The US dollar suffered a blow from the bad NFP and despite the recent recovery, the team at BNP Paribas do not see any strength for the greenback. And, they set a target for EUR/USD:

Here is their view, courtesy of eFXnews:

The weak May employment report has diminished the significance of Wednesday’s FOMC meeting next week, with the committee now very unlikely to adjust policy or signal a move in July. There will still be significant information to digest, with market participants likely to focus on the dot plot evolution and to look for evidence that the Fed is becoming less confident in the economic outlook.

However, in general, the message is likely to mirror Federal Reserve Chair Janet Yellen’s Philadelphia speech, emphasising a need to wait and see whether the slowing in jobs growth is part of a broader deterioration, while still signalling an expectation that rate hikes will resume later this year. We think the USD remains vulnerable against this backdrop, with EURUSD likely to recover towards 1.16 in the weeks ahead.

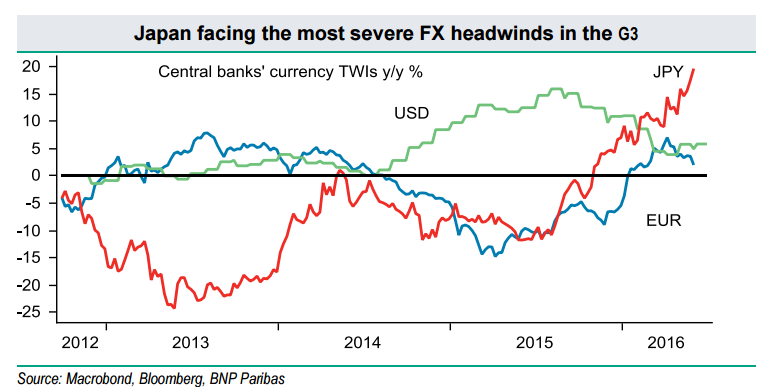

The Bank of Japan (BoJ) and Swiss National Bank (SNB) also conclude meetings on Thursday next week. Both central banks are keen to avoid appreciation of their currencies during a period of potentially rising market stress and steady Fed policy. With EURCHF continuing to hold relatively stable, we expect the SNB to repeat recent guidance on rates and discretionary FX intervention, with no new measures likely.

The BoJ is more likely to deliver new measures, particularly if the JPY continues to strengthen heading into the meeting, but our base case remains that the central bank will wait for the July meeting before acting. With the BoJ still more likely to resist currency pressure than the ECB, we remain bullish on EURJPY.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.