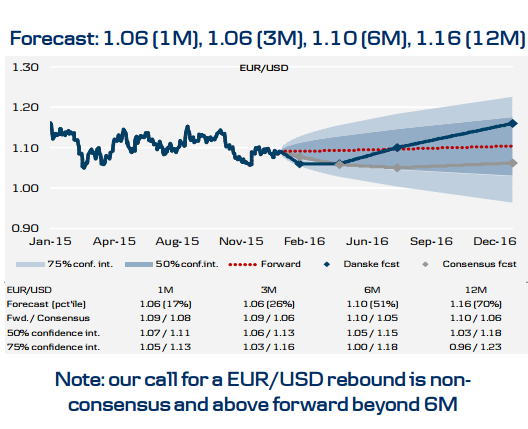

EUR/USD is certainly already on the move, thanks to the big dollar dive. To be fair, this assessment from Danske was released before the move. Here is their reasoning:

Here is their view, courtesy of eFXnews:

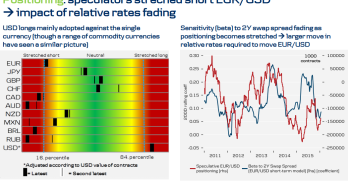

One argument for a lower EUR/USD:

– Relative rates: still in favour of USD…

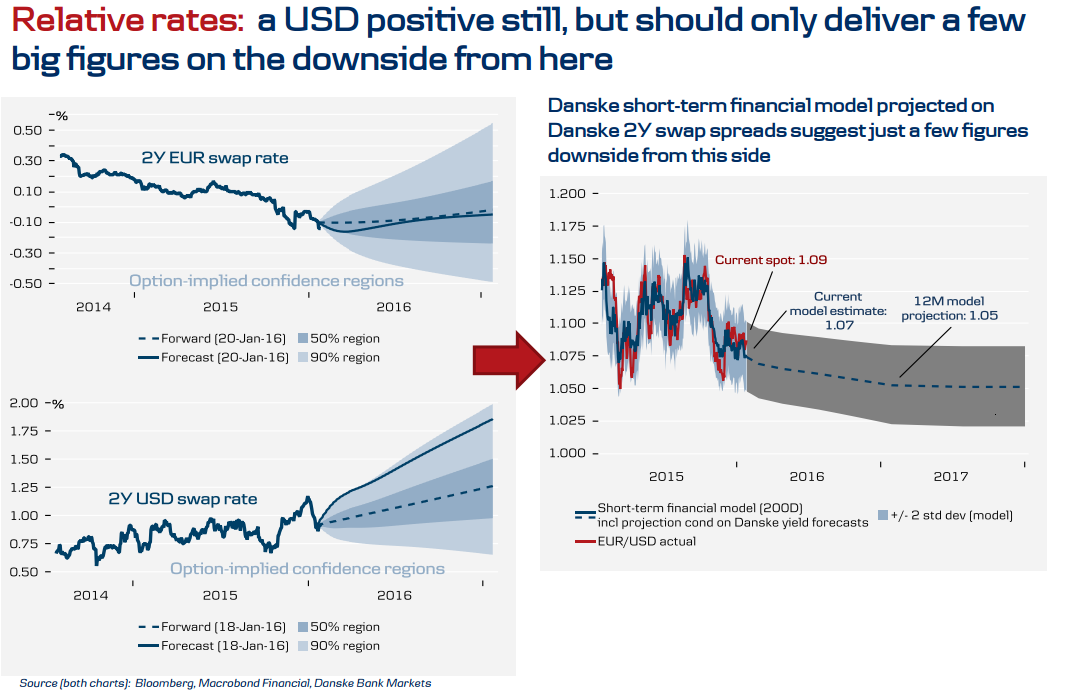

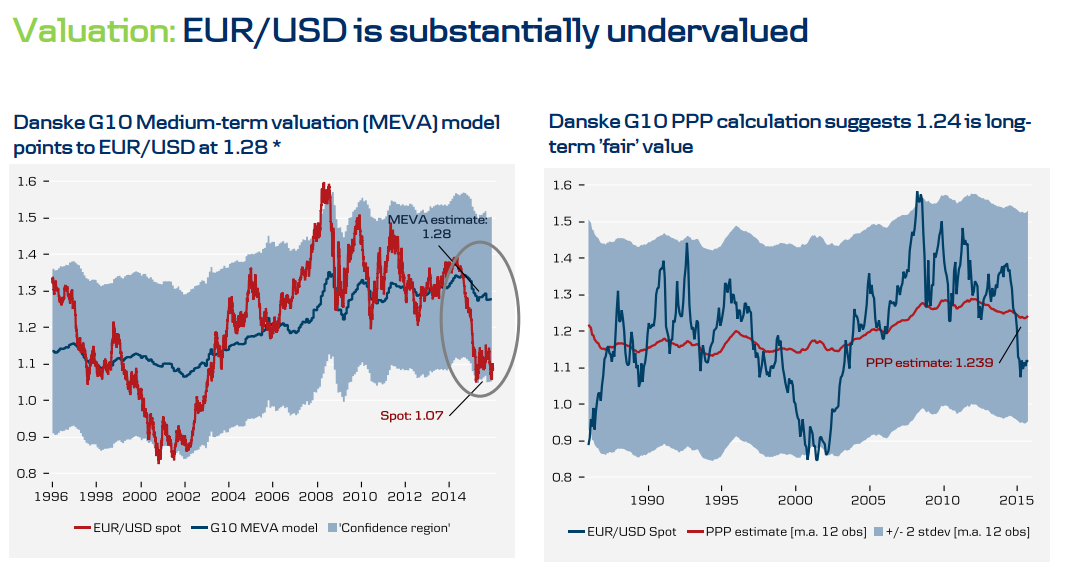

…but several arguments for a higher EUR/USD:

Valuation: EUR/USD is substantially undervalued

External balances: The EU/US CA differential is at its widest level since 2004-06

Cyclicals: the Eurozone’s business cycle looks stronger than the US cycle

Positioning: speculators are stretched short EUR/USD > impact of relative rates fading

Terms of trade: ’lower oil for longer’ has become a EUR positive

Hedging flows: commercials FX hedging of EUR set to fall, which should support EUR/USD

Now is the time to prepare for a higher EUR/USD:

We recommend investors have long EUR exposure. We recommended to buy EUR/USD 12M bullish seagull.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.