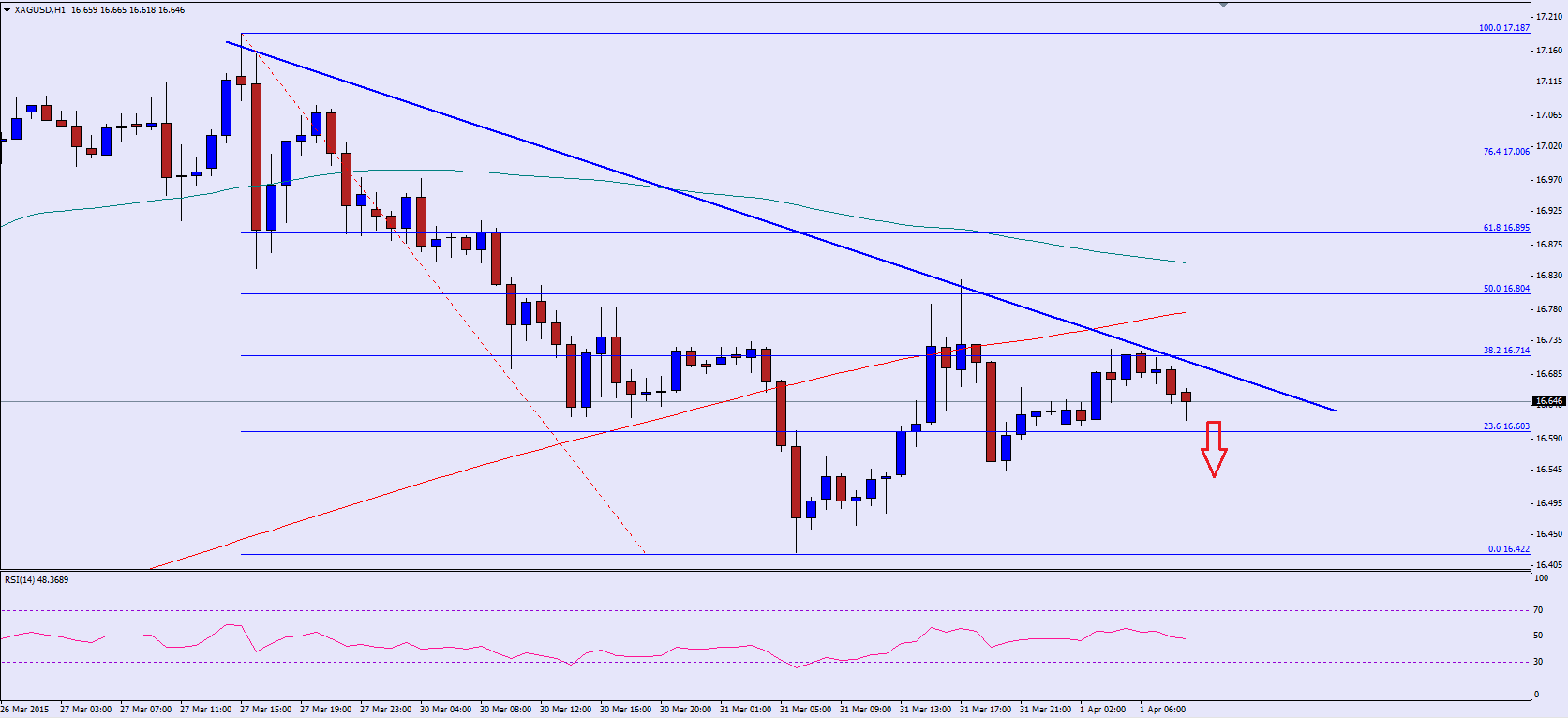

The US dollar was trading mix, as earlier it was seen gaining bids and then later it lost the momentum. SILVER traded higher recently, but failed to break a crucial resistance area around the $16.80 levels. There are a couple of important releases lined up today in the US. The Institute for Supply Management (ISM) Manufacturing Index presenting business conditions in the US manufacturing sector will be release during the NY session. The forecast is of a decline from the last reading of 52.9 to 52.5 March 2015. Let us see how the outcome shapes up, as a better than expected result might push SILVER lower.

There is a solid bearish trend line formed on the hourly chart of SILVER, which acted as a barrier in the near term. There is a main point to note, as SILVER recently traded higher, but right at the 50% fib retracement level of the last leg from the $17.18 high to $16.42 low, which was also coinciding the highlighted trend line. The prices are well below the 100 and 200 simple moving averages, which suggest that there is a chance of SILVER moving lower in the near term. On the downside, the most important support is around the $16.40 level where buyers might fight to protect more losses moving ahead.

If buyers manage to push prices back higher, then a retest of the highlighted trend line is possible. A break above the same might call for a move towards 100 hour MA.

Overall, one might consider selling in SILVER as long as prices are below the 200 hour MA.

————————————-

Posted By Simon Ji of IKOFX Technical Team: Online Forex Broker

Website: http://ikofx.com/

In our latest podcast we interview David Stein on investment, QE and lots more

Subscribe to Market Movers on iTunes