Pound/dollar volatility is at Brexit levels – not as wild as throughout March but still highly elevated. Coronavirus health and economic developments are likely to continue dominating trading, with several US developments set to have their say as well. Will GBP/USD hold up?

This week in GBP/USD: Curve far from flattening

The US dollar has been on the back foot amid end-of-quarter corrections, and as markets found a semblance of stability after the US passed a $2.2 trillion fiscal package. The Federal Reserve’s ongoing support to markets via various programs has also contributed to softening moves and sending investors away from the safe-haven dollar.

However, coronavirus continues taking a high human and economic toll.

The number of UK COVID-19 cases – and deaths – continue rising quickly and limit the pound’s moves. Wednesday’s report of a 31% increase in fatalities and stories that only a few medical staff have been tested have caused concerns. Officials estimate that the UK may be under some form of restrictions through September.

In the US, the number of infections has surpassed 200,000, and the curve is far from flattening. Shortages of equipment and mixed messages from some governors have contributed to the gloom. President Donald Trump changed his tone and warned of two painful weeks and that guidance to stay at home will run through April, contrary to previous aspirations to open the country at Easter.

The US ISM Manufacturing Purchasing Managers’ Index and Markit’s final UK Manufacturing PMI both beat expectations – and seem out of data with the rapid pace of events.

On the other hand, the more up-to-date US jobless claims painted a devastating picture of the economy with a surge to 6.648 million applications, worse than all estimates. The Non-Farm Payrolls report showed a destruction of 701,000 positions, far below expectations but probably only the tip of the iceberg, as the report relates to the week including March 12.

As mentioned, GBP/USD’s range has somewhat narrowed but remains broad amid nonstop news.

UK events: COVID-19 figures and last look at Boris bounce

After several days of rapid rises, investors will be watching the daily reports on coronavirus cases to see if the efforts are flattening the curve – lowering the daily death count, the number of infections, and those hospitalized in intensive care units.

If pressure on ICUs drops, the government could begin thinking of loosening some of the restrictions. The UK may enter a cycle of making decisions related to the lockdown every three weeks. The government is meeting via Zoom, as some members – including the PM – have tested positive for the illness.

Brexit talks will likely remain on ice once again, and the economic calendar does not feature crisis-related data. Gross Domestic Product figures for February will probably show some growth – the last signs of a post-election improvement in the economy dubbed the “Boris bounce.” Manufacturing Production figures are also of interest, but disease-related data is becoming more important.

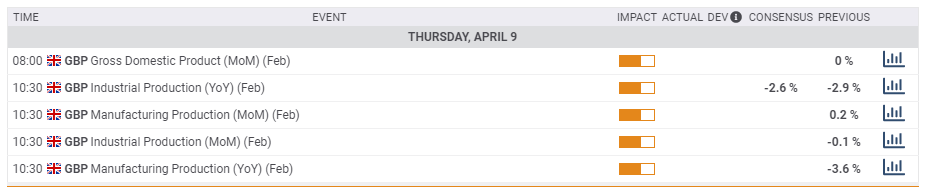

Here is the list of UK events from the FXStreet calendar:

US events: Fed minutes, consumer confidence and New York’s figures

Similar to the UK, reports on the spread of coronavirus are left, right, and center. New York Governor Andrew Cuomo’s daily updates on the situation in his state – the epicenter of the disease – are of high interest. The death toll and ICU utilization stand out.

Figures from other states could gain traction as well. Florida’s population is relatively elderly and has been one of the last states to impose a lockdown. Other large states such as California and Texas are also significant.

House Democrats may try to advance a new stimulus bill – the fourth coronavirus-related package as the economy continues suffering. If Republicans jump on the idea, markets could rise while if the ruling party shrugs it off, the market sentiment will likely sour.

The economic calendar consists of several significant releases. Jobless claims are of high interest once again, after their surge. The indicator for the week ending on April 3 will shed light on the current state of the US labor market.

Earlier, the Federal Reserve’s meeting minutes from the latest emergency meetings could reveal the central bank’s motives – how distressed the financial system was before the Fed acted. It may also provide insights on the Fed’s next potential actions.

Another significant publication is the University of Michigan’s preliminary Consumer Sentiment Index gauge for April. It dropped in March but remained at a relatively robust level of 89.1 points.

Markets will likely ignore the Consumer Price Index figures for March. While it related to the crisis period, investors are more interested in employment numbers than inflation at this point.

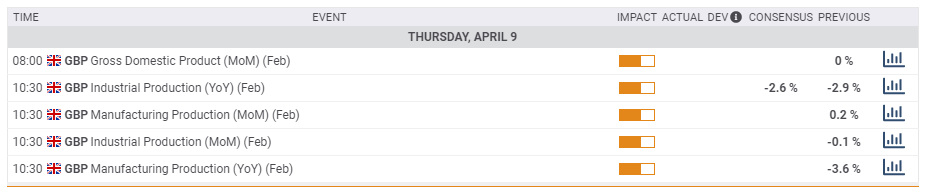

Here the upcoming top US events this week:

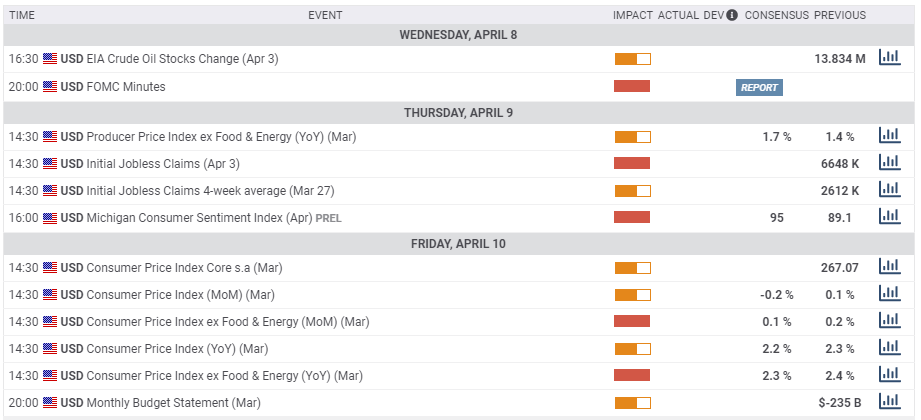

GBP/USD Technical Analysis – Death Cross pattern

Pound/dollar is still suffering from downside momentum on the daily chart and is trading below the 50, 100, and 200-day Simple Moving Averages. However, momentum is off the lows, and the Relative Strength Index has stabilized.

Once the 50-day SMA crosses the 200-day SMA, the death cross pattern will be triggered, a bearish sign.

All in all, bears are still in the lead.

Resistance awaits at 1.2330, a support line from late March. Further up, 1.2485, which was a stubborn cap in late March and early April. The next noteworthy cap is only at 1.2670, which is the confluence of the 50 and 200-day SMAs. 1.2735, 1.2770, and 1.2850 are the next lines to watch.

Some support awaits at 1.2240, a swing low from the same period and also a support line from early April. It is emerging as a double-bottom. Next, 1.2110 was a stepping stone on the way down and 1.1980 capped GBP/USD capped it on the way up. There are very few noteworthy levels on the way to the 35-year low of 1.1414, with 1.17 and 1.1530 standing out.

GBP/USD Sentiment

The currency pair’s stall may indicate that the recovery is over. The ongoing increase in COVID-19 cases, deaths, and hospitalization may benefit the safe-haven US dollar.

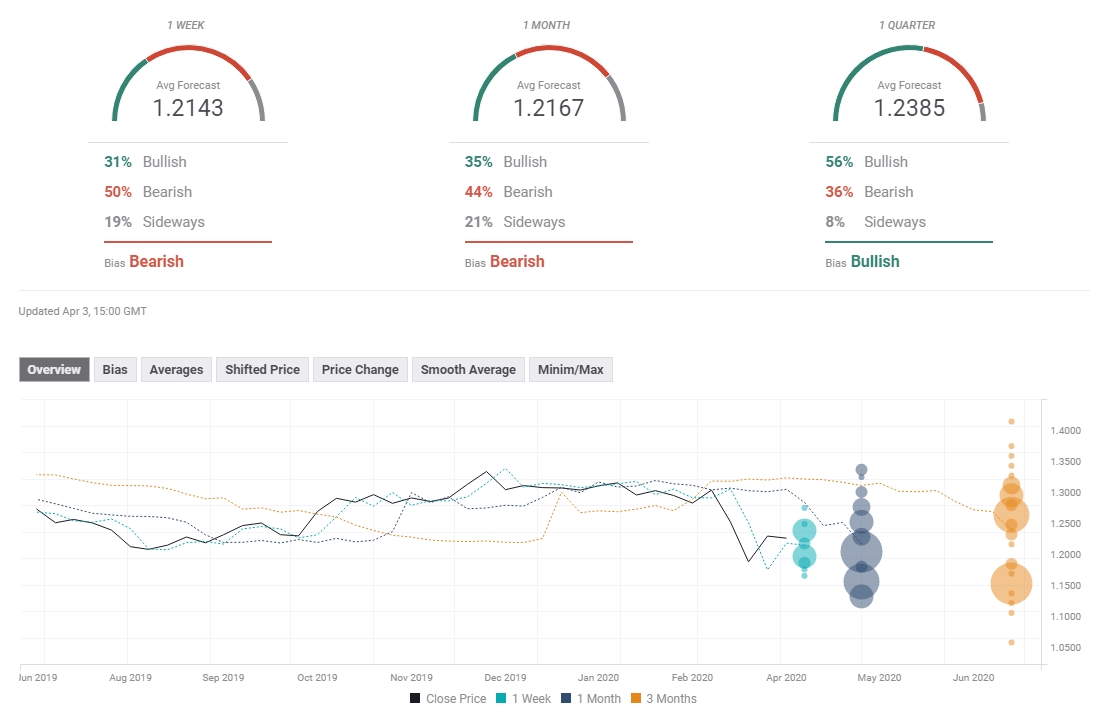

The FX Poll is showing that experts are bearish in the short and medium terms, with an average target below 1.22. However, they remain bullish in the medium term, foreseeing a bump. The most substantial shift is in the long-term target, which had been considerably higher in the previous week.

Related Forecasts

Get the 5 most predictable currency pairs