March 10th is a date circled on many calendars: it’s the ECB meeting, What does Mario Draghi have in store? Where will EUR/USD be next? Here is a preview from CIBC:

Here is their view, courtesy of eFXnews:

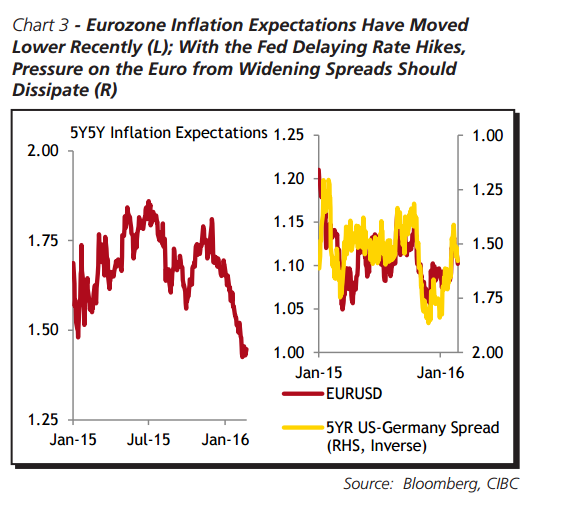

ECB President Mario Draghi has already unleashed a sizeable wave of central bank stimulus, but it hasn’t been enough to combat the deteriorating outlook for inflation. Over the past two months, 5y5y inflation expectations have fallen 40bps, reaching their lowest level on record. While it’s often argued that these market-based inflation expectations are not perfect measures of the actual level of expectations, the move lower is nonetheless troubling for the ECB.

It will likely influence some of the hawkish board members to vote in favour of more substantive easing during the central bank’s upcoming meeting on March 10. As a result, look for the ECB to cut the deposit rate another 20bps, taking it down to -0.50%. In an attempt to protect banks, following the example of the BoJ, lower rates would likely be accompanied by a move to a tiered system where existing deposits don’t incur additional costs. The banking sector has already been hit by new bail in rules that took effect on January 1, the ECB doesn’t want to add to the negativity surrounding the sector.

While President Draghi will play up the central bank’s ability to ease policy further, questions will be raised about how much firepower he really has left. Markets have yet to fully price in additional easing, as they don’t want to get caught offside for a second meeting in a row. However, even if the central bank delivers more than what markets currently expect, the currency is unlikely to depreciate much from current levels. That’s because the one-way policy divergence trade with the US is now much more uncertain (Chart 3). Just as ECB policy appears to be reaching its limits, FOMC voters are stepping away from a March rate hike.

As a result, look for the euro to decline slightly following the next round of easing, but to remain above the 1.10 mark over the next couple of quarters.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.