EUR/USD had another exciting week, with significant moves, this time inspired by the biggest central bank. Here is a digest of the events:

Here is their view, courtesy of eFXnews:

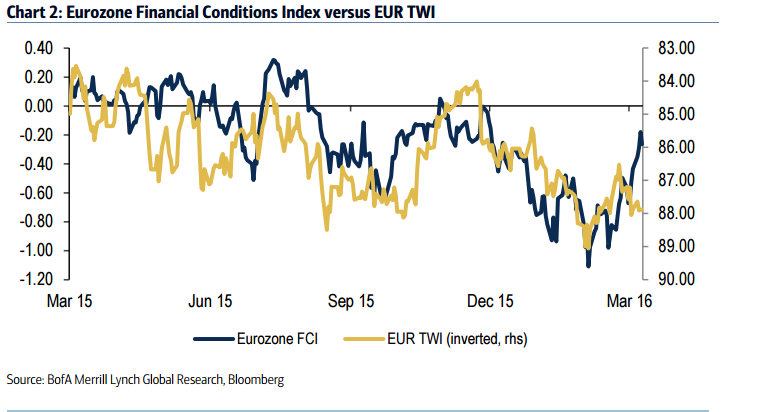

That was the week that was It has now been a week since the ECB delivered its latest package of measures and so far, the initial market reaction appears to have been positive. Whilst the inevitable focus has been on reaction of EUR/USD, the ECB will be reassured that broader measures of financial conditions have shown further signs of improvement. Chart 2 shows that the improvement in the Bloomberg calculated financial conditions index accelerated in the aftermath of the March 10th meeting and is now back towards levels seen in December.

They key for the ECB will be whether this improvement in financial conditions can now be sustained. But even though the improvement has come despite the appreciation of the EUR, Chart 2 highlights that the ECB will not be willing to accept an overly strong Euro. EUR/USD is now nearly 5% off its pre-ECB lows and is approaching the highs for the year.

With the currency pair within striking distance of levels which triggered verbal intervention from ECB officials last year, markets are likely to become increasingly nervous as we approach the 1.145/1.15 area. We would urge caution on EUR/USD at these levels and reiterate our view for renewed depreciation in the coming months, despite the Fed’s dovish tone at this week’s meeting.

A light week for data. In a holiday shortened week, the data flow from Europe is relatively light. The main focus is on UK inflation and retail sales data though as we have stated in recent months, the impact of data surprises on GBP has diminished markedly as the Brexit risk premium builds and the UK rates markets refuses to recalibrate its rate hike expectations in the face of the EU Referendum. In Europe, preliminary PMI readings for the region will be published. Though they may come too early to capture the full impact of the ECB rate decision, it will be closely watched to see if there has been any early signs of initial investor reaction.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.