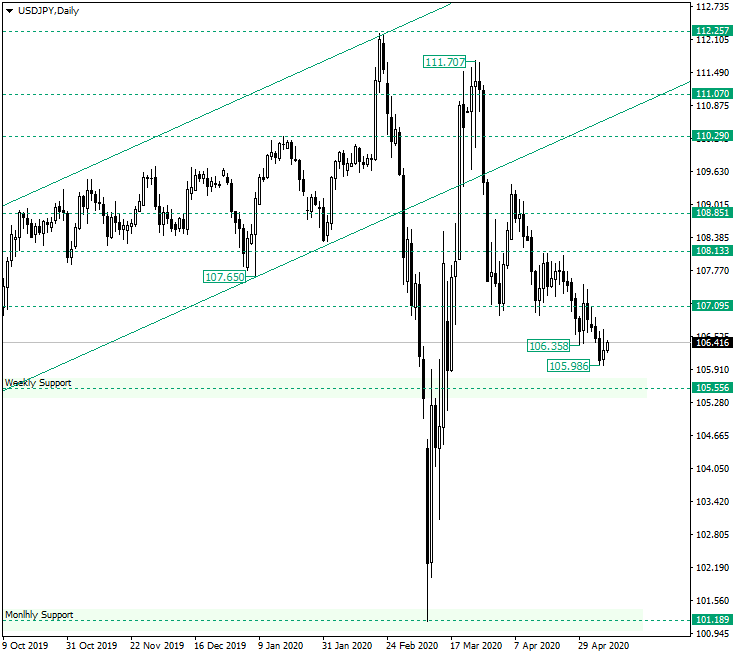

The US dollar versus the Japanese yen currency pair is approaching the weekly support level of 105.55. How may the market react?

Long-term perspective

After falling from the 111.70 high, the price extended until the 107.09 level, which served as support almost for the entire length of April.

As the market was printing lower highs and the bulls were showing less and less conviction to drive the price higher, the expected outcome happens, as the price pierced the 107.09 support (etching the low of 106.35) and confirmed it as resistance.

The confirmation fueled a depreciation that reached the low of 105.98.

If the bulls can make a comeback and close above the low of 106.35, and preferably above the high of the candle on May 7, then they could rally to a very close distance to 107.09. If this happens, they could, later on, define a reversal pattern that brings the price above 107.09, which would expose 108.13.

On the other hand, if the current situation continues, then the market could reach the 105.55 level. Once here, the market should be left to decide if it will confirm the level as support or, vice-versa, pierce it, and validate it as resistance. In the latter scenario, 101.18 would be a long-term bearish target.

Short-term perspective

The price is in a descending trend, the resistance line of which starts from the 109.06 high.

The price slipped under the 106.41 level and the bears are attempting to confirm it as resistance. But even if the price gets back above the level, as long as it is oscillating under the trendline, the overall profile remains bearish.

For the bulls to get back in the game, the price must be sent above the double resistance made possible by the trendline and the level of 107.38. This could allow further advancement to 107.92 and 108.43 later on.

Levels to keep an eye on:

D1: 107.09 108.13 105.55 101.18

H4: 106.41 107.38 107.92 108.43

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.