The Easternmost members of the European Union have similar economies with similar outlooks. It’s important to note that Hungary, Czech Republic and Poland have robust manufacturing export economies within the EU. One notable example is semi-manufacturing automobile production with Germany. Fortunately, this was among the strongest sectors in the 2015 global economy. Robust demand from Asia and the Americas kept factories in central and Eastern Europe productive. The year didn’t begin that way however. Early in 2015 the ongoing political and economic turmoil in Greece weighed down on the global economy and posed a threat to European Union cohesiveness. Eventually, after several dramatic elections and shuttle diplomacy, the Greek crisis faded from the headlines, but only to be replaced by another existential crisis: the war refugee migration. Complicating matters was a disturbing trend in China’s economic growth which, in turn, began to weigh on commodity export economies still operating at full throttle.

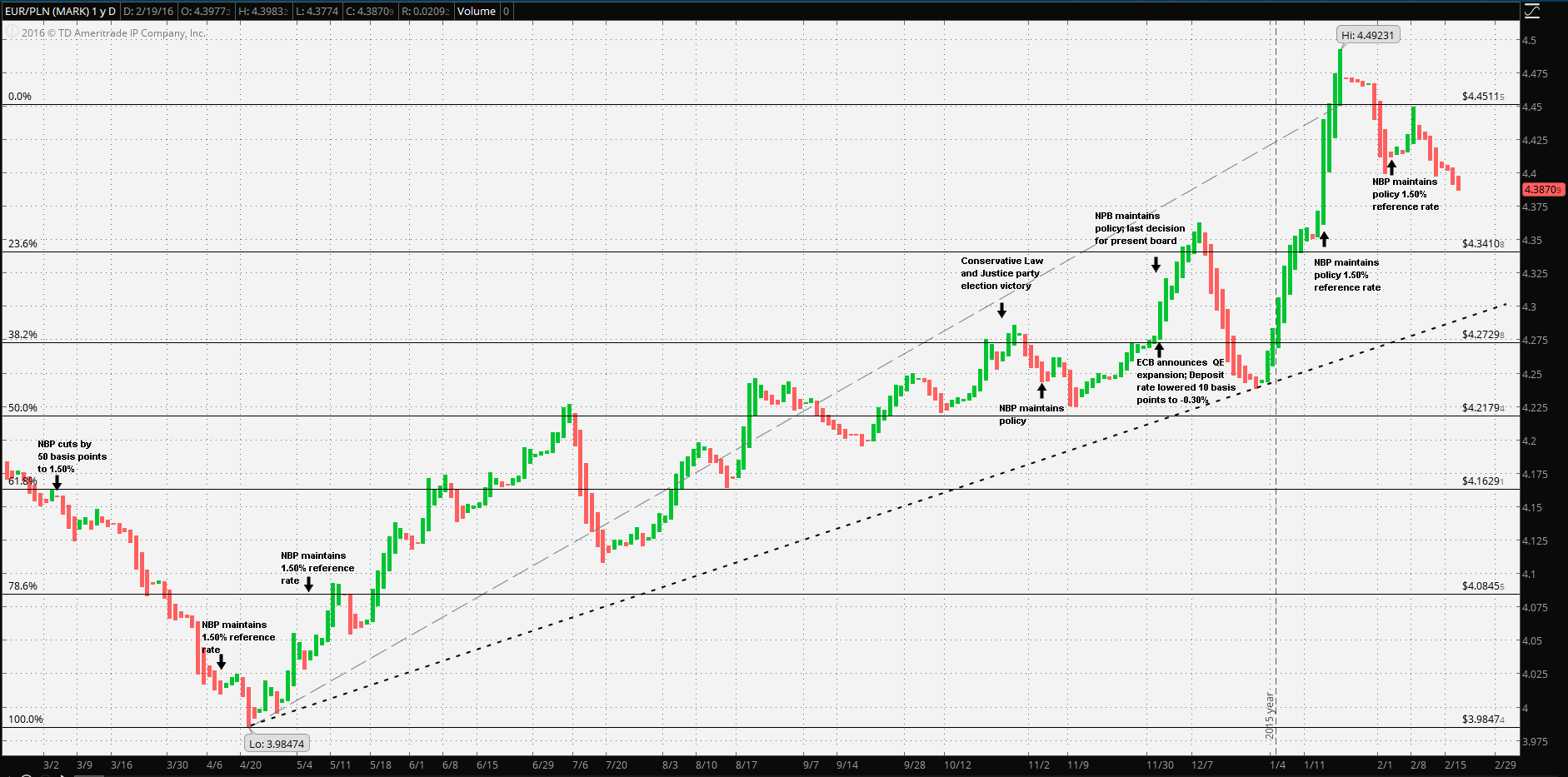

In early March of 2015, Narodowy Bank Polski reduced its benchmark short term policy rates by 50 basis points across the board; the benchmark reference rate was reduced to 1.50% from 2.00%. It should be noted that the confluence of events had strengthened the Zloty versus the Euro 7.24% from 1 January 2015 at 4.2971 per, to the 21 April 2015 52 week high of 3.98474 per Euro.

Guest post by Mike Scrive of Accendo Markets

At the meeting the NPB made specifically reference those economies which could have greatest impact on the Polish economy. “…In the euro area, GDP growth remains low… … In the United States, economic growth is significantly higher than in the euro area … In… … China, GDP growth remains low… …in Russia it has probably slid below zero…” The NBP also referenced its concerns over the trend of commodity prices. “...The fall in commodity prices… … has been deepening deflation in most European countries…” The statement concluded justifying their decision with mathematical clarity, detailing the risks to price and GDP growth in terms of probabilities.

The NBP followed up on its reasoning at the April meeting with specific emphasis on the ongoing conflict in neighboring Ukraine. It should be noted that well over 65% of Poland’s exports are destined for the EU, plus 4.39% for the Russian Federation and 1.96% for Ukraine. Over the next several meetings the focused remained the same and expressed continued satisfaction with the domestic economy.

At this point it’s worth noting a general theme among the three export manufacturing economies of Czech Republic, Hungary and Poland: depressed food and energy prices are adding support to growth rates by maintaining consumer purchasing power. In other words having ‘low-flation’ is far more tolerable than disinflation or outright deflation. “…low commodity prices and moderate nominal wage growth are contributing to the continued lack of cost pressure…” This often repeated line when combined with higher inflation expectations going forward is nearly a sure indication that the NBP will maintain its policy rate. Further, the Zloty continued on a steady weakening trend, breaking through one Fibonacci retracement level after another. Subsequent meetings followed suit, citing low inflation, positive but cautious notes on the domestic economy and a moderately positive outlook.

A major shift in focus occurred at the 1-2 September 2015 meeting. In particular the NBP noted the recession in Russia and Brazil and that “…the Federal Reserve is signalling a possibility of their increase this year… …The People’s Bank of China has devalued the yuan, what was conducive to weakening of some emerging markets’ currencies…”

This tone was reiterated at the October, November and December meetings. The December statement also noted that “… the ECB is continuing its asset purchase programme and is signalling the possibility of a further monetary easing…” indeed the ECB reduced the very next day. The effect on the Zloty was short lived and the trend continued reaching the 52 week Zloty low of 4.49231 per Euro on 21 Jaunary; a 12.738% decline since the April high in a nearly unbroken trend.

In the 14 January statement, the NBP noted the divergence of monetary policy, but remained satisfied with domestic growth, “…the monetary policies of the Federal Reserve and the EBC continue to diverge… …In Poland, stable economic growth continues, driven mainly by domestic demand. Demand growth is supported by robust labour market, optimistic consumer sentiment and good financial condition of enterprises…”

At the recent 2-3 February meeting, the NBP continued with the very same theme: “…In the Council’s assessment, CPI inflation will remain negative in the coming months due to the depressed prices of global energy commodities. At the same time, a gradual increase in core inflation is expected and will be supported by stable economic growth amid improving economic activity in the euro area and favourable labour market conditions…”

An important note needs to be made here. The day after the NBP meeting, S&P downgraded Polish debt. S&P credit analyst Felix Winnekens noted that “…The downgrade reflects our view that Poland’s system of institutional checks and balances has been eroded significantly…” There have been concerns over the NBP’s independence since the conservative ‘Law and Justice’ party attained a majority in the Polish parliament. Fitch and Moody’s maintained their ratings. In a Bloomberg interview 18-2-2016 Polish Finance Minister Pawel Szalamacha dismissed concerns over the NBP’s independence as a non-issue but did voice concerns over Poland’s unresolved foreign loan issue. Mr. Szalamacha also emphasized the strong trade relation with Germany and that the weaker Zloty was beneficial to both nations.

Over the course of the past 52 weeks, the NBP maintained the same theme, noting all risks, weighing those risks against a reasonably well performing economy with low consumer price pressure and then maintaining the policy initiated at the March 2015 meeting. Under these circumstances it’s reasonable to expect the Zloty to trade against the Euro in a range with resistance at 4.4511 and support at trend.

Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.