Expectations are somewhat lower for the upcoming Non-Farm Payrolls report. But it’s not only the headline figure and not only the wages. Here is a preview from Bank of America Merrill Lynch, also explaining the US impact:

Here is their view, courtesy of eFXnews:

In the May employment report, we expect nonfarm payroll growth of 160,000, which would be a subdued pace relative to the prior 3-month trend of 200,000. That said, job growth will be depressed by the ongoing Verizon labor strike—media outlets suggest that 39,000 workers were not working during the survey week. Accounting for this distortion, the labor market would still be improving at a healthy clip. We believe private payrolls contributed 150,000, while government added 10,000.

A potential reason for optimism in the jobs data is that there is a tendency for April job growth to be revised higher—last September we took a look at historical revisions for each month and found positive and statistically significant results for April. There is some slight downside risk to May: initial jobless claims picked up on average during the month, though this is after reaching a cycle-low in April. With a softer increase in employment, the unemployment rate likely held at 5.0%. The participation rate did tick back down in the last report, but there is still room for cyclical improvement so we may see a resumption of the uptrend prior to April. Increasing participation would also make it more difficult for the unemployment rate to fall further.

Average hourly earnings should increase by 0.2% mom in May, which would be a tenth lower than in April. This would leave annual wage growth unchanged at 2.5% yoy. This is the last employment report heading into the June FOMC meeting. If the data come in as we anticipate, a June rate hike would remain on the table, but it is not our base case.

For latest trades & forecasts from major banks, sign-up to eFXplus

FX: USD consolidation

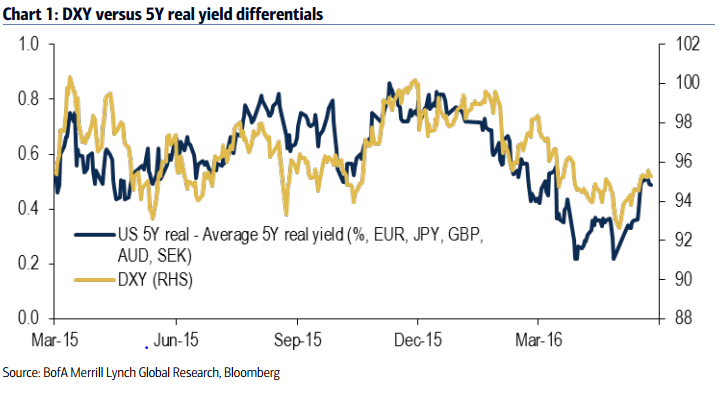

Dollar risks are asymmetric in our view heading into next week’s non-farm payrolls report as the Fed recently pulled up market expectations for a summer hike amidst modest data improvements. The USD has responded positively to the Fed’s hawkish tone, but with the market pricing a 70% chance of a July hike already, a lot of good news appears to be priced already. Indeed, based on real yield differentials, the USD looks pretty fair here (Chart 1).This leaves the burden on the data to justify their more optimistic tone.

A figure which leaves the 6m moving average above 200k (the Fed’s rough benchmark for labor market tightening), and strong wages should see the USD modestly supported. But, a disappointment could have a more significant negative impact—given market pricing—leaving the dollar under pressure.

In our view, the next leg higher in the USD needs to come on the back of better US data that convinces the market spillover risks from Fed hikes will not stop it in its tracks. With short-term Fed expectations looking a bit stretched, we think the pace of hikes in 2016 & 2017 would need to rise for the USD to rally more significantly.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.