The pound is not alone in its reactions to the British EU Referendum. After all, it’s the EU and the euro-zone at stake here. The team at NAB have clear opinions on the potential outcomes:

Here is their view, courtesy of eFXnews:

EUR to quickly follow GBP lower on Brexit:

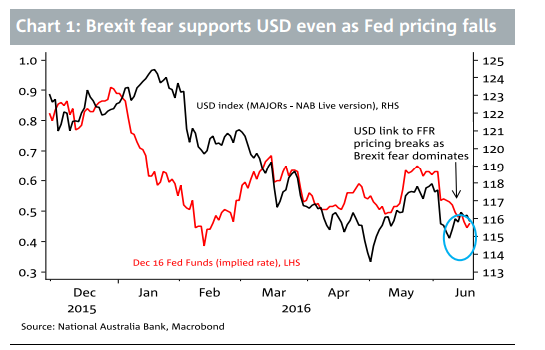

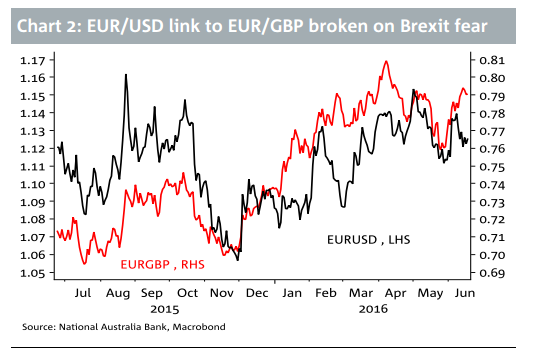

While market focus has been on the extent to which Sterling would be expected to fall in the immediate aftermath of a vote for ‘Brexit’ and likely safe-haven flows into the likes of JPY, USD and CHF, there has in recent days been a greater recognition that all things EUR would quickly be a major causality in the fall-out from a Brexit vote. This would be on the view that a UK split from the EU will see a clamour for similar plebiscites in other EU countries, and potentially much broader fragmentation of the EU (including heightened risk of eventual break-up of the single currency).

It is for this reason we believe that a sharp fall in GBP under Brexit could quickly spill-over to a similar-sized sell-off in EUR/USD and which could see parity tested within days of a Brexit referendum outcome.

Dual EUR/USD upside from ‘Remain’ but still a range trade:

Under our continued, albeit not high-conviction, assumption that the UK elects to say in the EU, global risk sentiment will undoubtedly improve. We would judge that EUR/USD should recoup part of the ground lost since early May when EUR/USD briefly traded above 1.16.

The caveat is that to the extent the overhang of Brexit fears has – Yellen admits – factored into the Fed’s decision making, the elimination of this risk removes one of the constraints on proceeding with ‘gradual’ tightening sooner rather than later. That said, waiting for the passing of Brexit fears was really a debate about the Fed moving in June versus July at a time when the domestic economic pre-conditions for a Fed move looked to be in place.

While Yellen has said July is ‘not impossible’, it seems more likely the Fed will now want to see several months of data to convince themselves the May employment report was just noise. The Fed is also still worried about inflation expectations and which also suggests they will let the economy run hot for a while.

We still have two Fed hikes this year in our forecast albeit with clear risk we get no more than one (and none at all under Brexit).

So other than under this latter scenario, we still see EUR/USD continuing to be a 1.10-1.15 range trade.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.