The Japanese yen is undoubtedly the king of the hill this week, with seemingly unstoppable gains. Here is the view from Morgan Stanley on these moves:

Here is their view, courtesy of eFXnews:

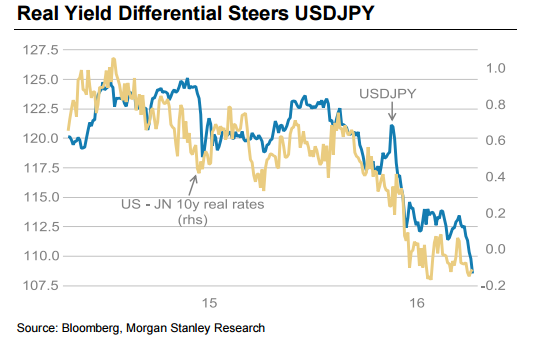

Over recent weeks, the EUR moved moderately higher, while the JPY accelerated sharply, with USDJPY now nearing our USDJPY 105 year-end target. The negative reaction of the European and the Japanese equity markets to FX strength suggests that the two regions need policy stimulus, but this policy stimulus is now more difficult to deliver. Fiscal policies pose difficulties given high debt levels and the use of unconventional monetary policy including QE, and negative interest rates seem to have reached limitations. In the Eurozone and (more so) Japan, the reason the currencies have rallied has to do with the existing tools central banks have at their disposal to prevent their currencies from rising. Japan seems especially exposed. Here we see first cracks in the otherwise ‘beautiful world of USD weakness’

JPY Strength Leads to Strength. As US yields moved lower, so has USD/JPY. JPY strength has led to further strength, however, undoing much of the BoJ’s work. Indeed, the most recent Tankan survey shows that Japanese companies still assume an average USD/JPY rate of 117.46 for 2016. As USD/JPY moves lower, companies will need to hedge to protect profits. Moreover, the longer USD/JPY stays down, the more likely earnings guidance in Japan gets revised lower, which puts downward pressure on NKY and, in a circular manner, USD/JPY too.

Does the BoJ could push USDJPY back to previous highs? Without the help of the Fed, we doubt it. In the end, the buying of private assets by the central bank is primarily designed to support portfolio effects. The QE operations from 2013/15 were effective instruments, weakening the JPY via first-round reallocation effects. Now as Japan’s yield curve remains at extremely low levels and the BOJ may have to buy private sector assets, the JPY weakening impact will be muted.

For ‘Abenomics’ to work, Japan may now need the help of US authorities, and the further USDJPY falls, the more urgent the need. In other words, the turnaround of the USD may come via a sharp fall of USDJPY. This is why we think USD weakness will be a very limited affair.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.