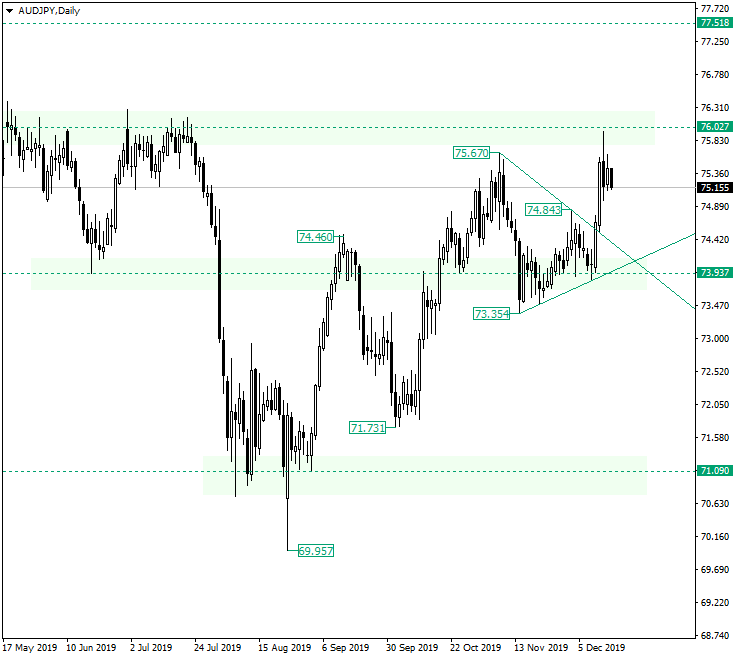

The Australian dollar versus the Japanese yen currency pair retraced sharply from the 76.00 psychological area. Is this a bearish sign or is it only that the bulls are booking the profits?

Long-term perspective

From the support of 71.09, the market is in an ascending movement that extended — for now — until the 76.02 level.

The appreciation came after a relatively long period of stagnation, as the price oscillated around the 73.93 level from the end of November until the middle of December. This period was just long enough to facilitate a lot of steam to build up, as it can be seen from the strong appreciation that followed and was fueled by it.

The rally crystalized a new higher high with respect to the previous high — 75.67 — and, as a consequence, the bears do not have any reasons to believe that the retracement from 76.02 — even if strong — is a sign of bullish weakness.

Even more, the retracement on December 13, was followed by an appreciation candle that was able to close above the midline of the previous candle’s body.

In this context, it is reasonable to expect any depreciation to be limited, as it represents an opportunity for the bulls to join the market at better prices.

The aggressive traders will be looking to buy from the current area — above the 75.00 psychological level, which is not highlighted on the chart.

More conservative traders would wait for a false piercing of the aforementioned 75.00 or even a retest of the previous high — 74.84 — with the confirmation of it as support.

For the time being, the aim is still 76.02 and, if it is conquered, the bulls would switch target to 77.51. Only if 73.93 gets taken out, then the situation turns neutral.

Short-term perspective

The appreciation that started from 73.90 stopped at 75.99, retraced to 74.96 and, after confirming it as support, went back up to 75.62, from where a new retracement to the downside began.

As long as the price confirms 74.96 as support, new appreciations are to be expected, the targets being 75.33, 75.62, and 75.99, respectively.

If 74.96 gives way, then 73.90 gets exposed, but from there a new appreciation may emerge, targeting the aforementioned three levels and, of course, 74.96.

Levels to keep an eye on:

D1: 75.00 77.51 73.93 and the previous high at 74.84

H4: 74.96 75.33 75.62 75.99 73.90

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.