EUR/USD is hovering around 1.09 and waiting for the next hammer to fall. Where next?

Here is their view, courtesy of eFXdata:

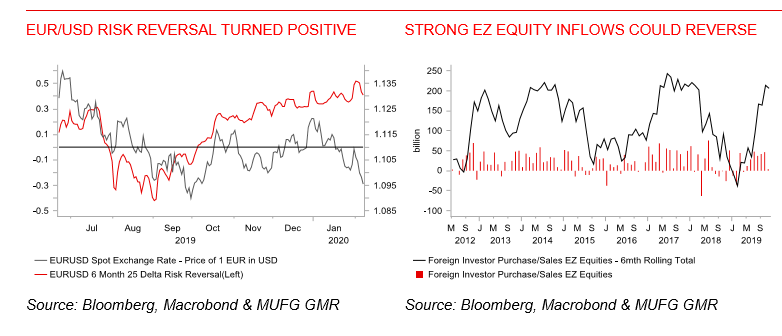

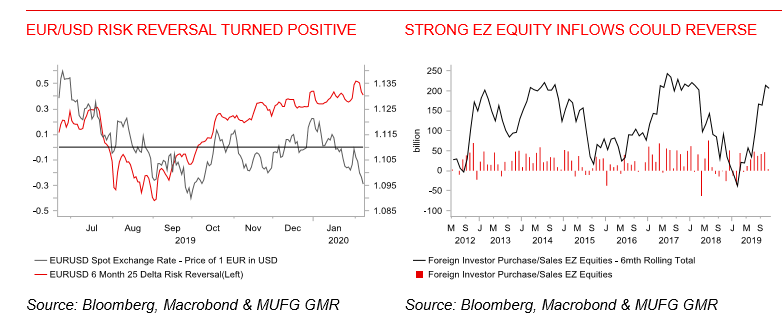

MUFG Research discusses EUR/USD outlook and adopts a tactical bearish bias in the near-term.

“The data from the euro-zone today have certainly shifted out short-term view for the euro given the scale of weakness in manufacturing activity in the two largest economies of the euro-zone. The 3.5% plunge in IP in Germany and the 2.8% plunge in France were far weaker than expected and raises the likelihood of a contraction in euro-zone real GDP in Q4 when the data is released next Friday,” MUFG notes.

“This notable turn in IP data across key countries in the euro-zone (Spain & Netherlands data were also very weak) comes in the same week as ECB President Lagarde stated that the scope for monetary easing has become very limited to deal with external shocks like coronavirus. Markets may conclude that the FX channel is now the primary tool available for countering negative growth shocks going forward,” MUFG adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up for eFXplus via the link above, you are directly supporting Forex Crunch.

Get the 5 most predictable currency pairs

EUR/USD: Elevated N-Term Risks Of Further EUR Weakness – MUFG