The current moves in the US dollar seem to resemble a behavior in the not-so-distant past. What can we learn going forward? ?he team at Deutsche Bank explains:

Here is their view, courtesy of eFXnews:

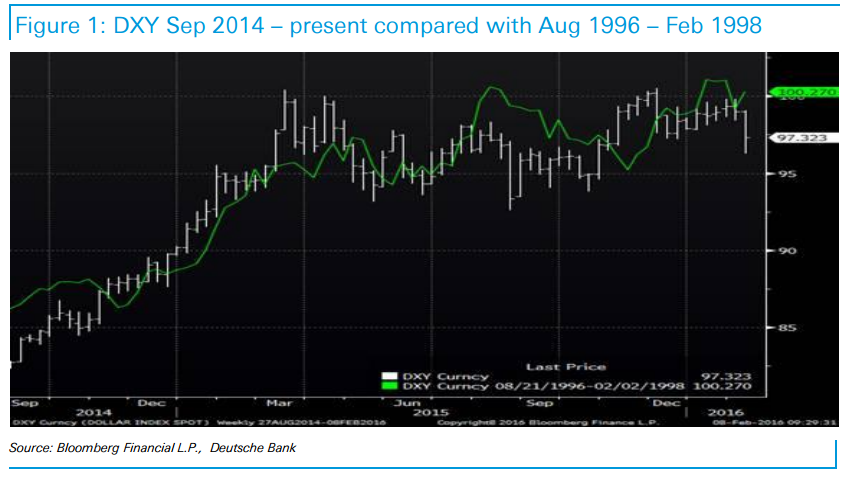

The bullets and charts below show how history is partly repeating itself in interesting ways.Figure 1 shows the current DXY (the bar) since Sep 2014, with a line chart of the DXY between 1996 and Feb 1998. Beyond the way the charts are tracking – and one has to be wary of being too cute in finding a best fit – the really interesting aspect is that the DXY is also at almost exactly the same levels as in this period! It is rare that history repeats itself so elegantly.

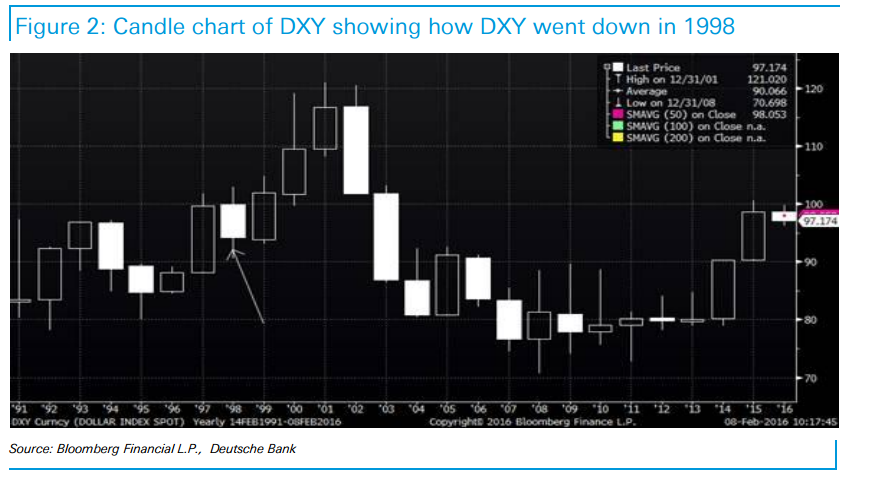

It is easy to forget that even in the middle of a USD bull market the DXY ended 1998 down on the year, as illustrated by Chart 2.

An extension of the chart in beyond Feb 1998 shows what happened. The DXY went sideways through mid-1998 before weakening sharply, partly on the back of a much stronger yen that plummeted from Y145 to Y115 versus the USD. As much by default, the yen in current circumstances remains the most likely currency to benefit from a USD pause – see below.

In the big USD cycle, 1998 was the pause that refreshed the USD, as Fed rate cuts in 1998 were more than reversed, and the tech bubble went into overdrive.

1998 included numerous shocks of which the Russia crisis and the LTCM collapse, were among the major risk-off events. In the end, US trend growth near 4% carried the day, and of course the Fed could and did ease by 75bps – actions that reinforced the view of a ‘Greenspan put’ and contributed to the equity bubble.

Presently, the other cross currents are mostly more USD friendly, if only because there are even more limited alternatives to the USD than in 1998. At a minimum, as long as there is a meaningful risk of significant Rmb slippage, it will keep the USD broad TWI bid.

…The 1998 yen reversal was partly triggered by Fed- BOJ joint intervention, included a major exit of short yen carry trades. This time around, the issue is the relatively low hedge ratios that many Japan long-term investors have on their foreign investment.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.