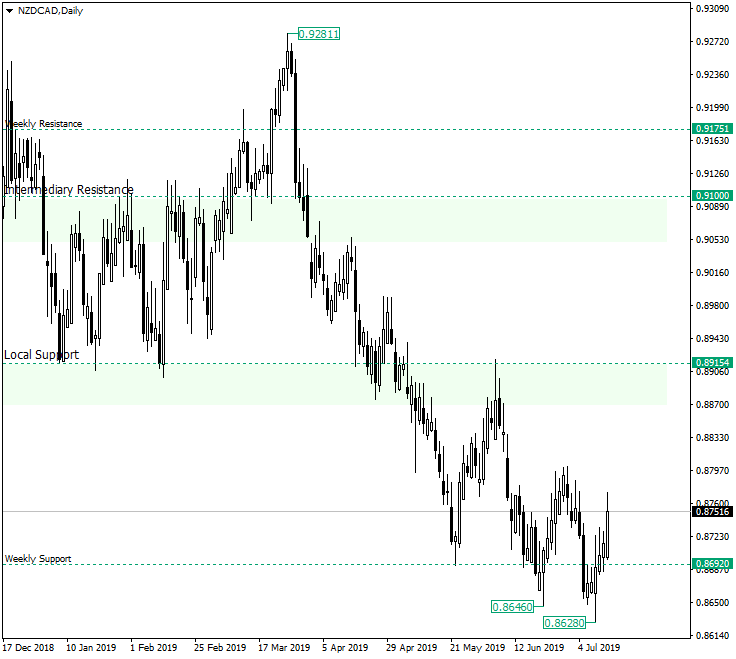

The New Zealand dollar versus the Canadian Dollar currency pair looks as if it confirmed the weekly support of 0.8692.

Long-term perspective

The fall from 0.9281 was driven by the bears with extreme confidence, but now, as the price approached this important weekly level, the bears preferred to book their profits and let the bulls do their thing.

This fact is represented by the low of July 1, 2019, which is a lower low if compared to the low of June 21, 2019. However, the price retraced above the important weekly level, thus getting into a zone that is favoring the bulls and also printing a false break.

The price might still continue this transition period, with the possibility of etching bottoming chart patterns. As long as the price does not take out the low of 0.8628 or as long as it sits above (or falsely pierces) the 0.8692 level, the upwards move will continue, with a first target around 0.8915.

Short-term perspective

The low of 0.8628 confirmed as support the resistance line of the descending channel that the price oscillated in beginning with April 2019. This confirmation propelled the price above 0.8717.

As long as the movements develop above 0.8717, new appreciations are possible, targeting 0.8792. If the high of 0.8801 is taken out, then the confirmation of 0.8782 as support will open the path to 0.8825 for the short term and, as discussed earlier, to 0.8915 on the long run.

Levels to keep an eye on:

0.8692 0.8919

0.8716 0.8782 0.8825

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.