The Australian dollar versus the US dollar currency pair extended to as low as 0.6433. Is this the end of the road for this depreciation?

Long-term perspective

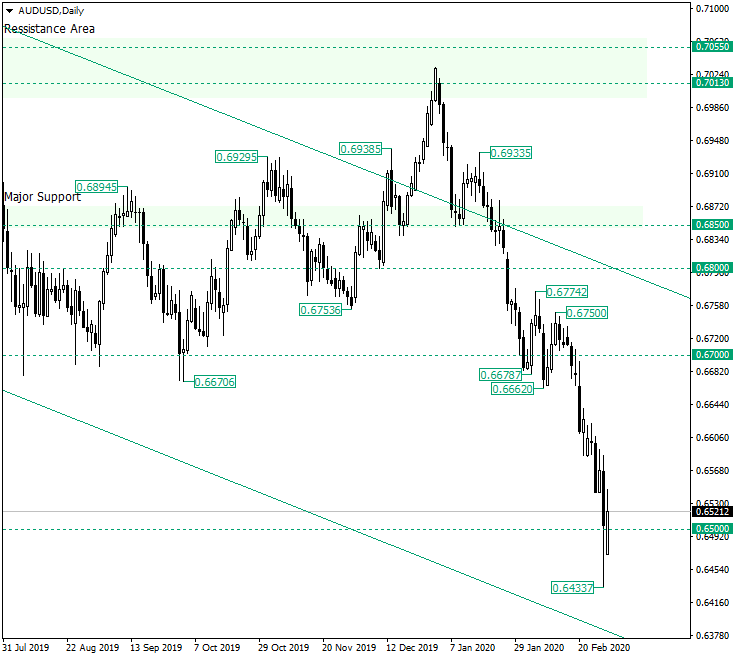

After confirming the resistance area defined by 0.7055 and 0.7013, the price started to fall towards the major support of 0.6850.

As the price reached the support, the head and shoulders — shoulders marked by the highs of 0.6938 and 0.6933, respectively — was ready to let its message print on the chart.

The 0.6850 support — which also served as the chart pattern’s neckline — gave way, and so a strong depreciation began.

After a pause around the 0.6700 psychological level, the bears further moved the price towards the south, piercing the 0.6500 level, etching the low of 0.6433, and retracing above 0.6500.

It is expected that the bulls will try to take the chance of rendering the strong retracement from 0.6433 as a false break of 0.6500, and thus to fuel an appreciation that may target the psychological level of 0.6600 — not highlighted on the chart.

As long as the price stays above 0.6500, appreciations are possible, but they may serve as good spots for the bears to join the market at better prices.

On the other hand, if the price stabilizes under 0.6500, then a first target could be the previous low, 0.6433, respectively, followed by the next psychological level — 0.6400.

Short-term perspective

On February 19, after the price confirmed the level of 0.6705 as resistance, it declined towards the next support, 0.6600.

After a short consolidation above 0.6600, the fall continued, reaching the low of 0.6433.

The price could start a consolidation phase lined up by the support of 0.6497 and the resistance of 0.6556.

It will be very interesting to see which of the consolidation phase’s limits gives way first. If the resistance is the one that allows the price to traverse it, then 0.6600 may be challenged and, if conquered, may favor the bulls in reaching 0.6705. On the other hand, a fail of 0.6497 to contain the price can result in 0.6433 receiving a visit.

Another possibility is for a reversal pattern to form — a double bottom, an inverted head and shoulders, or even an inverted bump and run which may materialize if the trendline is pierced. In light of this event, the same 0.6705 is the target.

The last scenario is the one in which the price gets back under 0.6497. If this happens, 0.6433 is the main target, but the drop can extend until 0.6400 — not highlighted on the chart.

Levels to keep an eye on:

D1: 0.6500 and the low of 0.6433

H4: 0.6497 0.6556 0.6600 0.6705

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.