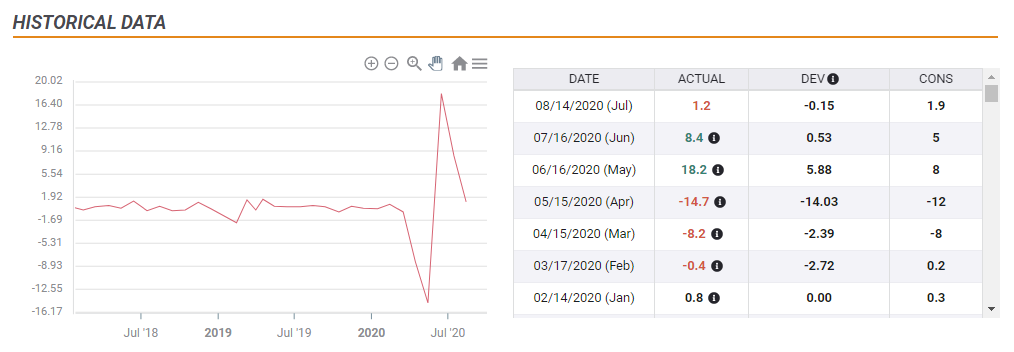

V-shaped recovery – that is what retail sales figures for July reflect for the US economy, and that was already seen in June. Overall expenditure increased by 1.2% last month, while below 1.9% expected, it was more than compensated by an upward revision to June’s figures.

Moreover, the all-important Control Group – “core of the core” which is used in growth calculations – is up 1.4%, better than 0.8% projected and also here, on top of an upward revision.

Consumption statistics complete an excellent week in America’s economic releases. Initial jobless claims dropped below one million for the first time in 21 weeks and Non-Farm Payrolls exceeded forecasts with a jump of around 1.763 million in July.

All hunky-dory in the US economy? Not so fast.

The robust recovery is sales is a result of massive government support – which kept consumption in line with an economy running on full employment according to Micahel Gapen of Barclays.

The federal unemployment top-up of $600/week was responsible – on its own – for around 5% of America’s disposable income, according to economists at the hiring firm Indeed. Other programs also kept the economy afloat.

The funds compensate for a slowdown in the recovery triggered by the resurgence of coronavirus. While the slowdown is seen in the figures, the positive marks may turn negative without additional help.

Republicans and Democrats let the July 31 deadline lapse without a deal. Trump’s executive orders stipulate only $300/week – and have yet to be implemented. Support to small business and states – all in dire needs – is unclear.

Moreover, the current figures may encourage lawmakers – especially the ruling Republican party – to claim that additional assistance is unnecessary, or can be further reduced. While throwing money at the economy makes sense in an election year, having to do so is also an acknowledgment that the country is not doing well without the government.

The results of pulling support away will be seen only later in August, and most probably only in September. By then, more Americans could lose their jobs and temporary position losses could turn permanent.

All in all, upbeat retail sales figures – alongside other robust statistics – are good news on their own, but they could eventually become bad news by discouraging politicians from acting.

Get the 5 most predictable currency pairs

US Retail Sales: Last hurrah may risk critical stimulus, prove double-edged sword