Coronavirus fears are gripping markets, triggering high volatility – and it will get far busier in the election week in the US. The battle for the White House could be protracted, and the Senate control is also critical. Rate decisions by both central banks and the US Nonfarm Payrolls mean there will be no moment to rest.

This week in GBP/USD: (Mostly) covid concerns

Second wave hits hard: The last week of October is when markets finally came to grips with the surge in COVID-19. Germany and France announced national lockdowns, and experts urged UK Prime Minister Boris Johnson to follow suit.

The increase in Britain’s covid infections and deaths continues, showing that local restrictions may be insufficient. Apart from hurting the pound, GBP/USD dropped alongside global stock markets – the safe-haven dollar saw fresh demand.

COVID-19 mortalities in the US, the EU and the UK

Source: FT

The US is also struggling with the surge in infections, reaching new peaks, and pressure on hospitals in several states. The health crisis is the hottest topic in the upcoming elections. Early in the week, hopes that Congress would approve a stimulus package were still alive, but these vanished when lawmakers went home without agreeing on an accord, leaving the focus on the vote.

Post-presidential debate opinion polls continued showing former Vice President Joe Biden with a substantial lead over President Donald Trump. However, a tighter race in the perennial swing state of Florida and memories of the incumbent’s victory in 2016 are still fresh on everybody’s minds.

The last full week before the elections was marked by record early voting – surpassing half of all ballots cast in 2016 at the time of writing. Another development is, as aforementioned, the increase in covid cases, especially in the Midwest.

US Gross Domestic Product rebounded in the third quarter by 33.1%, annualized, the best in history, after the worst decline recorded in the previous one. GDP exceeded estimates, and the personal consumption jump of over 40% annualized is good news. Nevertheless, the output is still below pre-pandemic levels.

Back in the UK, the pound temporarily benefited from two encouraging developments around Brexit. First, Chief EU Negotiator Michel Barnier extended his stay in London, signaling progress had been made. Second, just after negotiators moved to Brussels, reports concluded that they were indeed coming together on state aid. However, both sides remain at odds over fisheries, and in any case, the upbeat news was insufficient to stem the tide.

UK events: Brexit hopes vs. BOE, Boris’ covid reaction

How long can Johnson resist imposing a nationwide lockdown? Covid statistics are set to have a greater influence on sterling as a continued increase could tip the scales in favor of such a move. A second full shuttering is far from being priced in and could weigh heavily on the pound.

Is the PM holding back on closing a Brexit deal due to the elections? This speculation has come and gone, but perhaps intervention from the highest levels on both sides could trigger an announcement of an accord. On the other hand, there is still time until the only genuine deadline – year-end, when the transition period expires.

If France gives ground on fisheries and a magic formula including “creative ambiguity” is found on state aid, sterling could shine. Talks continue and are set to move markets.

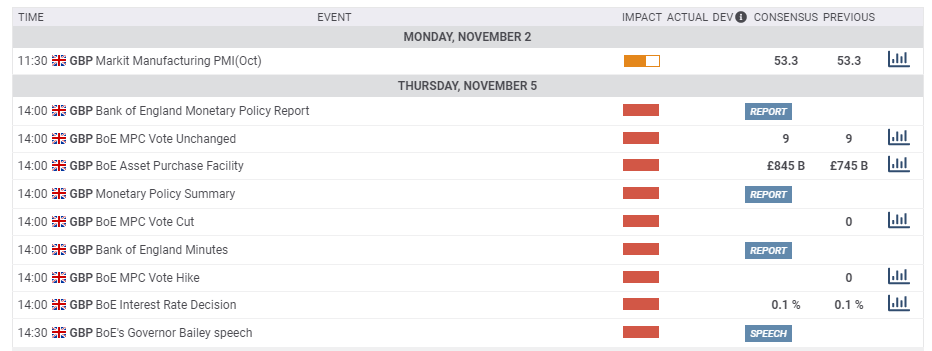

The main event on the calendar is the Bank of England’s “Super Thursday” rate decision. The BOE releases its rate decision, meeting minutes, and its quarterly Monetary Policy Report, including new forecasts. Officials at the “Old Lady” seem to set the ground for setting negative interest rates sooner than later. In the previous decision, the BOE noted it is examining how to implement it but refrained from signaling it is imminent.

Since then, the economic outlook has deteriorated as coronavirus took further hold. Will Bank of England Governor Andrew Bailey pull the trigger and set sub-zero borrowing rates? That would send the pound tumbling down and not priced by markets.

There is a greater chance that Bailey keeps talking about such a move in his press conference. Investors will also be watching the bank’s forecasts – if they include a substantial downgrade to recovery prospects. In any case, the BOE’s decision will likely trigger high volatility, given the uncertainty around the virus.

Here is the list of UK events from the FXStreet calendar:

US events: All eyes on Trump, overshadowing Fed, NFP

Trump or Biden: Llong months of campaigning and speculation are finally culminating in Election Day, but an instant outcome is not guaranteed. The challenger has a substantial lead in the polls, while his party has somewhat lower chances of winning.

The pandemic has impacted voting intentions – hurting the incumbent due to his mishandling of the disease – and the mechanics of casting a ballot.

At the time of writing, over 82 million have already voted. Some states count early and mail-in ballots as they arrive while others begin processing them only on election day. Floridian officials are already busy tallying up votes, promising an almost immediate outcome. If Biden carries the Sunshine State, the race is all but over.

However, if Trump wins his new home state, the next critical battleground is Pennsylvania, where early voters’ envelopes are only opened after election day polls close. The process has already seen legal battles reaching the Supreme Court, and a tight race could be contested. For markets, the worst outcome would be an inconclusive election, where both sides claim victory. Such a stalemate could boost the safe-haven dollar.

Ahead of the last days of the campaign, fiscal stimulus was high on the agenda. A generous relief package heavily depends on Democrats winning the Senate, and the closest race is in North Carolina. Similar to Florida, votes are counted quickly, but the race is close also there. If the Democratic challenger Cal Cuningham wins, the “blue wave” scenario is in play and could weigh heavily on the dollar.

More: How low will markets go? State of play after the covid-related fall, ahead of a huge week

Here is the current state of the race:

Source: FiveThirtyEight

Source: The Economist

While the elections dominate the airwaves, the first of November also features top-tier events – the Federal Reserve’s decision and Non-Monthly Payrolls for October. The buildup to the NFP kicks off with the ISM Manufacturing Purchasing Manufacturing Index, projected to signal ongoing moderate growth.

The ADP private-sector labor statistics are also watched as a clue toward the official jobs report, despite being off the mark in recent months. ISM’s Services PMI is the last measure of interest, and similar to the industrial sector, it is projected to hit 57.5, reflecting robust growth.

Nonfarm Payrolls fell short of forecasts in September with 661,000, a considerable slowdown after several months of a quick recovery. A return to faster restoration of jobs is on the cards for October – 850,000. The Unemployment Rate is projected to extend its decline.

Upbeat employment figures could boost the dollar, especially if it falls in case of a clear outcome in the elections. Three days should be sufficient to know who won.

The Fed is set to leave its policy unchanged nor indicate any move in December when new forecasts are due. While the world’s most powerful central bank delayed its decision to two days after the vote, there is nothing in recent economic developments to trigger an imminent change, of course.

Jerome Powell, Chairman of the Federal Reserve, clarified that the bank is “not thinking about raising rates” anytime soon. Additional bond-buying will likely wait as well, given the recent upbeat economic data. Markets could fall if Powell expresses concerns over the virus’s impact or sounds desperate in calling lawmakers to act. However, fiscal stimulus will likely wait for the new Congress in January.

Here the upcoming top US events this week:

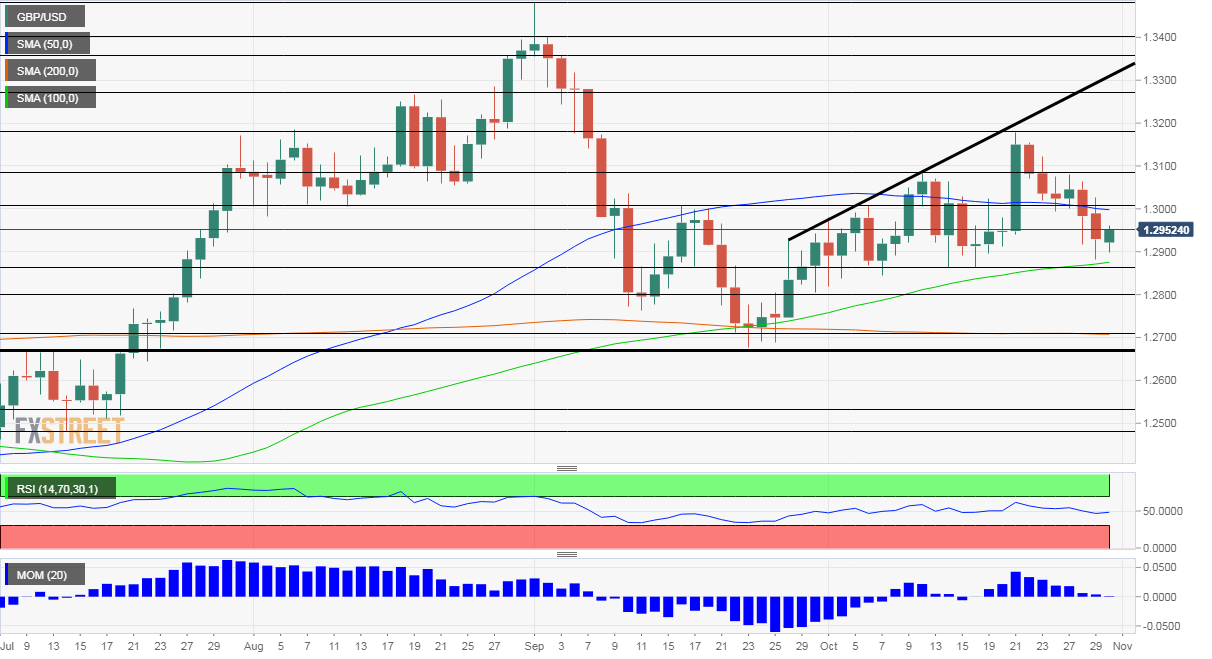

GBP/USD Technical Analysis

Pound/dollar has failed to hold onto the 50-day Simple Moving Average, and upside momentum disappeared. On the other hand, it is holding above the 100-day and 200-day SMAs. All in all, bears have a minor advantage.

Support awaits at 1.2865, which provided support twice in mid-October. It is followed by 1.28, a round number that worked in both directions in September. Further down, the 200-day SMA hits the price at 1.2705, and September’s low, 1.2665.

Resistance is at 1.30, the psychologically significant level, followed by 1.3090, a high point in late October. Next up, 1.3180 is October’s high.

GBP/USD Sentiment

Covid and the BOE point downward, but Brexit could turn positive. What about the elections? The polls may be right this time and even underestimate Biden. A clear result would provide some relief and weigh on the dollar, boosting GBP/USD – at least in the short run. However, betting against Trump has proved wrong in the past, so caution is warranted.

The FXStreet Forecast Poll is showing a short-term bounce, stability in the medium term, and then a rise in the long-term. Experts seem to be pointing to a moderately bullish response to the US elections and a more significant one after Brexit – perhaps assuming the EU and the UK strike a deal. The average targets are little changed from last week.

Related Reads

Get the 5 most predictable currency pairs