Earlier this year I used Elliott Wave analysis to find my biggest opportunity to date. In USDCAD, I was able to pick the top from an entire year of consolidation and the ensuing move was over 1600 pips to the downside! Now, risking only 20 pips meant the potential on this trade was huge and one could’ve almost doubled their account just holding this one trade risking 1%. However, at the time, I didn’t have the discipline and I ended up exiting for a 6% win. Yes… I lost over 13x the move. Ever since that trade, I have changed the way I think about open trades. I very rarely close a trade manually and I now instead wait for my trailing stop to be taken out. I don’t even use profit targets. Since that day, I have seen a massive increase in the size of my winners with losses still remaining the same.

Now, the reason I’m rambling on about this trade is not because I’m trying to show off; I’m merely trying to showcase the power of Elliott Wave. It’s not a coincidence that the market went parabolic at that particular point. It was all calculated from the wave characteristics and guidelines presented by R.N. Elliott himself.

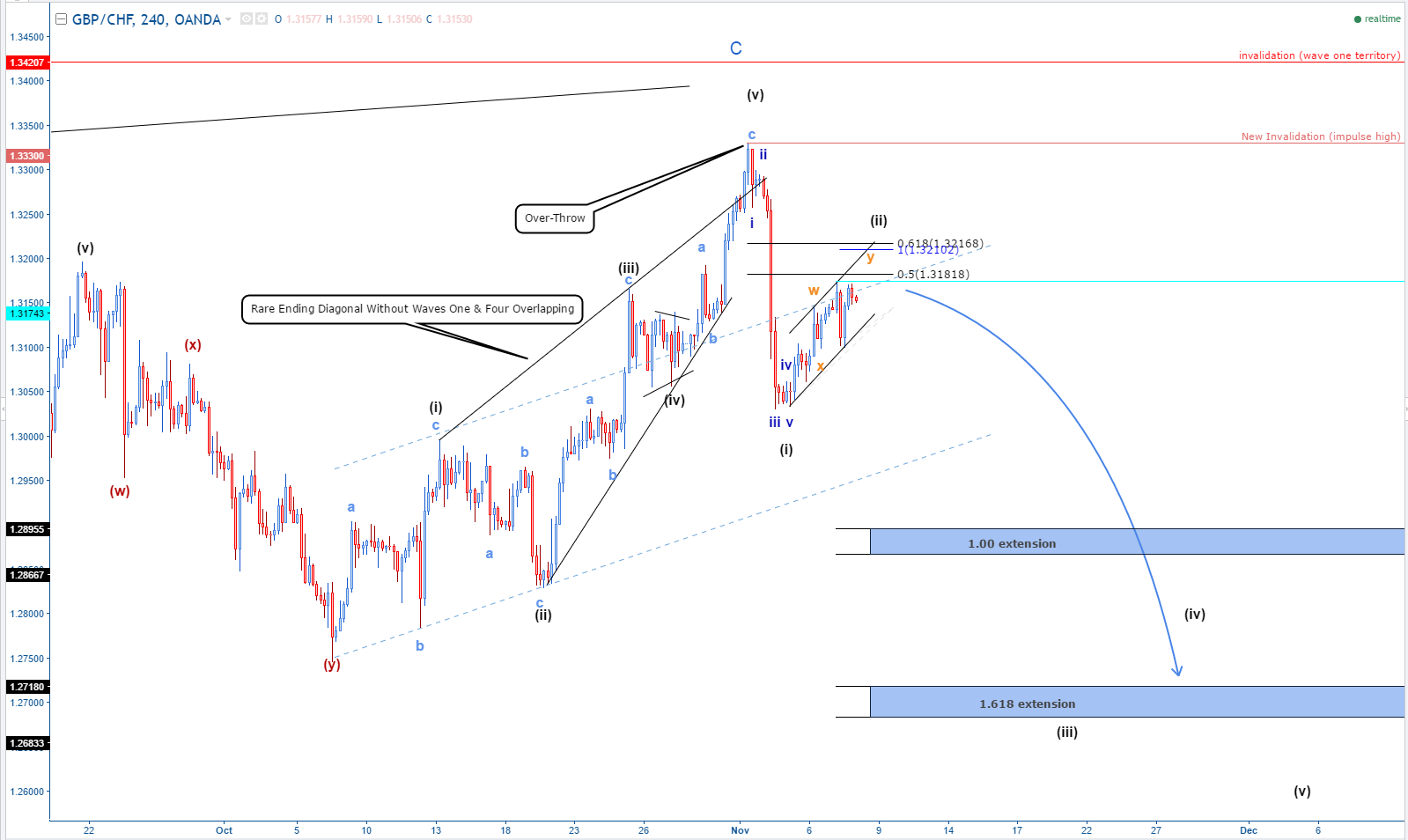

If there is going to be another trade as rewarding, it may be right now on GBPCHF. It has a potential of 2400 pips (18%). Yes, that’s right 2400, not 240. Let me show you what I mean:

This chart is showing something really extraordinary. It appears as if wave ((4)) is completing as a very deep and time consuming wave. This really is good for trading to the downside. Why? Well because look at the distance it has to move to get below Primary ((3)). Now, if you have studied Elliott Wave Theory more rigorously, you may notice, by eye, that Primary ((1)) and ((3)) are not too dissimilar in length. This is a completely valid claim and when measured, Primary ((3)) is actually only 1.43x the length of wave ((1)). That’s not even 1.618x the length of 1, which most wave 3’s tend to be. In this case we can consider the possibility that wave 5 COULD extend. In every impulse wave, it is very very likely that one of the waves extends (note: this is a guideline, not a rule). So if we know it’s not waves 1 or 3, then it’s probably going to be 5. What does that mean for us? Well, a much bigger trade is to come.

The 4 hour chart shows that we may be ready to drop. This will be confirmed if there is a significant breakout (to the downside) of the flag pattern price is currently. Just blindly selling here would be a bad idea. You may falsely be rewarded some of the time by doing this but ultimately you will probably see your account evaporate over time. Learning the rules of Elliott Waves are useless if you cannot apply them and understand how they actually work. You need a strategy to be able to trade the waves. This requires timing, risk reduction, risk elimination, and the protection of profits. Overtime, you will make adjustments to your strategy to optimize it, however, if you start out with something that doesn’t work in the first place then optimizing is completely useless.

If GBPCHF does drop as my analysis shows, then I will be ready. My strategy will be applied and I will have multiple positions in the market.

What if GBPCHF instead breaks the high and invalidated the structure? This is the best part of a good Elliott Wave strategy and it always seems to surprise beginners… I don’t care. Why? Surely I was wrong and I should be angry I didn’t profit? No, because I’m not in a trade. I haven’t lost money that’s what it’s all about.

“Every single one of those [people]is obsessed with not losing money. I mean, a level of obsession that’s mind-boggling”

– Tony Robbins talking about some of the best investors in the world including: Paul Tudor Jones, Ray Dalio, Carl Icahn, Kyle Bass and many more.

I would recommend regularly looking at this chart and comparing it to my analysis until it’s invalidated. The downside looks open and it’s not a setup to skip over. Do your own analysis and tell me what you think.

Wian Stipp

4xTrading.co.uk