Back in the fourth quarter of 2015, when the Federal Reserve was contemplating hiking rates, many expected gold prices to fall. The bearish sentiment picked as gold prices fell nearly 10% between September 12 2015 and November 23 2015 on increasing chatter about the historic Fed rate hike. By December 2015, gold prices hit lows of $1046 an ounce, last seen in February 2010.

Back then, the justifications for gold to fall further was that “gold pays its holders nothing and struggles to compete with yield-bearing investments when rates rise.” In fact, some analysts believed that with the threat of a rate increase being so substantial, investors preferred not to hold gold. But that was back then (gated).

Analysts clearly were wrong on two counts:

- The threat of rate hikes is far from substantial

- Interest rates rise in a period of higher inflation, which diminishes the risk of returns, thanks to inflation. In such a scenario gold tends to be more attractive, if not as an outright investment, then at the very least a good asset to diversify one’s portfolio

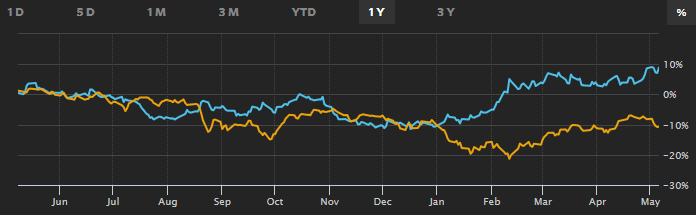

Gold vs. Global Dow (1 Year) Source: WSJ.com

Gold – No looking back

After the symbolic rate hike in December, gold prices simply burst out of its multi-year declines and has made the $1100 price level a thing of the past. Indeed, many investors who were hoping to buy the dips in gold were left out on the sidelines as gold posted strong gains with $1200 now the new norm, which even today remains a remote price level that gold, could test.

In early February, Goldman Sachs said “We maintain our view of rising U.S. rates and hence lower gold prices with a 3-month target of $1,100 (per troy ounce) and 12-month target of $1000 (per troy ounce).” Since February, gold prices climbed another 15% by the end of April.

Gold snaps a 39-month falling trend line. (Source: Tradingview.com)

Gold snaps a 39-month falling trend line. (Source: Tradingview.com)

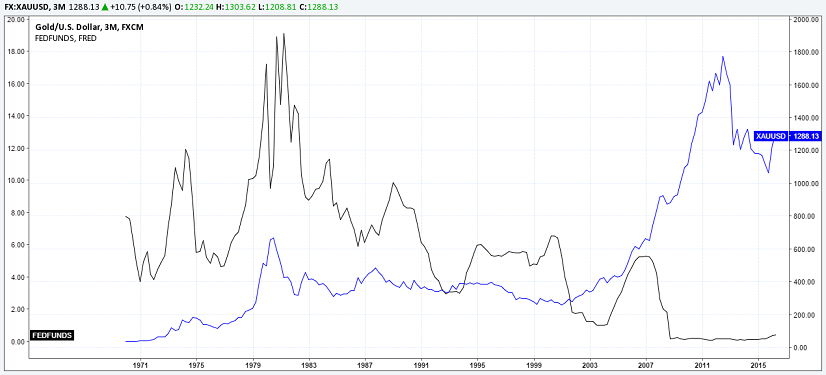

Caught between higher interest rates and NIRP chatter

Gold remains at crossroads for the moment, and perhaps for the better. While higher interest rates is likely to see gold prices able to sustain above the $1200 mark, negative interest rates have become the norm in recent times as well. So far, the ECB has joined ranks with the SNB, BoJ, and Swedish Riksbank to name a few central banks that are pursuing a policy of negative interest rates. Unlike QE which has so far only managed to boost the equity markets, negative interest rates take on a different role, in that banks will now have to pay the central bank for holding excess reserves. While no such factors have trickled over to retail deposits, some see it only as a matter of time, which will translate into investors continuing to buying gold over the longer run.

Gold and Fed funds rate comparison (Source: Tradingview.com)

Over the next couple of quarters, the markets remain uncertain on the direction of the Fed rate hikes. The median estimates point to one more rate hike this year. On the dovish scale of things, some expect no rate hikes at all, while on the hawkish scale, two rate hikes are likely. For gold, the medium to long term outlook remains clearly bullish after the markets saw gold prices test January 2015 highs at $1300 an ounce last week (May 2nd 2016) and under the current conditions, it wouldn’t be surprising to see gold prices test $1400 levels. For those who were still waiting for more signs of bullishness in gold and got left out of the rally, a dip to $1200 could be an interesting proposition. But if history is anything to go by, one can only hope that gold will correct to $1200 before surging higher.

Guest post by Andreas Pavli of http://www.allfxbrokers.com