The Australian dollar versus the US dollar currency pair is, yet again, above the 0.6500 psychological level. It’s the bulls that won, or is the bears that are preparing their final push?

Long-term perspective

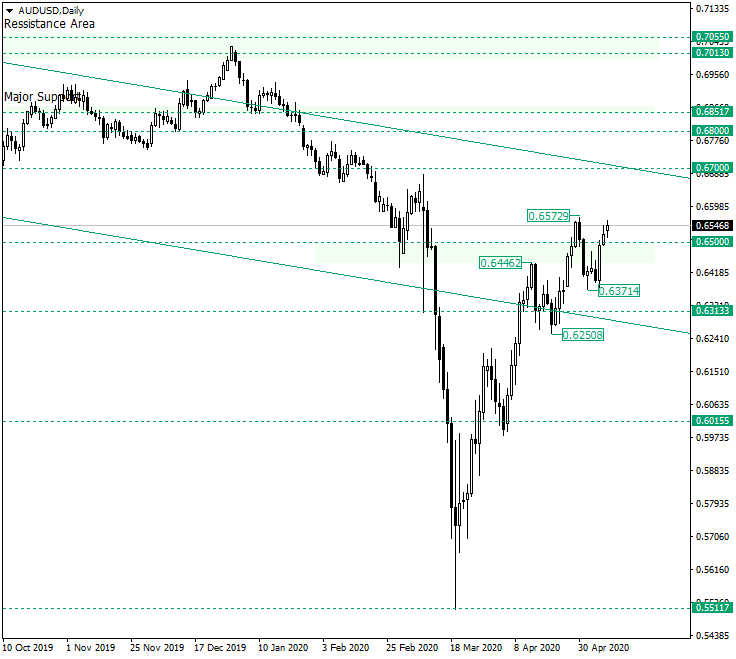

After confirming the support level of 0.5511, the price started an upwards movement that, against the bearish odds, accomplished to pierce major resistances and establish them as support areas.

And it looks like the 0.6500 psychological level si next. As the price falsely pierced it on April 30, peaking at 0.6572, the bears drove the market back under this mark and beneath the previous high of 0.6446. They even invalidated the pin-bar on May 4, as the two following days, May 5 and 6, respectively, carried a clear bearish message — as the first one was a bearish pin-bar and the second one confirmed it by closing lower than the low on May 5. However, all this bearish setup was taken out by the strong bullish candle on May 7.

Although the candle on May 7 closed a hair away from 0.6500, the next candle made it loud and clear that the bulls want the price above this level.

As a result, further development could unfold in the form of two scenarios. The first one considers the recent bullish comeback. In other words, as long as the price oscillates above the 0.6500 level, it is only a matter of time for the level of 0.6500 to be confirmed as support and for the high of 0.6572 to be taken out, respectively. Once that passes, the bulls have enough room to push the prices towards their primary target, 0.6700.

On the flip-side, if the market returns underneath the 0.6500 level, the bearish scenario may materialize. Irrespective of the price printing a higher high above 0.6572, if a retracement under 0.6500 occurs, then a new fall towards the 0.6400 psychological level — not highlighted on the chart — and then to the 0.6313 support could be in the cards.

Short-term perspective

The price is at the double resistance made possible by the ascending trendline that starts from the low of 0.5988 and the level of 0.6556, respectively.

If the double resistance remains in place, then the price could be sent towards the 0.6440 level, a first bearish target in the short term. If the market does not find support here, then the decline could extend until the next support, represented by the 0.6363 level.

On the other hand, if the bulls manage to conquer 0.6600, then they could extend until the 0.6705 resistance.

Levels to keep an eye on:

D1: 0.6500 0.6700 0.6313

H4: 0.6556 0.6440 0.6363 0.6600 0.6705

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.