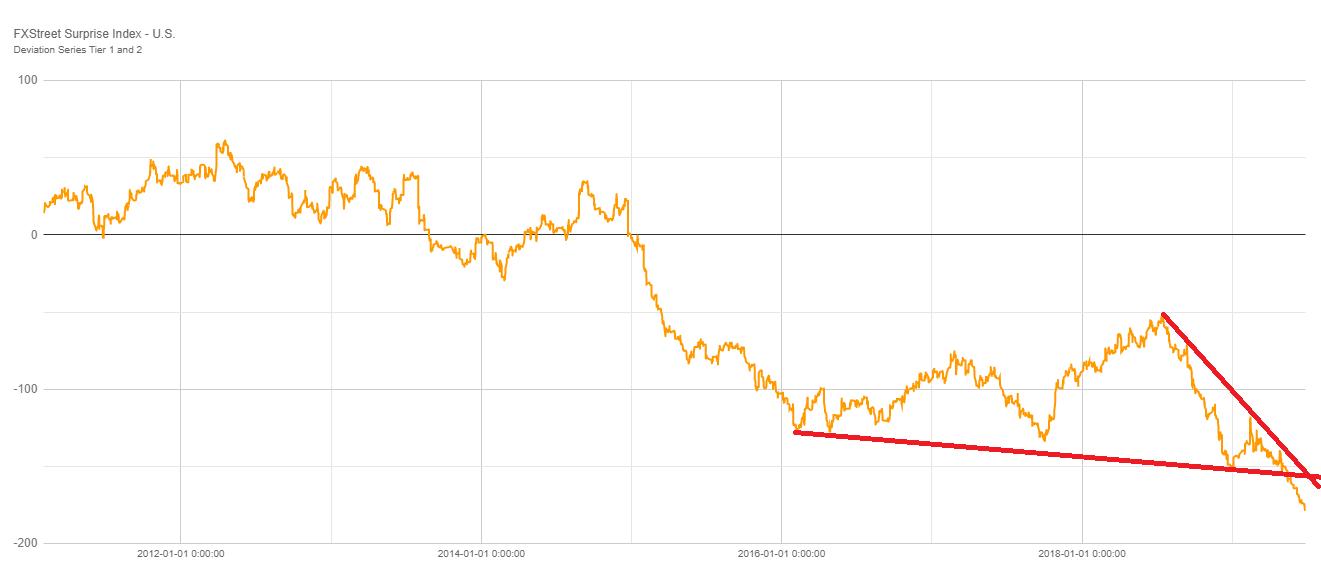

Surprise index points to a short-term correction

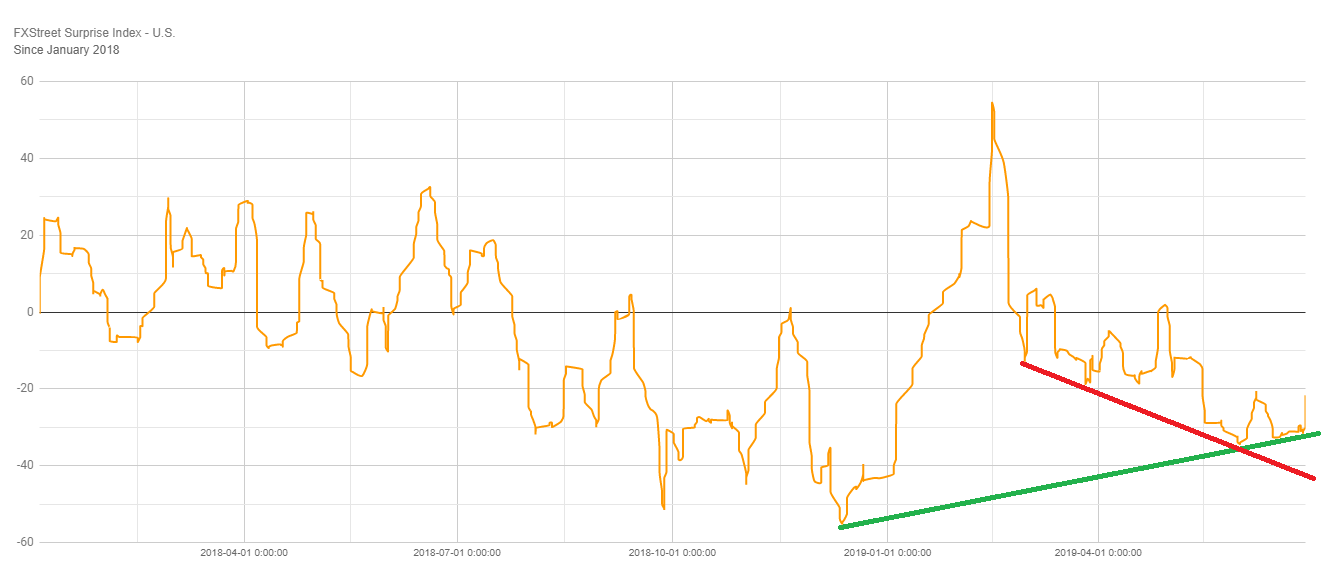

FXStreet Surprise Index quantifies, in terms of standard deviations of data surprises (actual releases vs. survey median), the extent to which economic indicators exceed or fall short of consensus estimates.

When we examine the long-term trend, surprises have been to the downside. When looking at top-tier and second-tier figures since 2011, we note that the Surprise Index is capped by downtrend resistance. Moreover, the indicator has broken below downtrend support. The lines are drawn on the chart below.

However, when we take a closer look, using figures dating back only to January 2018, the picture is more hopeful.

On this chart, the FXStreet Surprise Index has risen off the downtrend support line (in red) and has even set a higher low, beginning a potential uptrend (green line).

Therefore, the Surprise Index points to a higher chance of an upside surprise within the general trend of disappointing economic indicators.

How to trade the Non-Farm Payrolls with EUR/USD

After we have assessed the expectations and the chances for a surprise, let us examine EUR/USD – the world’s most popular currency pair.

The current trend in EUR/USD is to the downside due to recent political developments.

The Federal Reserve’s upcoming rate cut is already fully priced in. The Fed has sent a clear message in its previous rate decision in mid-June. Markets reacted by pricing in a possibility of a deep rate cut in July – 50 basis points. However, Fed officials have since cooled down expectations by saying it is probably going to be only an “insurance rate cut” – not a series of moves.

Moreover, President Donald Trump and his Chinese counterpart Xi Jinping have reached an agreement to resume trade talks and refrain from slapping new tariffs. The Fed’s dovish twist was partially triggered by global commerce, and as tension diminish, the case for embarking on a long cycle of loose monetary policy has waned.

All in all, the greenback has reasons to gain ground.

On the other side of the pond, the European Central Bank is ready to cut rates and perhaps introduce a new round of Quantitative Easing. President Mario Draghi has opened the door to further accommodation in his Sintra speech, and while the move is unlikely in its mid-July meeting, the ground is set for a substantial loosening in September.

And the next ECB President will be a dove as well. European leaders have nominated Christine Lagarde – the Managing Director of the International Monetary Fund – to lead the Frankfurt-based institution. Lagarde has recently praised the ECB’s accommodation and will have the chance to practice what she preached as early as November. All in all, the bias is in favor of the dollar and against the euro.

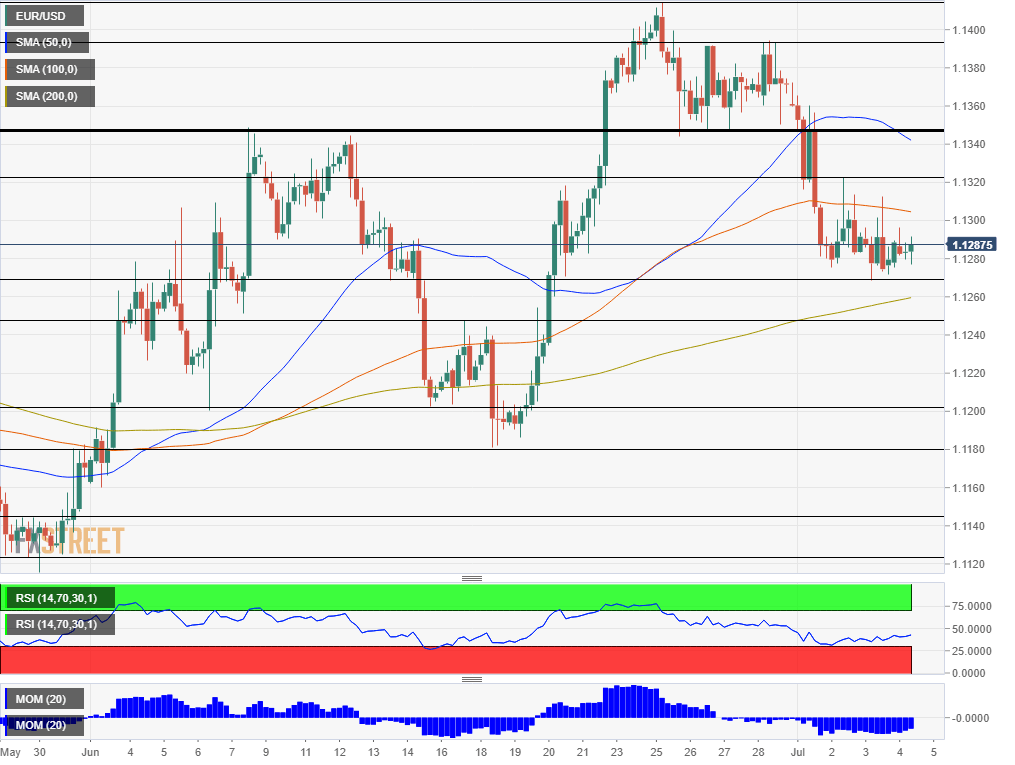

EUR/USD Technical Analysis

EUR/USD has been suffering from downside momentum and trades below the 50 and 100 Simple Moving Averages at the time of writing – bearish signs.

Resistance levels from the current price include 1.1410 (June’s high), 1.1390 (late June resistance), 1.1340 (support in late June and resistance earlier), and 1.1320 (early July high point.).

Support levels from the current price include 1.1270 (early July low), 1.1250 (mid-June temporary cap), 1.1200 (round number and support in early and mid-June), 1.1180 (mid-June low), and 1.1140 (late May resistance).

Should the data surprise the market substantially, expect the EURUSD to move an average of 60 pips in the first 15 minutes after the release. Because the previous two releases were weak in terms of deviation between Actual and Consensus, our systems will be more sensitive to trigger a trade. The deviation formula employs a ratio function to replicate behavioral anchors of market participants.

Last month’s Employment Report release triggered a Buy signal in the EURUSD at 1.1294 which closed after 12 minutes for 20 pips. This trade was triggered by a deviation of just -1 in the NFP change figure, according to our Market Impact scale.

Let us move onto the scenarios.

1) Return to normal – EUR/USD may lean lower

After the leading indicators have pointed to the downside, we can assume that real market expectations are lower than 160K. Therefore, the range for an “as expected” outcome would be 120-180K – asymmetrically lower.

In this scenario, EUR/USD may lean lower due to the current bearish bias. However, with no significant surprise from the headline change in jobs, Average Hourly Earnings may have the final word. An upside surprise may exacerbate the falls of EUR/USD while an adverse outcome may stabilize the currency pair or even push it higher.

2) Above 180K – EUR/USD may tumble down

As the FXStreet Surprise Index points to a chance of an upside correction, we assign this scenario a medium probability. Moreover, given the leading indicators’ lean to a worse-than-expected figure, the bar is low for an upside surprise.

In this case, EUR/USD may tumble down quickly due to the bearish bias.

Average hourly earnings may have no impact as the overwhelming message will be that May’s downbeat jobs report was only a one-off. It will take a considerable decline in wage growth to turn EUR/USD higher if jobs beat expectations.

3) Below 120K – EUR/USD has room to rise

After May’s meager employment increase, another downside surprise cannot be ruled out, yet it needs to be substantially worse than estimates. We assign this scenario low probability.

Such an outcome would exceed the low expectations set by the leading indicators and would go hand in hand with the broader picture of the FXStreet Surprise Index rather than the short-term one.

A figure of below 120K would open the door to EUR/USD gaining ground on rising expectations that the Fed would slash interest rates by 50 basis points later this month as the employment is already suffering.

Conclusion

The US Non-Farm Payrolls report for June is critical for the Fed’s potential rate cut in July. After a disappointing outcome in May, a bounce is due in June. However, economists expect a significant bounce yet below averages. Moreover, leading indicators point to an even lower result. The FXStreet Surprise Index points to a long-term downtrend in economic surprises, but a short-term correction.

EUR/USD leans lower ahead of the release and may fall if the headline meets expectations. In this baseline scenario, wage growth may steal the show. In case the data exceeds 180K, euro/dollar may tumble down. In the low likelihood of a meager increase of 120K or fewer jobs, the world’s most popular currency pair has room to rise.

Get the 5 most predictable currency pairs