The Great Britain pound versus the US dollar currency pair seems to be having trouble continuing the impulsive swing of the ascending trend. Is this just a minor correction, or it is the bears pressuring the market?

Long-term perspective

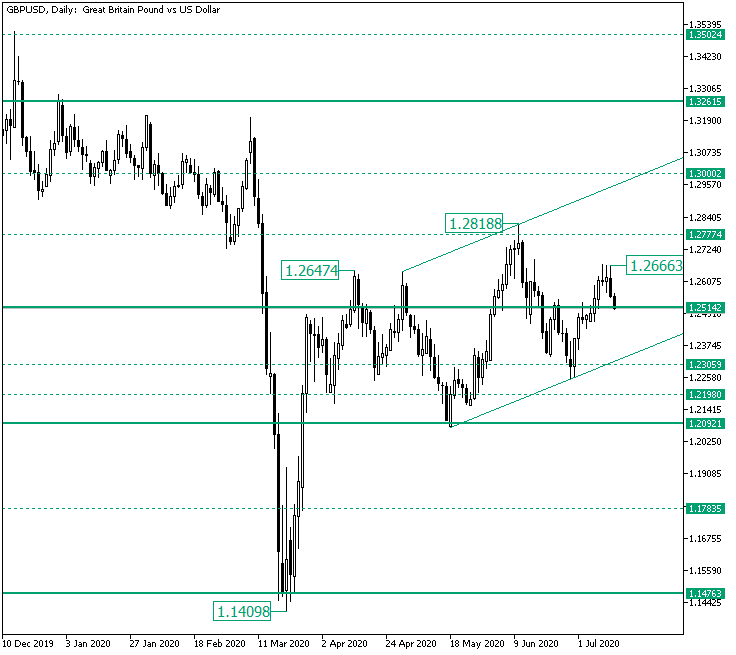

The strong rally that came into being after the confirmation of 1.1476 as support extended to as high as 1.2647. What followed was a retracement that validated the strong support level of 1.2092, the price continuing to rise and, thus, reaching the intermediary level of 1.2777, and printing the high of 1.2818.

From 1.2818, the price corrected getting beneath the firm 1.2514 level and extending until the intermediary level of 1.2305 in the process. As the latter level got confirmed as support, a new upwards leg started and a new ascending channel was defined.

The last impulsive wave managed to etch the 1.2666 high before the price got sent towards 1.2514. Now, as the 1.2666 high rests at about the same level as 1.2647, and as the latter one was part of the two false piercings that occurred in the middle of April and the beginning of May, respectively, the bears could think that the oscillations that took place between the moment when 1.2514 was pierced — July 7 — and the 1.2666 high represents nothing more than yet another false piercing.

On the other hand, the advancement form the 1.2305 level is a sign of bullish strength, the result of which is the piercing of 1.2514 which, naturally, should be followed by a retracement that confirms 1.2514 as support.

So, if 1.2514 is validated as support, then the bulls would send throughout the market the message that they are in control and that they are heading towards 1.2777 and 1.3000, their first and second targets, respectively.

On the other hand, if 1.2514 fails to serve as support, then the bears could inflict further losses, driving the price towards the lower line of the ascending channel and even to the 1.2305 intermediary level.

Short-term perspective

The appreciation from 1.2251 that marked the end of the descending trend that started at 1.2813 extended until the high of 1.2669. From there, the price pierced the potential double support noted by the ascending trendline and the 1.2612 level, slipping until the 1.2525 intermediary level.

If 1.2525 manages to withstand the bearish pressure and send the price back above 1.2612 (which is also a bullish intermediary target), then the price can revisit the firm 1.2783 resistance, the main bullish target.

On the flipside, 1.2525 giving way translates into the continuation of the fall, the bears targeting 1.2432, followed by 1.2282.

Levels to keep an eye on:

D1: 1.2514 1.2777 1.3000 1.3205

H4: 1.2525 1.2612 1.2783 1.2432 1.2282

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.