Hello traders,

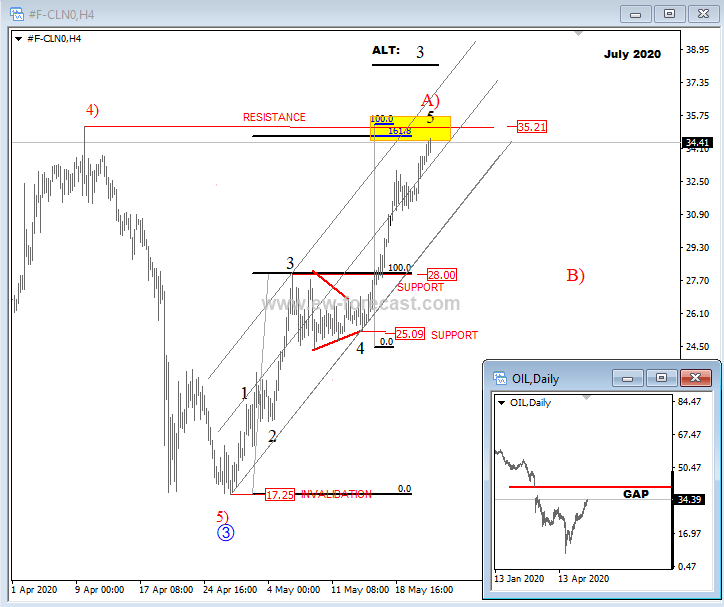

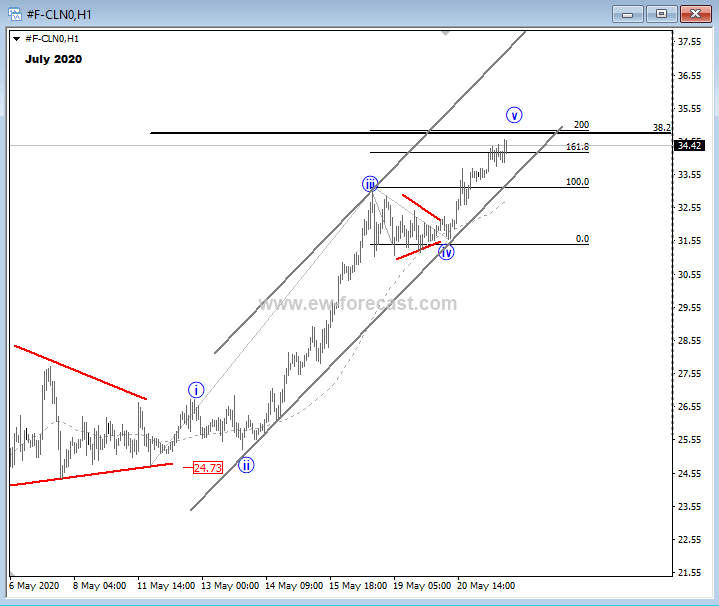

Crude oil is bullish since the end of April and is currently trading very strongly towards $35 per barrel. This can be now a temporary resistance, ideally for wave 5 of A), therefore traders should be aware of a potential wave B setback, before the trend resumes even higher. This pullback is anticipated even on the 1h time frame, where rise from 24.70 is also in five waves, which indicates a potential limited upside at near-term levels. But because we see price moving into resistance, it does not necessarily mean it will hold unless we see a reversal and decisive breakthrough the hourly channel support line. This will likely signal that retracement is underway. Once correction will unfold, we think that this can be an opportunity to join the trend towards March 09 levels, when a significant break down with a gap occurred, as shown on the daily chart.

Crude oil, 4h an daily

Crude oil, 1h

Crude Oil on the Way Towards March 09 Gap – Elliott wave analysis