While the US dollar looks a bit mixed, the team at Barclays has a clear tendency about the euro, and they provide their views:

Here is their view, courtesy of eFXnews:

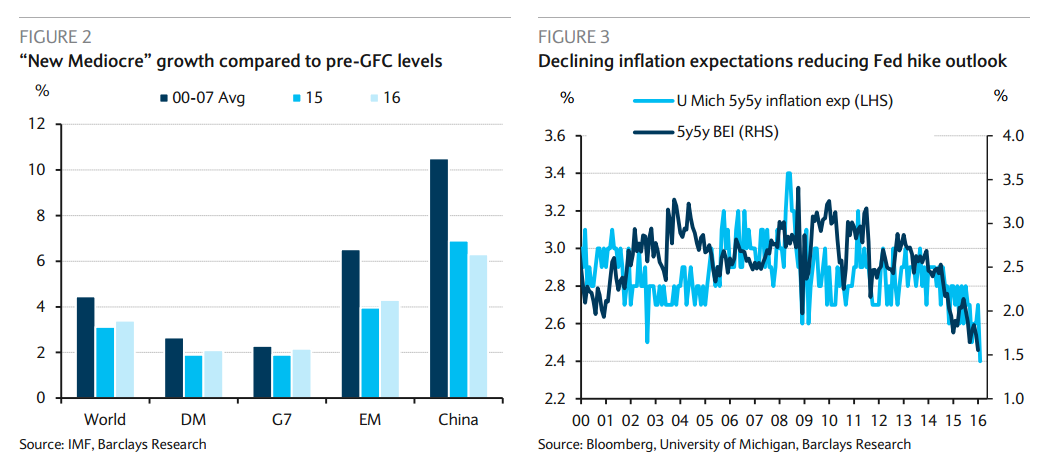

USD: Resilient inflation The latest prints in wage increases and inflation have been relatively supportive for the USD. After having reached multi-year highs in mid-January, the USD has retraced somewhat amid expectations of further delay in the monetary policy normalization cycle. Although risks for the global economy are substantial, we consider that potential moves for the short end of the USD curve are somewhat asymmetric, supporting the USD in the medium term. We would not expect a meaningful move, but rather the USD to trade sideways with an appreciating bias in the weeks ahead.

In terms of data, core PCE for January will be published on Friday. We expect a 0.2% m/m increase, which would imply a 1.5% y/y reading. Additionally, personal spending should continue showing signs of strength in the US consumer. We expect a 0.4% m/m increase. The GDP report and durable goods will be published as well. We expect the former (Friday) to be revised lower from 0.7% to 0.3% q/q, while the latter (Thursday) will, we think, show an increase in the core component of 0.7% m/m.

Last but not least, Vice Chair Fischer will give a speech on Tuesday about developments in monetary policy, followed by an audience Q&A. We believe he will keep the door open for March, but the likelihood of a hike at the FOMC’s next meeting remains low.

EUR: Continued moderation in manufacturing momentum The positive outcome of the EU summit supports EMU stability; as such, it may provide some upward pressure to EURUSD at the beginning of this week.

In terms of data, euro area February “flash” manufacturing (Monday; Barclays: 51.9; consensus: 52.0) and services (Monday; Barclays: 53.5; consensus: 53.4) PMIs are likely to show further declines in manufacturing momentum but stable services. The German February IFO (Tuesday) business climate index is likely to decline to 106.0 (consensus: 106.9; last: 107.3), reflecting the recent weakness in German industrial production. We and the consensus expect euro area final January headline and core HICP inflation (Thursday) to be confirmed at +0.4% y/y and +1.0% y/y, respectively.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.