The Australian versus the United States dollar currency pair seems to have lost its steam. Is that really so, or are the bulls setting up a masterplan?

Long-term perspective

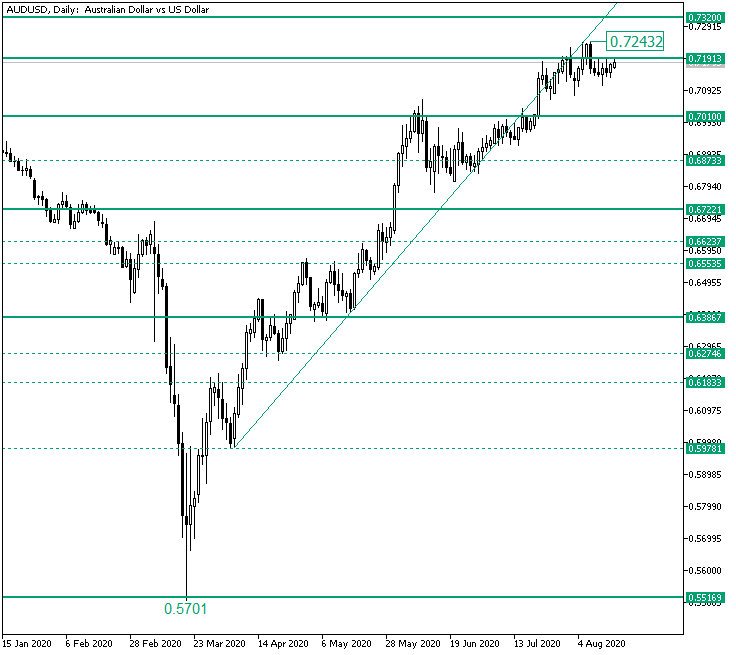

The appreciation from the 0.5701 low managed to etch the 0.7243 high. In this endeavor, important resistance levels were conquered, including 0.7010, which allowed a strong movement towards 0.7191.

However, to be noted is that the supportive trendline has been pierced. In turn, the trendline, alongside 0.7191, could define a double resistance area. And the first signs this could be the case is that the candle which recorded the 0.7243 high — on August 7 — closed under the firm 0.7191 resistance.

So, as long as 0.7191 is not conquered by the bulls, it remains a resistance area that, sooner or later, may attract sufficient sellers to be able to print another leg down. If that is the case, then 0.7010 could be the first target. However, it may very well cede, which would open the door to the 0.6873 intermediary level first, and 0.6722 later.

But even if the bulls do conquer 0.7191, they must take out the 0.7243 peak, as if it remains valid, then it can attract further sellers that could then send the price under 0.7191 yet again. On the other hand, if the 0.7243 is taken out, then 0.7320 is the next target.

Short-term perspective

The rally that started from the 0.6972 low extended until the 0.7183 high. From there, a range began to take shape, one limited by the firm 0.7236 resistance and the 0.7081 support.

However, the last low was written at 0.7109, but the resulting upwards pointing leg was limited by 0.7170. If the latter is validated as support, then the bulls can head for 0.7236. On the flip-side, 0.7170 being falsely pierced translates into the bearish opportunity of sending the price at 0.7081 in the first run, and 0.7002 later.

Levels to keep an eye on:

D1: 0.7191 0.7010 0.6873 0.6722 0.7230

H4: 0.7170 0.7236 0.7081 0.7002

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.