After the pound suffered yet another blow on Brexit fears, here is an updated map of risks for the main protagonists on both EU Referendum outcomes according to Danske:

Here is their view, courtesy of eFXnews:

There are now only 13 days to the UK’s EU referendum. Our base case has been and continues to be that the UK will vote to stay in the EU but also that polls will remain very close all the way up to referendum day on 23 June. This is certainly the case where polls in recent weeks have been as close as ever. The question we are consistently getting from clients is how to position for a Brexit.

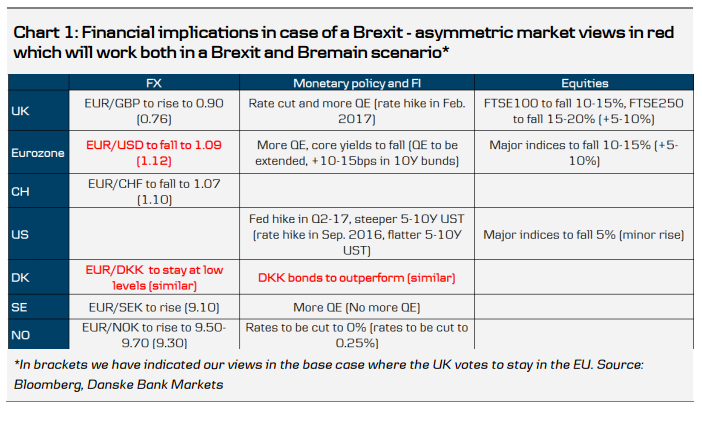

In the table below, we show our expectations of market reactions in case of a Brexit. In brackets, we show the likely market reactions if the UK votes to stay within the EU, i.e. a ‘Bremain’.

A couple of observations. First, there is a substantial digital risk in particular in EUR/GBP and UK equities. The range for EUR/GBP is 0.76 in 3M in case of a Bremain, which is our official FX forecast, and 0.90 in case of a Brexit. As such, the risks are heavily skewed towards a weaker GBP into the UK’s EU referendum.

Second: We also want to stress our asymmetric market views, which we believe will hold both in case of a Brexit and a Bremain.

We expect EUR/USD to fall over the coming three months with or without a Brexit albeit that the 1.11-1.15 range is likely to hold in case of a Bremain.

The market is now pricing in a 25% probability of a July hike and a 47% probability of a September hike, which we believe is fair. Hence, Fed repricing has come a long way following the appalling May labour market report last Friday and we think there is limited downside for the USD for the time being. We think the FOMC meeting next week will be a ‘wait and see’ meeting and will deliver limited surprises. In case of a Bremain, we believe that the market will price in a Fed hike by September with a higher probability than currently which should cap any EUR/USD strength.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.