The Australian versus the New Zealand dollar currency pair seems not to be prepared yet for the next upward leg. Is this just a delay or a bearish sign?

Long-term perspective

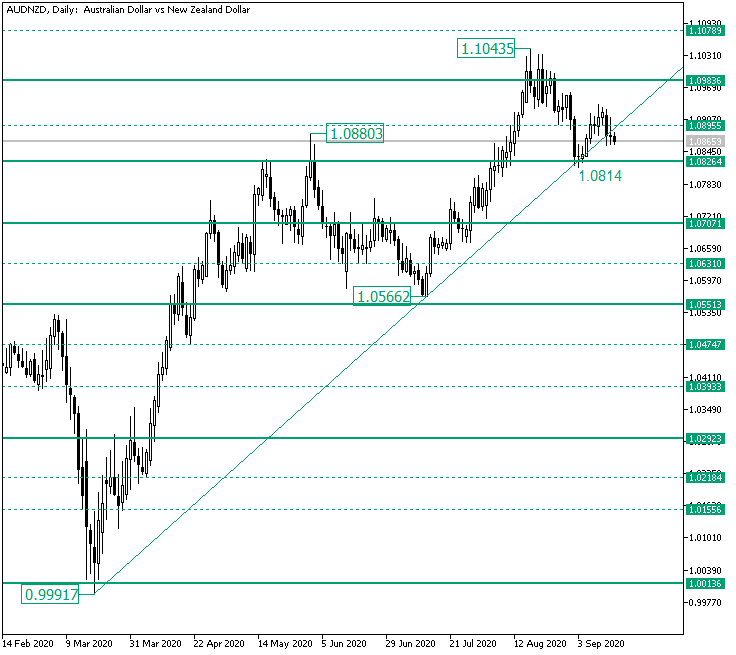

From the 0.9991 low, the price extended until the 1.0880 high before retracing under the 1.0826 level, thus coining a false break.

However, the resulting depreciation stalled at the 1.0566 low. Upon the formation of the low, the bulls took their chance and head for 1.0826 once more.

Their endeavor was a success, as they extended beyond the next level, 1.0983, etching the 1.1043 high.

From the high, the price started a throwback, which seemed to confirm the double support defined by the 1.0826 level and the ascending trendline that results by joining the 0.9991 and 1.0566 lows.

The resulting — third — low, 1.0814, aided the start of a new appreciation. However, after it oscillated above the 1.0895 intermediary level, the price seems to have lost momentum, as it slipped under the trendline and the 1.0895 level.

So, for the time being, it can be considered that the price is somewhat in a neutral zone.

So, if the bulls conquer 1.0895, then they could continue the appreciation to 1.0983. However, if 1.0820 cedes, then 1.0707 may be the next bearish target.

Short-term perspective

From the 1.1043 high, the price retraced, validating — at least for now — the 1.0820 support. From there, it appreciated but was limited by the 1.0921 intermediary level.

So, if the bulls are able to maintain the rise and, thus, confirm 1.0921 as support, then they could extend further, to 1.0987 and 1.1030, respectively.

But if 1.0866 fails to serve as support, then the bears could drive the price to 1.0778.

Levels to keep an eye on:

D1: 1.0895 1.0983 1.0820 1.0707

H4: 1.0921 1.0987 1.1030 1.0866 1.0778

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.