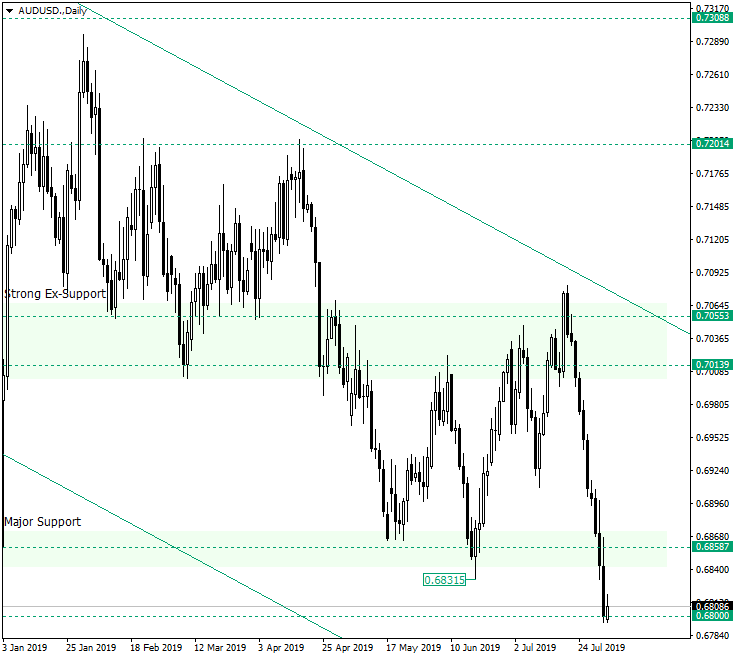

After such a strong decline, would the 0.6858 still be able to offer a surprise?

Long-term perspective

The steep decline that came after the confirmation of the double resistance etched by the upper line of the descending channel and the 0.7055 with 0.7013 resistance area managed to bring the price under the 0.6858 major support level, pausing at the 0.6800 psychological level.

This movement, besides taking out the previous low that falsely pierced the 0.6858 level, is composed of strong bearish candles — the only one which does not have a long body, although is bearish, is the one on July 29, 2019, the reason being that the bulls were trying to halt the decline around an important psychological level, 0.6800, respectively.

From here, the price could consolidate above 0.6800 and then continue the downwards movement. Another possibility is the one of a throwback. In this case, the price might retrace towards 0.6858. This could end up with the actual confirmation of 0.6858 as a resistance, followed by a new leg down. Another possible scenario is a confirmation as a resistance of the projection of the 0.6831 low. Also to be considered is a false break of 0.6858 — the price might get above it but fail to confirm it as a support, with the consequent fall beneath it and the continuation of the decline.

So, as long as the price does not confirm 0.6858 as support, the movement towards south is natural, being the materialization of the impulsive wave that pertains to the descending trend. A first target is represented by 0.6700, with a possible extension on the first run to 0.6650.

Short-term perspective

The price is in a clear descending movement and, as long as it continues or as long as its change prints a continuation pattern, it is expected to continue.

The first sign of a pause could be offered if the price gets above the 0.6865 level — which corresponds to the 23.6 level of Fibonacci retracement. But even in this case the other projections — preferably up to 50.0, which corresponds to the 0.6935 level — are well suited short-term areas from where the price to continue declining. The first target is represented by the 0.6700 psychological level.

Levels to keep an eye on:

D1: 0.6858 0.6800 0.6700

H4: 0.6865 0.6935 0.6700 and the Fibonacci retracement levels

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.