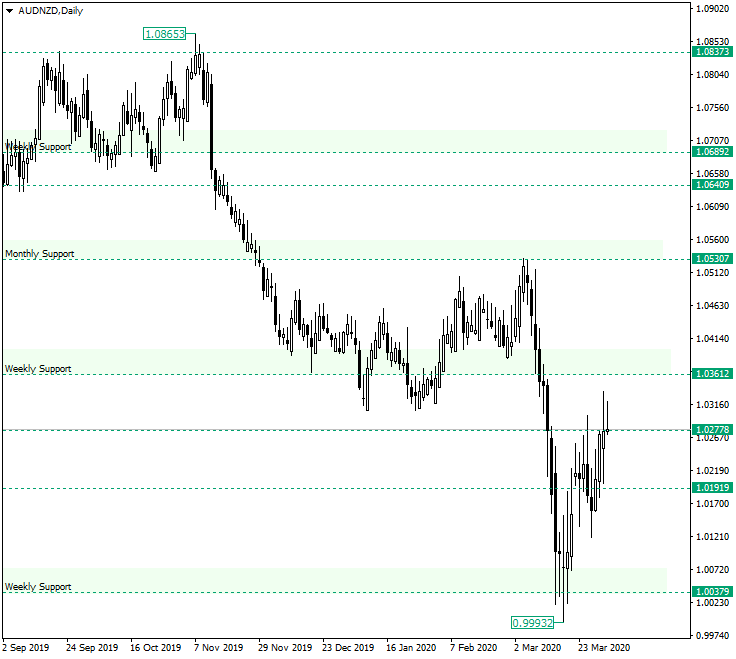

The Australian dollar versus the New Zealand dollar currency pair is approaching the important weekly level of 1.0361.

Long-term perspective

After confirming the level of 1.0837, the price started to decline. The first strong pullback occurred around the weekly support of 1.0037. But until here, the pierce passed important areas, such as the weekly support of 1.0361.

The reconfirmation of the 1.0037 support — which printed the low of 0.9993 — brought about a rally that conquered the first intermediary resistance — 1.0191 — but is still to do to the same with the second one — 1.0277.

So, the first scenario is the one in which the bulls manage to conquer the level of 1.0277. They have this chance, considering that by reaching this area they printed a higher low — on March 26 — and a higher high — on March 31. If they manage this, then their focus will switch on reconfirming 1.0361 as support, the target after that being 1.0530, which is an important ex-monthly support.

The second scenario is the one in which the bears get hold of the situation and confirm 1.0277 as resistance. If this takes place, then 1.0191 is their main target, as the bulls could be waiting here to start a new rally. Only if 1.0191 gets confirmed as resistance, then the price may visit the weekly support of 1.0037 once more.

Short-term perspective

The price is in an ascending movement that started after the retracement from 1.0308 confirmed the 1.0150 level as support.

As long as the price sits above the trendline that starts from the low of 1.0119, the bulls can be confident in their possibilities.

The price might form a consolidative phase limited by the resistance of 1.0332 and the support of 1.0282. This phase could, once the double support formed by 1.0282 and the trendline is confirmed, sparkle a new leg to the upside, targeting 1.0368.

On the other hand, if the trendline is pierced, then the situation turns neutral and the bears would be entitled to believe that is a conservative approach to join the market only after the 1.0150 level is confirmed as resistance, a case in which 1.0024 becomes their aim.

Levels to keep an eye on:

D1: 1.0277 1.0361 1.0530 1.0191 1.0037

H4: 1.0282 1.0332 1.0368 1.0150 1.0024

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.