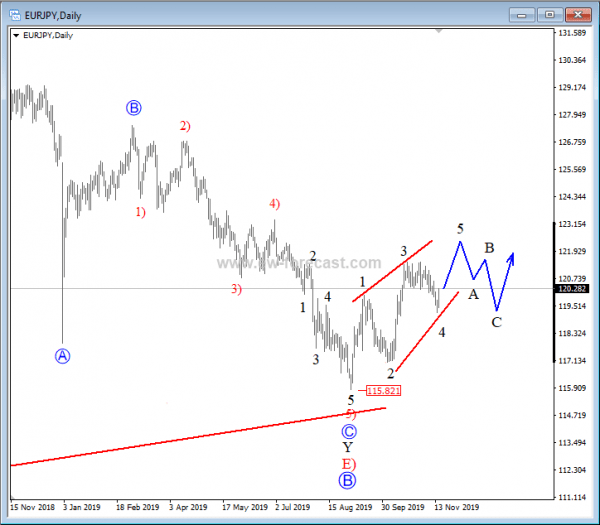

It seems that a probable Elliott wave leading diagonal can be in progress from the lows on EURJPY with a price ending a fourth wave correction, so be aware of one more leg higher, before a temporary A-B-C correction starts developing.

EURJPY, daily

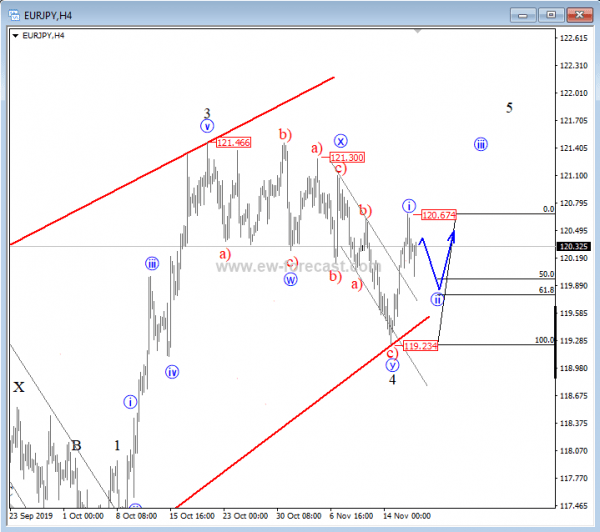

On the 4h chart of EURJPY, the pair made a strong turn higher after corrective wave 4 found a base at the 119.23 area last week. We labeled a completed double zig-zag in 4 which can now be followed by a five-wave move to the upside with sub-wave I already completed. If that is the case, then corrective wave ii may take price into a temporary pullback; possible support for wave ii can be at 119.9/119.7 region.

EURJPY, 4h

When diagonal triangles occur in the fifth or C wave position, they take the 3-3-3-3-3 shape that Elliott described. However, it has recently come to light that a variation on this pattern occasionally appears in the first wave position of impulses and in the A wave position of zigzags. The characteristic overlapping of waves one and four and the convergence of boundary lines into a wedge shape remain as in the ending diagonal triangle. However, the subdivisions are different, tracing out a 5-3-5-3-5 pattern.

Elliott wave leading diagonal:

Trade well,

The EW-Forecast team

Get the 5 most predictable currency pairs