- Doubts about a US-Sino trade deal are creeping in.

- Germany is getting closer to a recession according to new data.

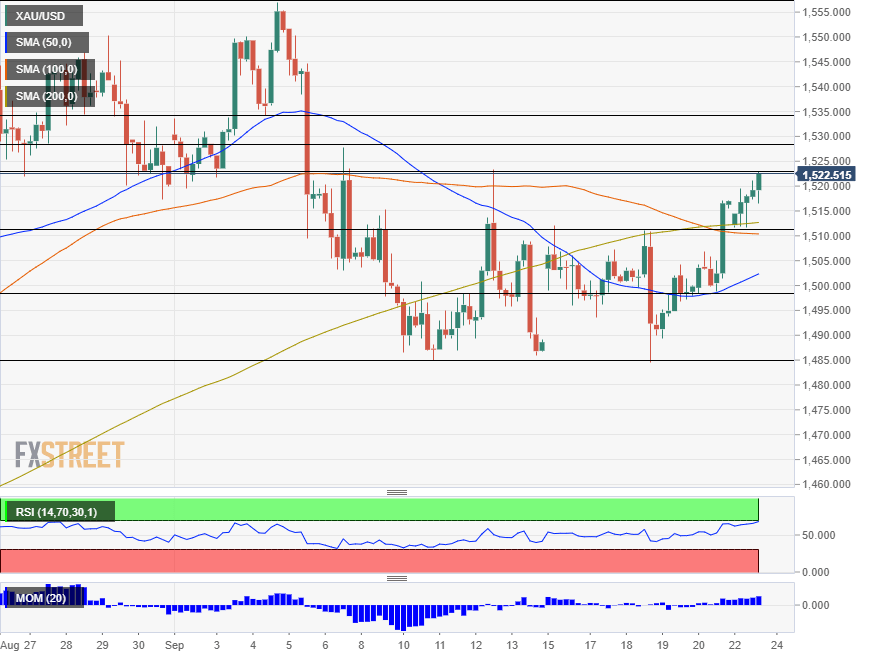

- Monday’s four-hour chart shows that bulls are in full control.

Gold is trading above $1,520 per oz, the highest since September 12. when the peak was $1,523. It has reached this critical resistance level – and may break it – for three reasons.

1) US-Sino relations cool

After the US and China seemed to be nearing an “interim deal” – an extended truce that would include steps to create mutual trust and perhaps lower tariffs – the mood is worsening again. President Donald Trump has rejected such a limited accord and says he prefers a comprehensive agreement. Moreover, he has been unable to describe his relations with Chinese President Xi Jinping as warm.

Moreover, a Chinese delegation was supposed to visit farms in Nebraska and in Montana – and these visits were called off. Officially, both sides are saying that talks were “productive” and “constructive” but there was no report of a breakthrough.

The safe-haven yellow metal is a beneficiary of rising trade tensions – a safe-haven asset.

2) Germany closer to a recession

Markit’s preliminary Purchasing Managers’ Indexes for Europe’s largest economy fell short of expectations –with the manufacturing PMI plunging to 41.4 points – against expectations for a rise. It is already clear that the critical sector – which is 39% of Europe’s manufacturing output – is experiencing a recession.

The services sector continues enjoying growth according to the forward-looking gauges – but it also dropped more than expected. The figures for France and for the whole euro-zone were also bleak.

As a bloc, the euro area is the world’s third-largest economy and its gloomy prospects also lead investors towards the havens.

3) Bullish technical setup

XAU/USD is has broken above the 100 and 200 Simple Moving Averages on the four-hour chart after leaving the 200 SMA behind last week. Momentum is to the upside and is rising – implying more gains. The Relative Strength Index is getting close to 70 – which reflects overbought conditions – but is not there yet.

All in all, bulls are in control.

The immediate resistance line is $1,523 mentioned earlier. The next cap is a peak from September 9 – $1,528. Next, we find $1,535, which provided support on September 4. From there, the road is open to the big prize – the 2019 high of $1,567 recorded on September 5.

Support awaits at $1,511, which provided support at the beginning of the new week and also coincides with the 100 and 200 SMAs. Further down, $1,498, was a support line last week. It is followed by $1,485, that was a triple-bottom in September.

Get the 5 most predictable currency pairs