The Australian dollar versus the New Zealand dollar currency pair is approaching an important support area. Will the bulls be able to withstand the bearish pressure?

Long-term perspective

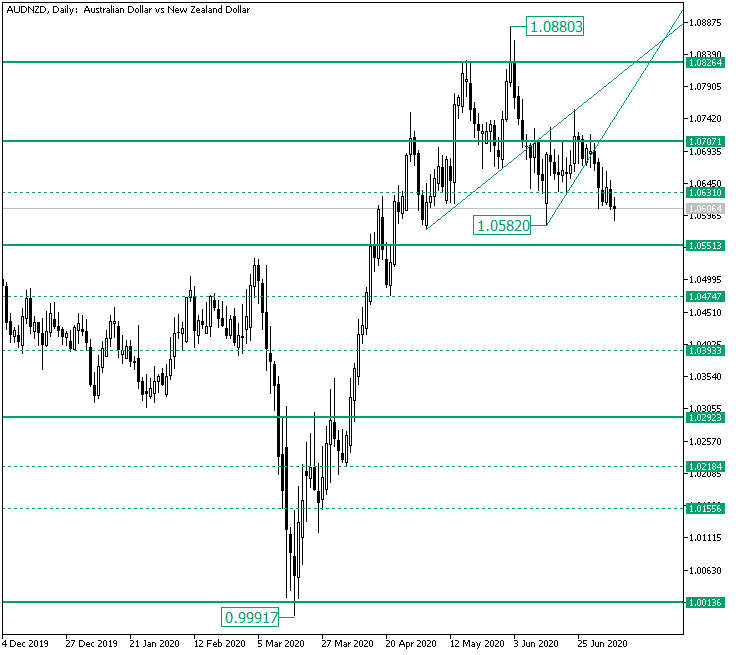

The appreciation that started from the 0.9991 low seems to have ended at the 1.0880 high, as the price confirmed the important resistance level of 1.0826. The confirmation sent the price under the next major support area, 1.0707. Once there, the bears took the opportunity to drive the price further to the downside, thus drawing the low of 1.0582, way beyond the 1.0631 intermediary level.

Even if the bulls tried to overcome the bears, they were not able to, and the result was that the price confirmed 1.0707 as resistance and then pierced the intermediary support of 1.0631.

Considering the previous low at 1.0582 and the importance of the 1.0551 level, the first possible scenario is for the bulls to make a comeback around this area. This may materialize as a depreciation until 1.0551 followed by a quick and strong retracement, thus confirming the area that the low of 1.0582 stands for.

A new rally may also begin around the 1.0582 low. Irrespective of where the bulls begin their movement, the targets are represented by the 1.0631 intermediary level and the 1.0707 firm area. Only a fall beneath 1.0551 and its validation as resistance makes it possible for the price to visit lower quotes.

Short-term perspective

The price is now in a descending movement that is limited by the resistance trendline that starts from the 1.0717 high and continues thru the 1.0662 lower high.

If the price confirms the double resistance etched by the descending trendline and the 1.0621 intermediary level, then it could go further towards the south, targeting 1.0573.

On the other hand, if the double resistance cedes, then the bulls could bring the price back to 1.0681 and, if they validate it as support, to 1.0741.

Levels to keep an eye on:

D1: 1.0551 1.0631 1.0707 and the low of 1.0582

H4: 1.0621 1.0573 1.0681 1.0741

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.