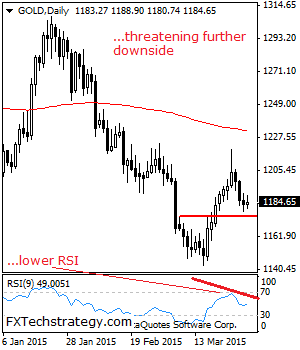

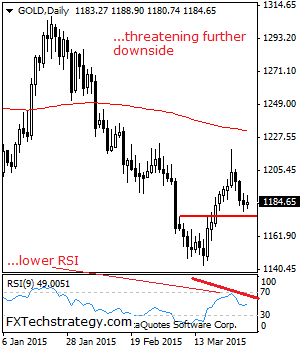

With GOLD’s bias continuing to point lower, further bearishness is now envisaged. This is consistent with its short term weakness triggered off the 1,219.51 level the past week.

On the downside, support comes in at the 1,170.00 level where a break will aim at the 1,150.00 level. Below here if seen could trigger further downside towards the 1,130.00 level where a break will aim at the 1,100.00 level.

Its daily RSI is bearish and pointing lower supporting this view. On the upside, resistance resides at the 1,200.00 level where a break will aim at the 1,219.51 level. A violation of here will turn attention to the 1,240.00 level followed by the 1,150.00 level. All in all, GOLD remains biased to the downside medium term but faces corrective recovery risky.

More: Euro Will Fall In A Cyclical Upswing: Why & Where To? – Goldman Sachs