The Australian dollar versus the US dollar currency pair seems to offer conflicting signals, but how can some light be shed upon the situation?

Long-term perspective

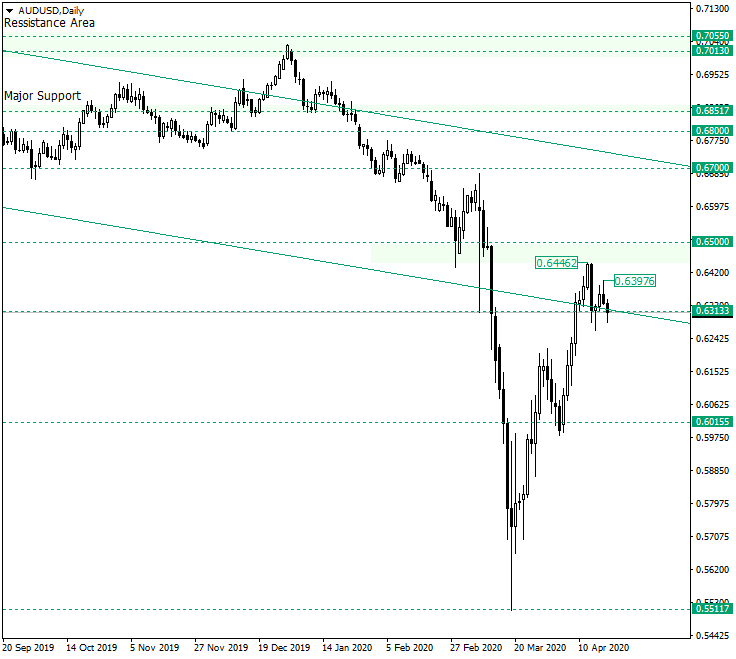

The advancement that started from the level of 0.5517 extended to as high as 0.6446, almost reaching the major area just beneath the 0.6500 psychological level.

After peaking at 0.6446, the price went under the 0.6313 support level only to peak again at 0.6397.

The fact that the price recovered from just under 0.6313 was an attractive progress for the bulls, keen to bring the price above 0.6500. However, the peak from 0.6397 now stays in their way, as it, alongside 0.6446, could craft a double top formation.

So, as long as the price is not taking out the peak at 0.6397, confirming 0.6313 as resistance is just a matter of time. Consequently, if 0.6313 is confirmed as resistance, via a day closing under it or by a throwback which considers it, then the level of 0.6015 is the main target.

Only if 0.6313 is confirmed as support, then 0.6500 becomes the aim for the market participants.

Short-term perspective

From the low of 0.5565, the price entered into an ascending channel, the support of which is now trying to pierce.

If the bulls accomplish to drive the price above the double resistance made possible by the level of 0.6363 and the upper trendline that is part of the descending channel, which may later enclose an angled rectangle, then 0.6497, followed by 0.6556, are potential targets.

Another possible scenario, bullish as well, is the one in which the double support, etched by the level of 0.6231 and the lower line of the descending channel, gets confirmed, thus fueling an advancement towards the aforementioned double resistance.

However, if the double support is invalidated, then 0.5967 is the prime bearish target.

Levels to keep an eye on:

D1: 0.6313 0.6015 0.6500

H4: 0.6363 0.6497 0.6556 0.6231 0.5967

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.